Chapter 3: Questions

Question 1:

Define the basic DuPont decomposition

equation and include a brief description of how to interpret its

component terms by relating your description to the major

decisions made by a firm.

Question 2:

Calculate and provide a

brief description of its meaning the following ratios for Best

Buy:

i.

Inventory Turnover

ii.

Accounts Receivable

Turnover

Question 3:

i.

If the Inventory Turnover

ratio is X, how many days does it take to sell the inventory?

ii.

If the Accounts Receivable

Turnover ratio is X, how many days does it take for accounts to

be paid?

Question 4:

Define the ratio “ROE” and describe what major firm decisions

influence this ratio.

Question 5:

Define “Fundamental Growth” (also known as “Accounting

Growth”). Describe

precisely how this number is influenced by major firm decisions.

Question 6:

Consider the

following information on Best Buy and Wal-Mart:

Compare the ROE for Wal-Mart and Best Buy and explain precisely

why the two companies have different ROE’s by relating your

explanation to the major firm decisions.

Question 7:

Estimating Cost Behavior using Account Analysis

In order to estimate the Degree of Operating Leverage, you need

to first separate costs into fixed and variable components.

This requires an understanding of cost drivers, and GAAP

compliant statements do not provide an easy way to break total

costs into fixed and variable parts.

When studying managerial accounting, you are typically

introduced to three techniques to assess cost behavior.

i.

Account Analysis

ii.

High Low Technique

iii.

Regression Analysis/Scatter Plots

In this question you will apply the

Account Analysis

technique. With

this technique start by reading Item 1, 10-K of Amazon’s 10-K

filed with the SEC.

This describes their business model.

From this business model and without referring to any

quantitative data, so that your answer is based entirely upon

your understanding of the business model for Amazon.com, apply

the Account Analysis technique (i.e., professional judgment) to

assess the cost behavior for the following three cost categories

for Amazon.com.

That is, consider how these costs are likely to be generated

given your understanding of Amazon’s business.

This will let you

understand what the major cost drivers are likely to be for the

following three categories:

a.

Cost of Goods Sold

b.

Selling and General Administration

c.

Research and Development

Estimate the proportion of each of the above cost categories

that you assess to be variable and fixed (relative to sales

revenue). The sum

of these proportions must equal 1.

Provide brief reasons in support of you assessed

proportions in relation to your understanding of Amazon’s

business model.

Question 8:

Estimating Cost Behavior using High Low Technique

In this question you will apply the

High Low technique to

separate total costs into fixed and variable components.

This method uses observations on two dates to estimate fixed

costs and the variable cost per dollar of sales revenue.

The Y-Axis variable is the aggregate cost category and

the X-axis variable is the volume of activity (usually sales

revenue for an outsider).

Variable Cost Per $ Sales Revenue

= (Total Costs High Sales Revenue – Total

Costs Low Sales Revenue)/(Sales RevenueHigh

– Sales RevenueLow)

Data:

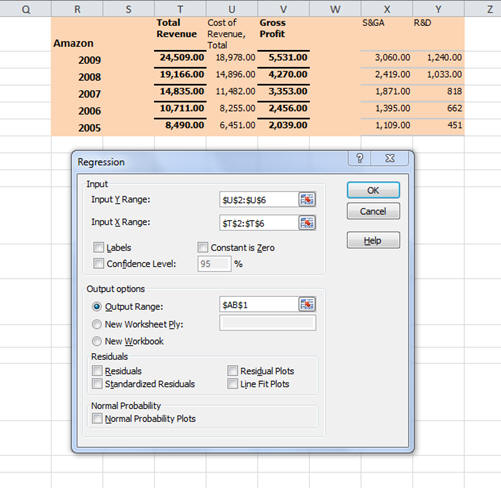

Suppose Amazon’s Sales

Revenue and COGS for the last 5-years is the following:

Apply the High Low Technique to compute the variable costs per

dollar of sales for each of the following categories:

a.

Cost of Goods Sold

b.

Selling and General Administration (S&GA)

c.

Research and Development R&D

Question 9:

Estimating Cost Behavior using Regression Analysis

In this question you will apply the Regression Analysis

Technique to separate total costs into fixed and variable

components.

This is a statistical technique for estimating fixed and

variable costs.span style="mso-spacerun: yes"> The

advantage of this technique over the high low technique is that

it uses all observations whereas the high/low technique uses

only two.

Regression analysis is easy to perform in Excel using the

following steps. WWe

show you how to decompose the total COGS into fixed and variable

components, the problem you solve is to repeat this for SG&A and

R&D using the following information.

Step 1:

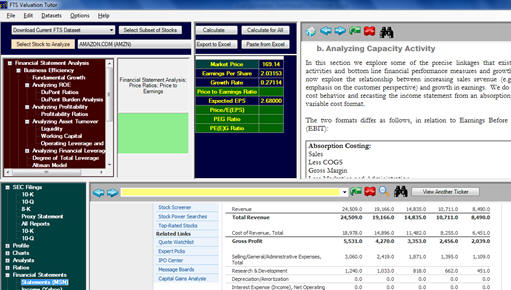

In Valuation Tutor select Amazon and then click on

Financial Statements, Statements (MSN):

Step 2:

Copy and paste the data into Excel and then use Excel’s

Copy/Paste Special Transpose to get the data into the following

block form ready for Regression:

The Y-Variable for the regression is in column U (U2..U6) and

the X-Variable is in column T (T2..T6).

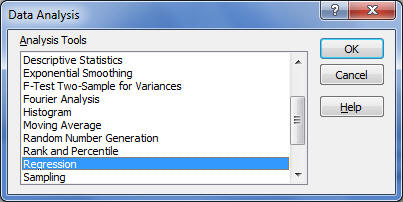

Step 3: Click on the “Data” menu item in Excel and then select

Data Analysis from the Analysis ribbon item

Note:

If the Data Analysis item is not available, then in

Excel, click on the Office Button, click on Excel Options, click

Add-Ins and at the bottom, under “Manage Excel Add-Ins” – select

the Analysis Tool Pack and click OK.

TThen close Excel and re-launch it.

Step 4:

In Data Analysis select Regression:

Note in the above the COGS is the Y-Variable and the Sales

Revenue is the X-Variable (cost driver).

Click OK and the regression analysis is performed:

The variable cost per $ of sales is provided above beside X

Variable 1 and equals 0.78.span style="mso-spacerun: yes">

In this example it turns out to be very similar to the

High/Low method in the previous question – but this is not the

norm. AAgain the

variable cost per $ of sales revenue is 0.78.

Repeat the above exercise to estimate the Variable Cost per $ of

Sales for both S&GA and R&D respectively.

Question 10: If you have completed questions 7 and 8 or questions 7 and 9

then answer the following.

In question 7 you assessed cost behavior using the Account

Analysis technique.span style="mso-spacerun: yes">

This required professional judgment in relation to your

understanding of Amazon’s business model.

In questions 8 or 9 you made use of data to estimate the

proportion of variable to fixed costs in each category.

Did your estimates agree or disagree when using these two

approaches? PProvide

a brief discussion as to why or why not.

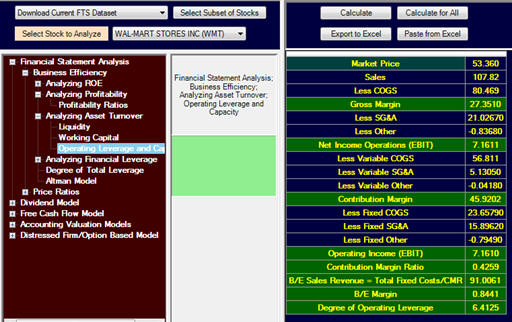

Information for the next three questions:

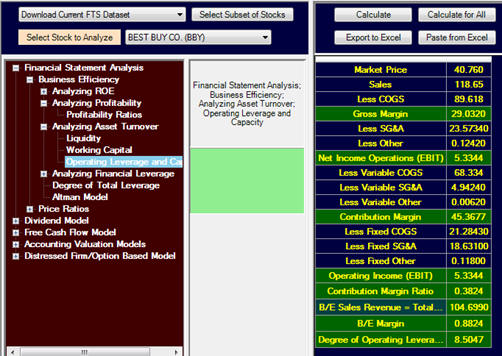

Question 11:

UUsing the above information for Wal-Mart and Best Buy,

define the contribution margin ratio, verify the calculation,

and provide a brief description of what it means.

Question 12:

Using the above

information for Wal-Mart and Best Buy, provide a brief

interpretation of what could explain the differences in the

contribution margin ratio for Wal-Mart and Best Buy.

Question 13:

Use the above information for Wal-Mart and Best Buy.

Suppose you expect sales for each company to increase by

3% over the next year.

WWhat is the predicted impact upon EBIT?

Real World Exercises

Exercise 1: Business

Ratios

Select two companies from

the Current FTS Dataset that are competitors, or at least are in

the same industry even if they do not directly compete with each

other.

Provide a summary report

of the results from conducting financial statement analysis of

the business ratios for your two stocks relative to each other.

Summarize what you view to be comparative advantages and

disadvantages for these two stocks relative to this analysis.

IIn addition, comment on how efficiently you assess each

firm is when implementing their business model/business strategy

based upon your analysis of their business ratios.

Exercise 2: Activity

Analysis

Select two companies from the Current FTS Dataset that are

competitors, or at least are in the same industry even if they

do not directly compete with each other.

By applying Valuation

Tutor’s Activity Analysis Calculator (e.g., Asset Turnover and

Financial Leverage subsections of the Business Efficiency

section), provide a summary report of the results from

conducting Activity Analysis for your two stocks and then

compare along the following dimensions:

i.

Degree of Operating

Leverage

ii.

Degree of Financial

Leverage

iii.

Degree of Total Leverage

iv.

Contribution Margin and

Contribution Margin Ratio

v.

Break Even Margin

You will first need to

estimate the % variable and fixed costs for each cost category.

You can refer to problems 7-9 above for guidance as to

how.