3.12 “Earnings Season” and the Importance of

Financial Statements to the Capital Markets

Today’s stock markets are

very sensitive to “earnings’ season.”

This happens every quarter when the companies release their

previous quarter’s earnings.

The important numbers the market watches are, Sales Revenue

and Quarterly Earnings in relation to consensus forecasts.

As discussed in the introduction to Valuation Tutor there

are different models used to estimate what a stock is worth.

The simplest is called the “dividend model,” covered in

Chapter 6. This model

takes the view that if you buy a stock, you are entitled to receive

future dividends paid by the stock.

From this perspective a stock’s “fair value” equals the

present value of the future dividends.

Applying the

above logic requires forecasting future dividends and also the

rate(s) at which these will be discounted.

Future dividends are paid from future earnings which in turn

depend upon future sales revenue.

As a result, stock prices depend

upon both earnings’ and sales forecasts.

Forecasting the future, however, is very difficult and in an

influential old book by Burton Malkiel, A Random Walk Down Wall

Street, he discussed implications for stock prices from the random

walk hypothesis. This hypothesis applied to the stock market

introduces the controversial idea that that one cannot consistently

outperform market averages.

Irrespective of ones view of this hypothesis it does serve to

underscore the importance of beating the consensus forecast when

observing changes in stock prices in relation to the release of

additional financial statement information over time.

From a reporting

perspective Valuation tutor provides access to these important

quarterly statements from the 10-Q filings that define “earnings’

season” for three quarters throughout the year.

The fourth quarter is defined from the 10-K filings.

It is noted, however, that the 10-Q financial statements are

unaudited and therefore it is not uncommon for earlier quarters to

be revised.

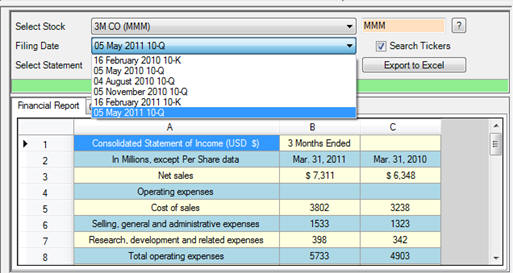

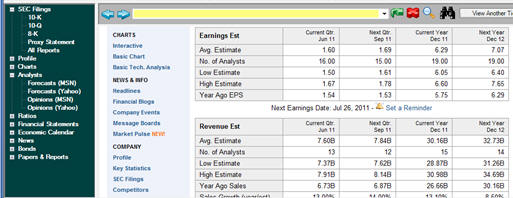

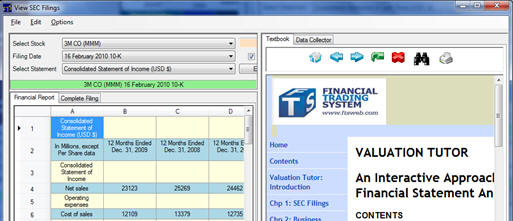

Valuation Tutor provides

easy access to both the quarterly financial statements (illustrated

below) and current consensus forecasts

from different sources on the web.

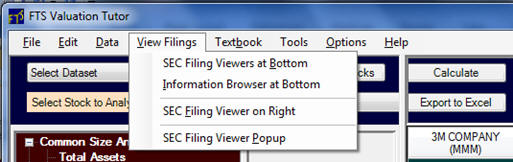

To access this information from the main screen you use the

menu item “View Filings.”

The sub-menu items let you

configure the screen in different ways:

·

SEC Filing Viewers at

Bottom --- this lets you bring up the interactive statements at the

bottom of the main container.

You then have immediate access to both annual and quarterly

interactive statements including one click exporting to Excel.

·

Information Browser at

Bottom – this gives immediate access (in a web browser) to a wide

range of relevant information that is available on the web including

Consensus Forecasts.

·

SEC Filing Viewer on Right

--- for some analysis and reconciliations it is convenient to have

the three major financial statements up – Income, Balance Sheet and

Cash Flow or a major statement as well as some of the supporting

schedules. This feature

lets you replace the Textbook with a third supporting statement.

·

SEC Filing Viewer Popup –

finally if you require even more information up simultaneously you

launch pop up windows containing additional filings, companies and

including access to the online textbook information

.

.

In summary, earnings

season only serves to reinforce the importance of financial

statement analysis, having immediate access and the knowledge

required to process lots of information that is available in today’s

world. In the next

Chapter we focus upon how the building blocks introduced in this

Chapter are actually applied to real world decision making and

analysis.