3.4 DuPont

Analysis

As we showed, fundamental growth for a firm equals Return on

Equity (ROE) times the Retention Ratio (RR):

Growth = ROE * RR

The DuPont model re-expresses the accounting return on equity

(ROE) as the product of the Return on Assets (ROA) and Financial

Leverage (measured by Total Assets/Shareholders’ Equity).

ROE and ROA are two major ratios that are associated with

the “Financial Perspective” of the balanced scorecard.

The DuPont decomposition has an interesting history:

Among the stocks that currently make up the Dow Jones Industrial

Index the oldest is E. I. du Pont de Nemours And Company more

commonly referred to simply as DuPont.

DuPont was originally a gunpowder mill founded in July

1802 by Eleuthère Irénée du Pont and today is one of the largest

chemical companies in the world. DuPont was a pioneer with

respect to management accounting systems, including devising the

accounting ratio Return on Investment (ROI).

Around 1912 their ROI approach was extended by one of

their financial officers, Donaldson Brown, who decomposed the

ROI calculation into a product of the sales turnover ratio and

the profit margin ratio.

In 1914 DuPont invested in General Motors (GM) to assist

the struggling automobile company.

In 1920, Pierre DuPont became chairman of GM, and during

his tenure implemented a pioneering management accounting system

that focused sharply on planning and control.

By organizing resources around this system GM grew to be

the largest automobile company in the world.

In 1957 DuPont had to divest itself of General Motors

because of the Clayton Antitrust Act.

The DuPont decomposition became popular after its

successful use at GM and DuPont.

As a reminder, we note that ROE = Net Income/Shareholders

Equity, and ROA = Net Income/Total Assets.

ROE measures the rate at which shareholder wealth is

increasing, while ROA measures the productivity of the assets in

generating income, and therefore measures the efficiency of the

investment decision.

Formally, the DuPont formula is:

ROE = (Net Income/Sales) * (Sales/Total Assets) * (Total

Assets/Shareholders’ Equity)

Each term in the decomposition has a specific meaning:

Profit Margin Ratio = Net Income/Sales

Asset Turnover Ratio or Asset Use Efficiency = Sales/Total

Assets

Financial Leverage Ratio= Total Assets/Shareholders Equity

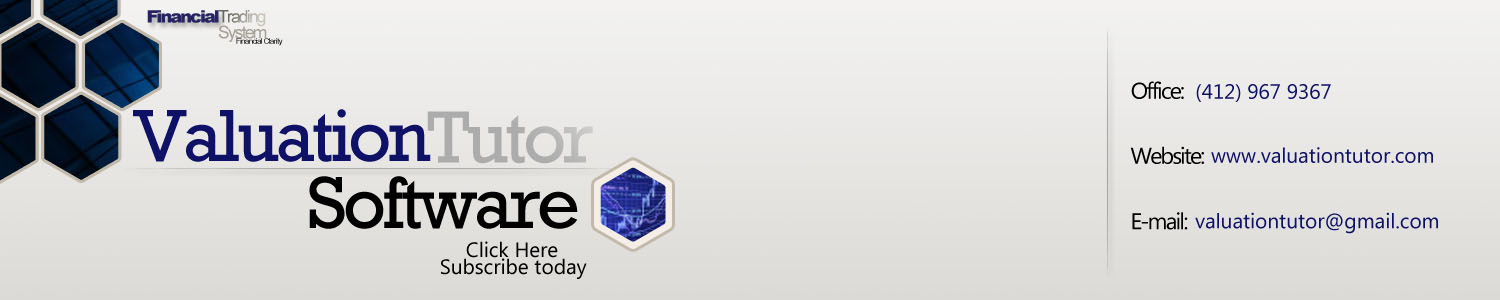

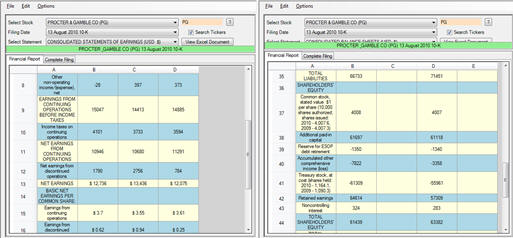

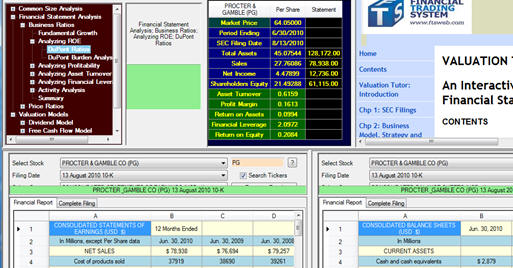

Step 1:

Bring up the Income Statement and Balance Sheet for

Proctor and Gamble as described in section 3.2.

This was displayed at the bottom of the screen as

follows:

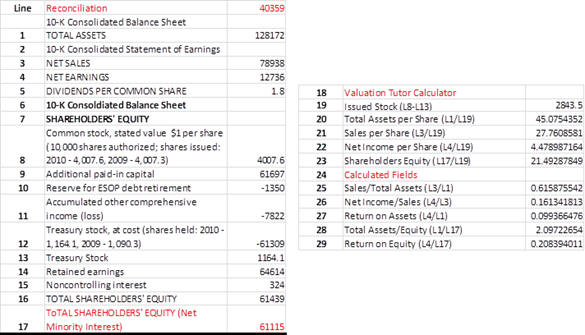

We can reconcile the DuPont decomposition by selecting the

Consolidated Income Statement and Consolidated Balance Sheet as

follows:

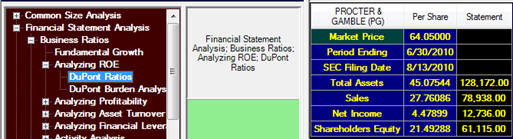

Step 2:

Refer to the calculator part of the Valuation Tutor

screen. This has

computed DuPont decomposition from the following per share

fields:

Total Assets per Share = $45.075

Sales per Share = $27.761

Net Income per Share = $4.479

Shareholders’ Equity = 21.4929

Step 3:

Click on Calculate for the DuPont decomposition:

You can observe above the additional derived fields are:

Sales/Total Assets = 0.6159 = Assets Turnover Ratio or Asset

Efficiency

Net Income/Sales = 0.1613 = Profit Margin Ratio

Return on Assets = 0.0994 = Product of the Asset Turnover Ratio

and Profit Margin Ratio.

Total Assets/Total Equity = 2.0972 = Financial Leverage Ratio

Return on Equity (ROE) = 0.2084

So Proctor and Gamble’s has enhanced its ROA by exploiting

financial leverage.

Later in this chapter, you will learn how to interpret these

numbers but first:

Step 4:

Where did these numbers come from?

Each of the numbers can be traced back to two primary financial

statements:

For convenience we relate the numbers in the 10-K to a summary

grid as depicted below and then refer to the line numbers in the

summary grid. So

for example from this you can see that the Net Sales is $78,938

and the Total Assets are $128,172 and so on.