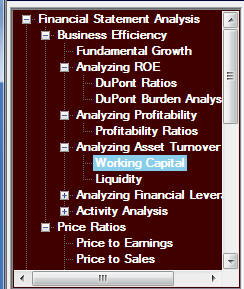

3.7 Working Capital Ratio

Working Capital is defined as Current Assets minus Current

Liabilities net of financing and tax related activities.

This leads to eliminating items such as short term debt

and the current portion of long term debt as well as deferred

tax assets/liabilities.

The problem group is cash and marketable securities.

The last group is usually split between the financing and

investment decisions, but predominately is influenced by the

financing decision.

As a result, the usual simplifying assumption is to

eliminate cash and marketable securities from working capital.

With these eliminations it largely consists of:

Accounts Receivable, Inventory and Accounts Payable.

These major components lead to the three major turnover

ratios. The

numerator of these turnover ratios is usually defined relative

to their closest driver.

For example, Accounts Receivable is driven by Sales on

Account and therefore Net Credit Sales is used in the numerator

if available otherwise Sales.

However, under historical cost accounting Inventory as

measured on the balance sheet is more closely aligned with the

Cost of Goods Sold (COGS) for an external analyst.

Finally, Accounts Payable is driven by Purchases and so

either Purchases if available or COGS is used in the numerator

for this ratio.

Formally, we can define them as follows:

Accounts receivable turnover = Sales/Accounts Receivables

Inventory turnover = COGS/Inventory

Accounts payable turnover = Purchases/Accounts payable or

otherwise COGS/Accounts Payable

In addition, turnover ratios are often expressed in terms of

number of days by dividing by the turnover ratio by 365:

Number of days to Collect Accounts Receivable = 365/Accounts

receivable turnover

Number of days to Sell Inventory = 365/Inventory turnover

Number of days to Pay Creditors =365/ Accounts payable

turnover

Finally, the Cash

Conversion cycle is then the aggregate number of days for

collecting accounts receivable plus the number of days required

to sell inventory

minus the days to pay creditors.

Cash Conversion

Cycle = Number of Days to Sell Inventory + Number of days to

collect accounts receivables – Number of Days to Pay

Payables

When comparing across firms in some industry the extension of

liberal credit may be an important part of the firm’s business

strategy. For

example, for Wal-Mart to successfully implement their business

model they have to excel along the Process dimension of a

balanced scorecard.

This is discussed further in the following example.

As a final remark, note that when valuing a firm, changes in

working capital may be a significant source of funds but this

can only last for a limited period of time.

Ultimately, change in working capital has to settle down,

you should be careful to ensure that the change in working

capital is not a significant source of funds in perpetuity!

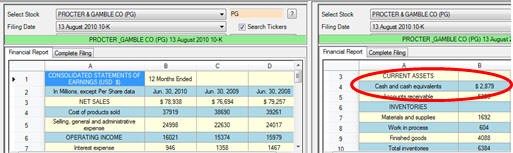

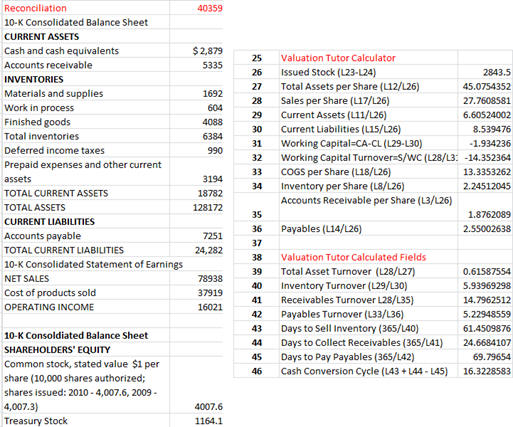

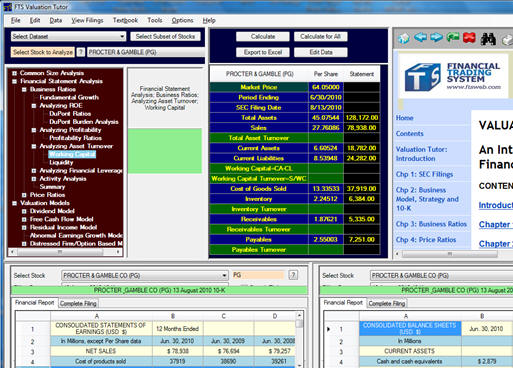

Tutor Reconciliation:

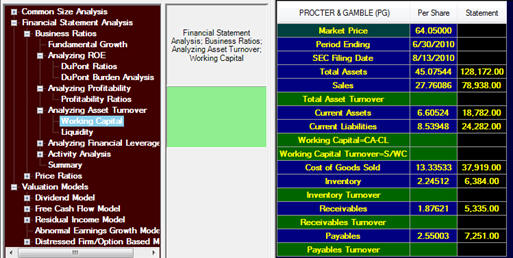

Proctor and Gamble (PG)

Our objective is to reconcile the following from the 10-K:

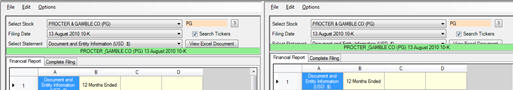

Step 1:

Bring up the Income Statement and Balance Sheet for

Proctor and Gamble as described in section 3.3.

This is displayed at the bottom of the screen as follows:

The above items deal mainly with the income statement apart from

the number of shares outstanding for expressing on a per share

basis.

You can stretch across a little the column 1 as displayed above

to make the labels more easily displayed and read.

For Proctor and Gamble you can see the “Cost of products sold”

($37,919) as P&G describe it and Net Sales are $78,938.

Similarly, total Inventories $6,384 and scrolling down reveals

the working capital items on the Balance Sheet.

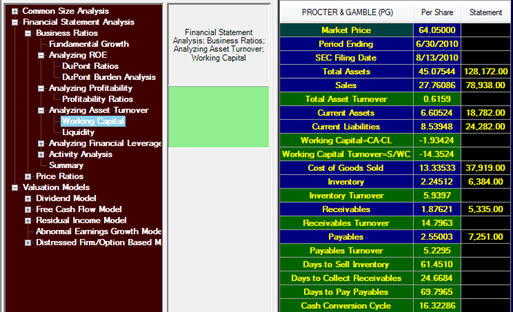

Step 2:

Click on Calculate and we can verify the input and

derived fields for the following:

Total Asset Turnover = 0.6159

Working Capital per Share (CA – CL) = -1.9342 per share

Working Capital Turnover (Sales/WC) = -14.3524 per share

Inventory Turnover (COGS/Inventory) = 5.94

Receivables Turnover = 14.80

Payables Turnover = 2.55

Days to Sell Inventory = 61.45

Days to Collect Receivables = 24.67

Days to Pay Payables = 69.80

Cash Conversion Cycle = 16.32

In step 1 we extracted the relevant aggregate numbers from the

10-K and so the full reconciliation can now be traced through as

follows. The first

item below being Cash and cash equivalents $2,879.