3.10 Degree of Operating Leverage and Capacity

Degree of Operating Leverage

A firm’s operating leverage is defined as the percentage change in the firm’s operating earnings (EBIT less any non-operating income), that accompanies a percentage change in the contribution margin. That is, the operating income elasticity with respect to the contribution margin. This important number predicts for an analyst what the percentage change in operating earnings is given the percentage change in sales revenue. As a result, this number is important for predicting EBIT given the predicted growth in Sales Revenue. The consensus sales revenue forecast is readily available and the DOL provides an EBIT forecast given this consensus number.

Formally, the definition of DOL is:

Degree of Operating

Leverage (DOL) = % Change in operating income / % Change in

sales revenue

Equivalently,

Degree of Operating

Leverage (DOL) = Contribution margin / EBIT

This important measure

reflects the fact that a change in Sales can lead to a more than

proportional change in earnings from operations.

In particular, the higher the degree of operating

leverage the higher the predicted change.

However, the relative size of the Degree of Operating

Leverage is affected by how close the firm is to their

break-even point.

The closer the higher is the DOL.

The above equivalence relationship is not immediately obvious. Understanding this requires reviewing the basics of cost volume profit (CVP) analysis first and then we will derive the above equivalence relationship.

Cost Volume Profit Analysis

Cost volume profit analysis studies the relationship among sales, variable costs and fixed costs. It assumes that linear costs provides a good description of real world cost behavior. From this assumption the accounting income statement can be restated in avariable costing format as follows starting from the traditional gross margin or absorption format::

Absorption Costing:

Sales

Less COGS

Gross Margin

Less Marketing and

Administration

Net Income from

Operations (EBIT)

A variable cost income

statement highlights cost behavior (i.e., variable versus fixed

costs) and contribution margin.

This immediately ties in to a cost/volume/profit break

even type of analysis:

Variable Costing

Sales

Less Variable COGS

Less Variable

Marketing and Administration

Contribution Margin

Less Fixed Overhead

Less Fixed

Marketing and Administration

Net Income from

Operations (EBIT)

The above format allows an analyst to immediately estimate the following important concepts:

Contribution Margin (CM) = (Sales Revenue – Total Variable Costs)

Contribution Margin

Ratio (CMR) = (Sales Revenue – Total Variable Costs)/Sales Revenue

Sales Revenue*Contribution Margin Ratio = Contribution Margin

The usual immediate relationships to derive from cost volume profit analysis is to compute break even sales revenue and break even margins as follows:

Break Even (B/E)

Analysis ($Sales Revenue)

= Total Fixed Costs/(Contribution Margin Ratio)

Break Even (B/E)

Margin = B/E $Sales Revenue/$Sales Revenue

However, we are currently interested in deriving the equivalence relationship from the definition of DOL and the concept of contribution margin.

Derivation of Equivalence Relationship for Degree of Operating Leverage (DOL)

At the beginning of this topic we defined DOL and the equivalence relationship can be derived as follows:

Degree of Operating Leverage (DOL) = % Change in operating income/%

Change in sales revenue

Assuming fixed costs remain unchanged and EBIT = Sales - Variable

Costs - Fixed Costs, it follows:

%ΔEBIT = Δ(Sales - Variable Costs))/EBIT = ΔCM / EBIT

%ΔSales = ΔSales / Sales

Taking the ratio of the above two equations and re-arranging:

%ΔEBIT /%ΔSales = Sales(ΔCM/ΔSales) / EBIT = Sales*CMR / EBIT = CM

/ EBIT

That is:

Degree of Operating Leverage (DOL) = Contribution margin / EBIT

In the next example we apply these relationships to the 10-K data:

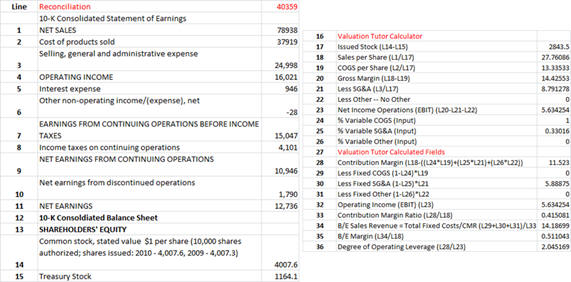

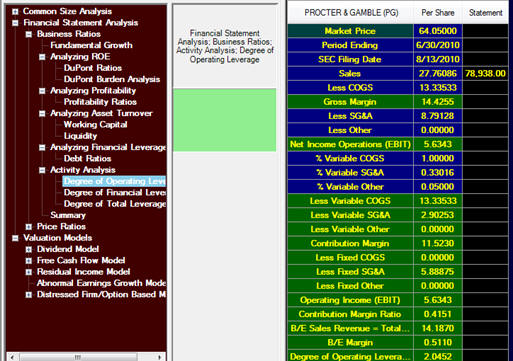

Tutor Reconciliation:

Proctor and Gamble (PG)

Our objective is to reconcile the following from the 10-K:

Step 1:

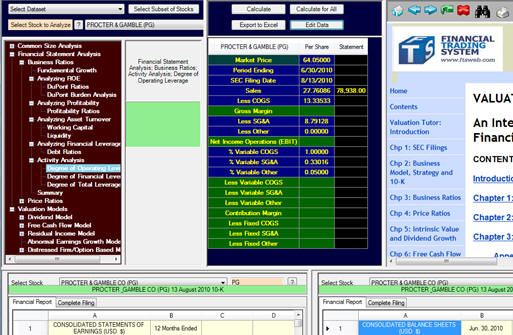

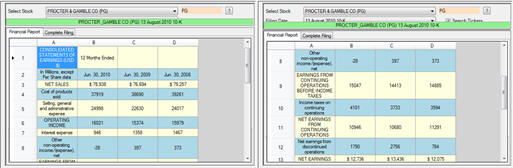

Now bring up two Income Statements for Proctor and Gamble

as described in section 3.2 as displayed below.

For Proctor and Gamble you can see that the Cost of products

sold = $37,919 and the “Selling, general and administration”

expense =$24,998.

To recast the income statement from its full or absorption

costing format to a direct or variable costing format we need to

break up these costs into their fixed and variable components.

For reconciliation purposes suppose we assume that 80% of

the COGS are variable and 20% of the SA&G expenses are variable.

These percentages can be subject to more refined analysis

later but for now we are more concerned with mastering the

operational details.

Step 2:

Click on Calculate and we can verify the input and

derived fields for the following:

The above demonstrates the power of recasting the income

statement in this manner.

This lets you estimate the Degree of Operating Leverage

but in addition it further lets you estimate Break Even points

for Sales Revenue and implied Margin of Safety (i.e., Sales

minus B/E Sales.

Cost Behavior Assessment Remark:

Observe above that the % Variable COGS, % Variable SG&A

and % Variable Other are numbers inputted into the calculator.

Where do these numbers come from? There are various approaches

used by professionals in the field for assessing these numbers.

Clearly, managers’ inside a firm have access to better

information than financial analysts outside of the firm.

However, financial analysts can still make reasonable

assessments of the cost behavior.

Interested readers are encouraged to work through

questions 7-13 in the problem set at the end of this chapter.

In particular, Question 9 provides the details for

estimating cost behavior using regression analysis.

Reconciling from the Income Statement

The reconciliation from the Income Statement is provided below.

: