3.6 Profitability

Ratios

These ratios provide

immediate insight into how well management is running a

business. They

become especially meaningful in relation to competitors in the

same industry. Two

closely watched profitability ratios are:

Gross Profit Margin

= Gross Profit / Sales = (Sales – COGS)/Sales

Operating Profit

Margin = EBIT / Sales

Gross Margin is the

difference between a company's sales and cost of goods sold

scaled by Sales. The

higher the gross margin usually implies the higher priced its

goods and or services are.

For example, if two firms are operating at similar levels

of cost efficiencies but one has a higher gross margin than the

other this usually implies that the higher gross margin is

either charging higher prices or dealing with non commoditized

goods and services that carry a higher price tag.

Gross margin is not

required under US GAAP and therefore for most public companies

this is a derived number from the reported cost of goods sold.

Similarly, a firm’s Operating Margin measures the

performance of the firm’s primary business(es).

This includes not only the cost of goods sold but also

other costs associated with operations such as selling and

general administration.

Tutor Reconciliation:

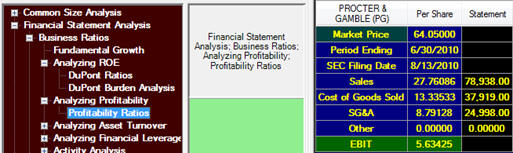

Proctor and Gamble (PG)

Our objective is to reconcile the following from the 10-K:

Step 1:

Bring up the Income Statement and Balance Sheet for

Proctor and Gamble as described in section 3.2.

This was displayed at the bottom of the screen as

follows:

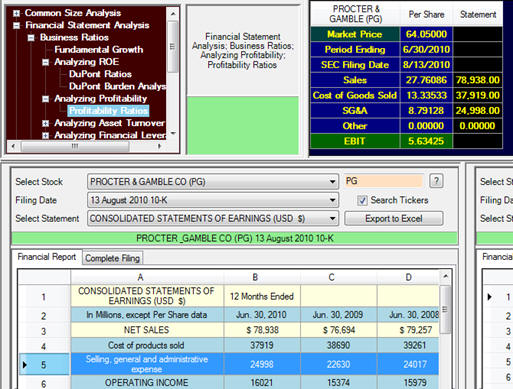

The above items deal mainly with the income statement apart from

the number of shares outstanding for expressing on a per share

basis.

You can stretch across a little the column 1 as displayed above

to make the labels more easily displayed and read.

For Proctor and Gamble you can see that the Gross Margin is not

directly provided but it is easily computed from the “Cost of

products sold” ($37,919) as P&G describe it.

Similarly, Net Sales are $78,938 and Operating Income

(EBIT) is $16,021.

Finally, the shares outstanding are provided from the

Shareholders’ Equity section of the Balance Sheet.

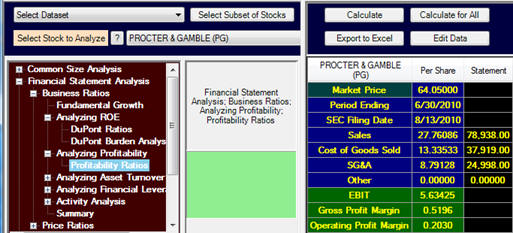

Step 2:

Click on Calculate and we can verify the input and

derived fields for the following:

Sales per Share = 27.7609 per share

Cost of Goods Sold = 13.3353 per share

EBIT (Earnings Before Interest and Taxes) = 5.6343 per share

Derived:

Gross Profit Margin (Sales – COGS)/Sales = 0.5196

Operating Profit Margin =

0.203

In step 1 we extracted the aggregate numbers from the 10-K and

so the full reconciliation can now be traced through as follows: