3.9 Debt Ratios and

Decomposing Financial Leverage and Solvency

It is an open question

whether the financing decision adds value to shareholders or

not. We will make

two observations here.

First, we have already seen that increasing financial

leverage has a positive impact upon ROE.

This follows from the DuPont analysis where ROE was the

product of ROA and Financial Leverage.

However, it also increases risk and so equity investors

will require a higher rate of return.

If this higher rate of return exactly offsets the

positive impact from financial leverage then it is all awash and

the financing decision has no impact upon shareholder value.

If the financing decision interacts with the investment

decision, for example as per a financial institution then the

financing decision matters.

As a result, when analyzing the financing decision

analysts are interested in assessing the risk of the firm and

ultimately how this risk translates into changes in the cost of

equity capital. We

consider this issue formally in the Valuation part of this book.

But first, we will analyze the financing decision and

then relate it to growth forecasts for net income.

Solvency versus Liquidity

If a firm’s financial

leverage becomes too high then questions arise regarding whether

or not a firm is likely to be a going concern.

Firms go bankrupt because they lack the cash (and or

access to cash) to repay debt.

Liquidity analysis adopts a short run focus and liquidity

ratios are designed to assess a firm’s ability to meet their

short term obligations.

Solvency on the other hand adopts a longer term focus and

Debt Ratios attempt to assess a company’s ability to meet its

long term obligations and thus whether it is a going concern.

Recall from the DuPont

decomposition that the Financial Leverage term is

Assets/Shareholders Equity.

Shareholders equity is defined from the basic accounting

identity as:

Total Assets –

Total Liabilities = Shareholders or Shareholders Equity

Dividing through by

shareholders Equity and rearranging then the Financial Leverage

term can be re-expressed as:

Financial Leverage

= Total Assets/Shareholders Equity

= 1 + Total Liabilities/Shareholders Equity

The last term is more

commonly expressed relative to Total Assets as the Debt Ratio:

Debt Ratio = Total

Liabilities/Total Assets

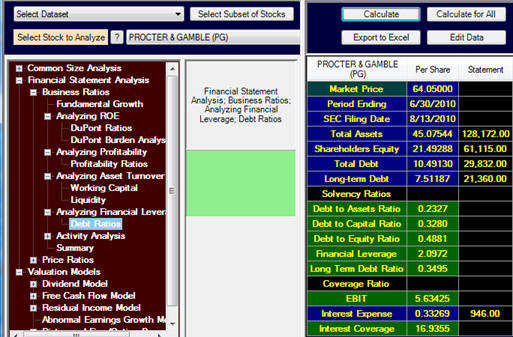

There are a number of

variations to the Debt Ratio and the ones covered by the

Valuation Tutor calculator are listed and defined below:

Debt to Assets =

(Long Term Debt + Debt Due within One Year) / Total Assets

Debt to Capital =

(Long Term Debt + Debt Due within One Year) / Total Equity

Debt to Equity

=(Long Term Debt + Debt Due within One Year) / Shareholders’

Equity

Financial Leverage

= Total Assets/Shareholders Equity = 1 + Total

Liabilities/Shareholders Equity

Long Term Debt

Ratio = (Long Term Debt / Shareholders’ Equity)

In addition, when interest

expense is focused upon this also defines a coverage ratio:

Interest Coverage =

EBIT/EBT

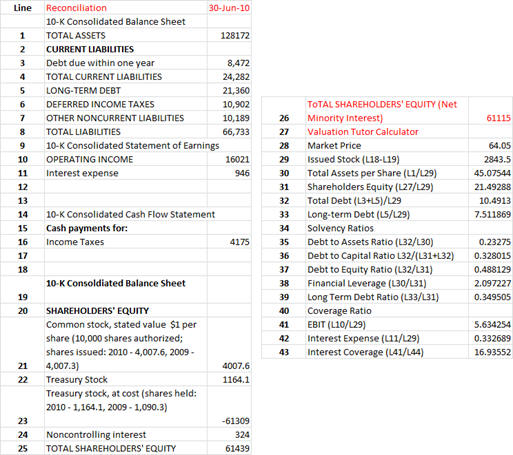

Tutor Reconciliation:

Proctor and Gamble (PG)

Our objective is to reconcile the following from the 10-K:

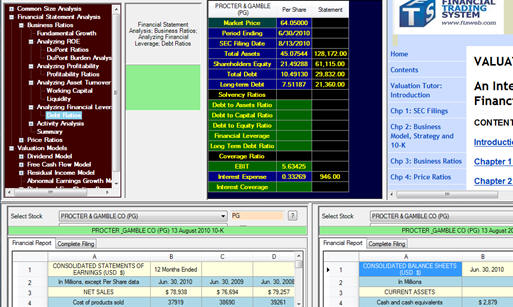

Step 1:

Bring up the Income Statement and Balance Sheet for

Proctor and Gamble as described in section 3.2 as displayed

above.

For Proctor and Gamble you will see that Debt Due within one

year = $8,472 and the “Long Term Debt” ($21,360).

Step 2:

Click on Calculate and we can verify the input and

derived fields for the following: