3.5 Extended DuPont

Analysis

The Extended DuPont

provides an additional decomposition of the Profit Margin Ratio

(Net Income/Sales) into two burden components, Tax and Interest,

times the Operating Profit Margin.

This is a positive refinement of the traditional DuPont

Analysis to provide a refinement of the profit margin ratio into

the operating profit margin ratio by taking out the effects

arising from taxes and interest expense.

As a result, it provides both management and the

financial analyst with finer information about a company and its

immediate competitors.

Formally, the Extended

DuPont formula is:

ROE = (Net

Income/EBT) * (EBT/EBIT) * (EBIT/Sales) * (Sales/Total

Assets) * (Total Assets/Shareholders’ Equity)

Each term in the

decomposition has a specific meaning:

Profit Margin Ratio

=Net Income/Sales now decomposes into:

Net Income/Earnings

Before Taxes = Tax Burden Ratio

Earnings Before

Taxes/Earnings Before Interest and Taxes = Interest Burden

Ratio

Earnings Before

Interest and Taxes/Sales = Operating Profit Margin

Asset Turnover

Ratio or Asset Use Efficiency = Sales/Total Assets

Financial Leverage

Ratio= Total Assets/Shareholders Equity

Net Income is measured

after taxes. So if

taxes are zero the tax burden equals one and so the lower this

number, the higher the tax burden.

Similarly, if Interest Expense is zero then interest

burden ratio equals one and therefore the higher the financial

leverage, the lower is this number.

The advantage of adjusting for taxes and interest is to

gain better insight into the firm’s profit margin by focusing

upon the operating profit margin.

Note that the product of

the first four terms is now ROA.

This is driven by operations, financing and the

management of taxes.

A nice property of the Extended DuPont formula is that one can

examine the breakdown of ROA from the perspective of major firm

decisions --- investment, financing and tax decisions.

The remainder of this

decomposition is as before.

That is, the fifth term is again related to the financing

decision; a highly leveraged firm has low Shareholders Equity

compared to Assets.

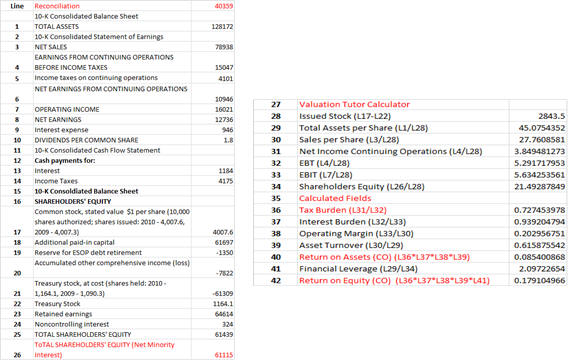

Tutor Reconciliation:

Proctor and Gamble (PG)

Practical Note:

Analysts vary in terms of how they apply the Extended DuPont

Analysis. The most

common practical variation from the above definitions is to use

the US GAAP definition of income from continuing operations.

The International Financial Reporting Standards (IFRS)

does not make the distinction between income from continuing

operations and so this practical note only applies to US GAAP.

The default numbers in Valuation Tutor screens have (CO) after

them to indicate that this is in relation to Continuing

Operations. The

reconciliation provided in this section will illustrate this for

Proctor and Gamble using continuing operations.

Users of Valuation Tutor can apply either definition to

the net income input field and if comparing across firms you

should apply the same convention.

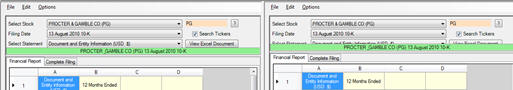

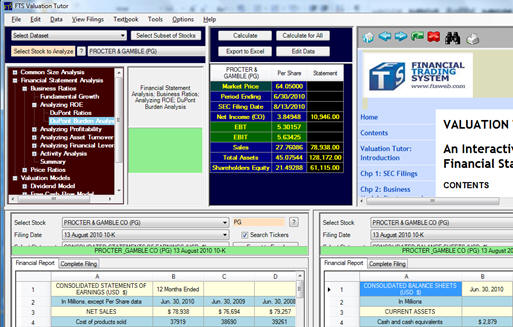

Step 1:

Bring up the Income Statement and Balance Sheet for

Proctor and Gamble as described in section 3.2.

This was displayed at the bottom of the screen as

follows:

We can reconcile the Extended DuPont by selecting the

Consolidated Income Statement and Consolidated Balance Sheet as

follows:

You can see from the above screen that the 10-K income statement

for Proctor and Gamble breaks out income from continuing

operations ($15,047) and taxes on income from continuing

operations ($4,101) from total income from continuing operations

after tax ($10,946) versus Proctor and Gamble’s Total Net Income

after Tax ($12,736) which was used in the previous topic 3.4.

Step 2:

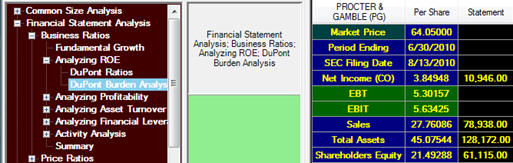

Refer to the calculator part of the Valuation Tutor

screen. This has

computed the Extended DuPont from the following per share

fields:

Net Income (CO, Continuing Operations) = 3.756 per share

EBT (Earnings Before Taxes) = 5.3016 per share

EBIT (Earnings Before Interest and Taxes) = 5.6343 per share

Sales per Share = 27.7609 per share

Total Assets per Share = $45.0754 per share

Shareholders’ Equity = 21.4929 per share

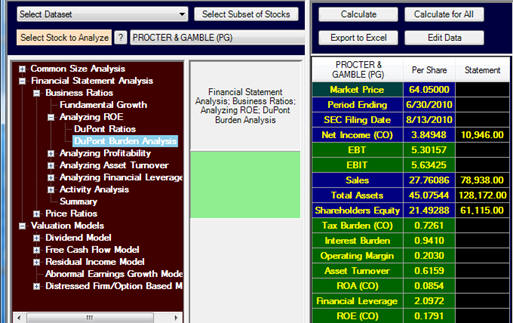

Step 3:

Click on Calculate for the DuPont decomposition:

The additional derived fields are:

Tax Burden (CO) = 0.7261

Interest Burden = 0.9410

Operating Margin = 0.2030 or 20.3%

Asset Turnover = 0.6159

Return on Assets (CO) = 0.0854.

Financial Leverage Ratio =

2.0972

Return on Equity (ROE CO) = 0.1791

That is Proctor and Gamble’s Operating Margin is refined to

reveal the margin from continuing operations after adjusting for

Tax and Interest burdens.

Again in the next step we verify how these numbers have

been estimated from the financial statements.

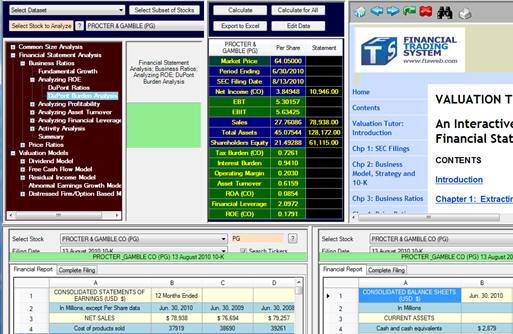

Step 4:

Where did these numbers come from?

Each of the numbers can be traced back to two primary financial

statements:

The full reconciliation can now be traced through as follows: