3.2 The PG Reconciliation: Setup and

First Steps

As stated, we will use the 2010 10-K filing of Procter and

Gamble (PG) to illustrate all the calculations.

This section shows you how to bring up the filing and set

up the Valuation Tutor layout.

There are two things you have to bring up.

The first is the dataset used by Valuation Tutor to do

the calculations.

The second are actual filings.

The filing was made by P&G on August 13, 2010, that

contains information for the fiscal year ending June 30, 2010.

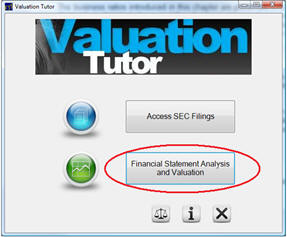

Step 1:

Run Valuation Tutor, and

select Financial Statement Analysis and Valuation:

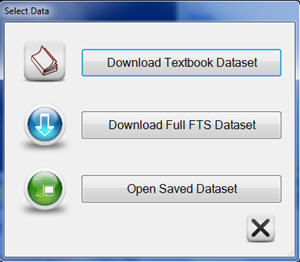

Step 2:

Download the Study Guide Dataset (data for the examples

in the textbook are in this dataset).

If you have already loaded a different data set, you can

get the Study Guide Dataset from the top-left of the screen

Now, select “Download Textbook Dataset”, select Procter & Gamble

as shown below by selecting it from the dropdown.

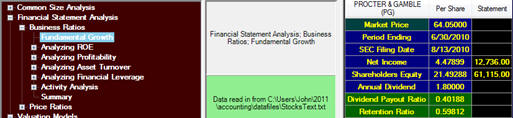

Step 2:

Select Fundamental Growth from the Business Ratios part

of the tree:

Step 3:

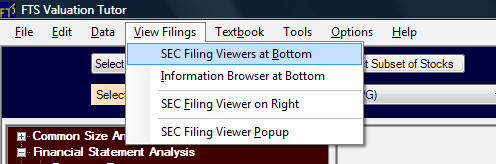

Click on the View menu

and select “SEC Viewers at Bottom.”

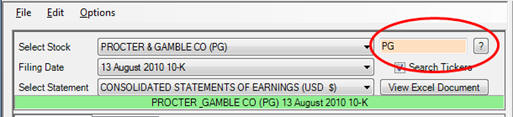

In the viewers at the bottom, bring up the Income Statement and

Balance Sheet for Proctor and Gamble (the easiest way to locate

PG from the dropdown is to click on the little question mark,

type in PG, and press Enter or click OK).

Note:

Be sure to select 13 August 2010 10-K from the set of 10K

and 10Q filings provided to match the Study Guide Dataset.

This date is in the calculator as follows:

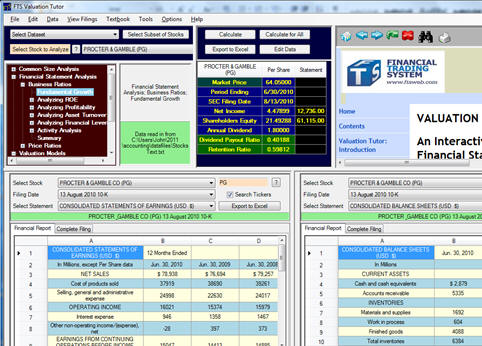

The full Valuation Tutor container now appears as follows:

The screen has three major components:

Top Left:

The tree that defines the topic we are working with.

Currently, we are studying Fundamental Growth which is

part of Business Ratios.

Top Right:

This contains the text for quick reference.

Bottom:

We have used the View menu item display two statements

for P&G simultaneously.

This is useful because the analysis frequently requires

data from different statements.

In the next section we start our journey through business

ratios, starting with fundamental or accounting growth.