3.3 Fundamental Growth

The shareholders of a company are residual claimants.

This means that they own what would be left after all

other obligations of the company have been paid.

The value of what they own is called the shareholder’s

equity, calculated as the difference between the assets and the

liabilities. This is

what they would get if the company was liquidated; if the assets

are worth less than the liabilities, they would get nothing. It

also represents the net investment in the firm made by the

shareholders.

Shareholders equity comes from stock sold by the company and

retained earnings.

So growth in shareholders equity, which is what ultimately

creates shareholder value, is fundamentally related to earnings

(equivalently, “net income”) growth.

Net income is the “bottom line,” and is what can be paid

to shareholders or retained (reinvested) by the firm.

So when you buy a stock, you buy a share of future

earnings; if these are expected to grow quickly, you will be

willing to pay more for the stock.

How well the company performed on behalf of shareholders

in generating the earnings is measured by the Return on Equity

(ROE). ROE is the

net income divided by the shareholders equity.

Over time, shareholders equity grows if additional stock

is issued or through retained earnings.

The net income is the money earned from the investment

made by shareholders, and so the ROE measures the return on this

investment and therefore ROE is intimately related to growth.

As a result, our starting point when introducing business

ratios is the growth of shareholders equity.

Consider a firm that does not pay dividends; in that case,

shareholders equity would grow by the amount of the net income.

A little notation makes this clear.

Suppose the shareholders equity at time t is St,

and it grows at rate g.

Then,

St+1 = St(1+g)

If the firm earns Et and pays no dividends, St+1

= St + Et, so

St+Et=St(1+g) and solving for

g, you get:

g=Et/St = ROE.

If the firm pays dividends D, we get St+1 = St

+ Et - Dt.

Let PR be the payout ratio, the percentage of earnings

that are paid, so Dt=Et*PR.

Re-arranging and solving for g gives:

g=Et(1-PR)/St = ROE*(1-PR) = ROE*RR

RR is called the Retention Ratio, the percentage of earnings

retained by the firm.

The growth rate, g, is called the “fundamental growth” and shows

how the growth of shareholders equity is related to earnings.

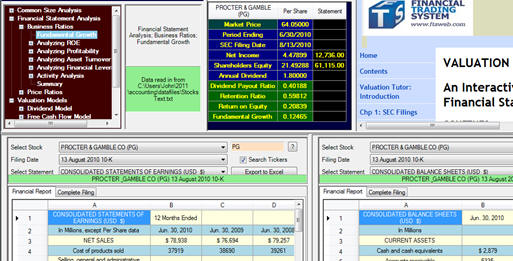

Tutor Reconciliation:

Proctor and Gamble (PG)

Step 1:

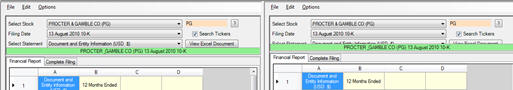

Bring up the Income Statement and Balance Sheet for

Proctor and Gamble as described in earlier.

Be sure to select the August 13, 2010 10-K from the

dropdown. This is

displayed at the bottom of the screen as follows:

We can reconcile Fundamental Growth by selecting the

Consolidated Income Statement and Consolidated Balance Sheet as

follows:

Step 2:

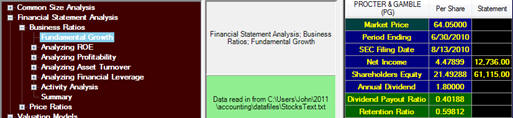

Refer to the calculator part of the Valuation Tutor

screen. This has

computed fundamental growth from the following fields:

Net Income per Share = $4.47

Shareholders’ Equity per share = $21.49

Annual Dividend = $1.80

Dividend Payout Ratio (DPR) = 0.366 (Derived in green 1.80/4.47)

Retention Ratio (RR Derived) = 0.634 (RR = 1 – DPR)

Step 3:

Click on Calculate:

You can observe above the additional derived fields are:

Retention Ratio = 0.598

Return on Equity = 0.208

Growth Rate = 0.125

That is Proctor and Gamble’s current fundamental or accounting

growth is 12.5% annualized.

In the Valuation tutor cases you will learn how to

interpret this number but first:

Step 4:

Where did these numbers come from?

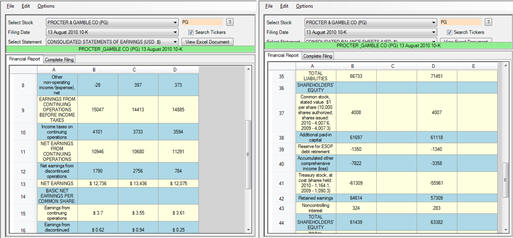

Each of the numbers can be traced back to two primary financial

statements (Income Statement and Balance Sheet):

For convenience we relate the numbers in the 10-K to a summary

grid as depicted below and then refer to the line numbers in the

summary grid. So for

example from this you can see that the Net Income is $12,736 and

so on.

The line containing the number of Treasury

Stock has been added to Excel

by entering the number in L9 into the cell.

This number is available in the 10-K spreadsheet labeled:

Consolidated_Balance_Sheets_P