3.11 Degree of Financial Leverage and

Degree of Total Leverage

In this section we explored operating leverage which is sometimes

referred to as first stage leverage and in the early topic on the

DuPont decomposition we introduced the term financial leverage.

The degree of financial leverage results from a second stage

analysis of Earnings Before Taxes (EBT) and Earnings Before Interest

and Taxes (EBIT).

Alternatively, when viewed from the perspective of the Income Statement we can define the degree of Financial Leverage in terms of Net Income as follows:

Degree of Financial Leverage = % Change in Net Income/% Change

in EBIT

Degree of Total Leverage

This number relates a firm’s operating and financial leverage to its

net income. This is a

useful number for financial analysts to assess because it allows

earnings’ forecasts to be made starting from Sales.

However, first we consider the operational details including

how to estimate this number from the financial statements.

In relation to Sales Revenue the Degree of Total Leverage is

defined as follows:

Degree of Total Leverage = Degree of Operating Leverage * Degree of Financial Leverage

Degree of Total Leverage = (% Change in EBIT / % Change in Sales) * (% Change in Net Income / % Change in EBIT)

Degree of Total Leverage = % Change in Net Income / % Change in

Sales

Or rearranged this yields:

% Change in Net Income = Degree of Total Leverage * % Change in

Sales

That is, by starting with the problem of forecasting sales revenue

then the Degree of Total Leverage can relate this forecast to an

earnings’ forecast.

We can further decompose the Degree of Total Leverage into the

product of its two drivers, the Degree of Operating Leverage times

the Degree of Financial Leverage.

In this form it can be related directly to the Contribution

Margin format of a Variable or Direct Income Statement as follows:

Degree of Total Leverage = Degree of Operating Leverage * Degree

of Financial Leverage

Degree of Total Leverage = Contribution Margin/EBIT * EBIT/Net

Income = Contribution Margin/Net Income

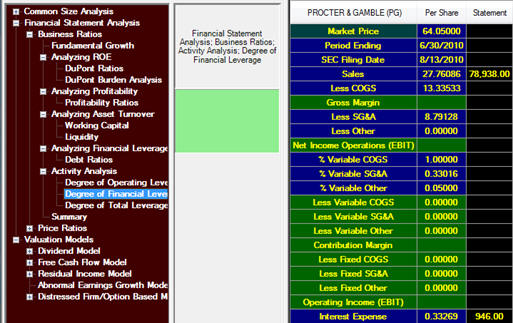

Next consider how this is computed from the financial statements.

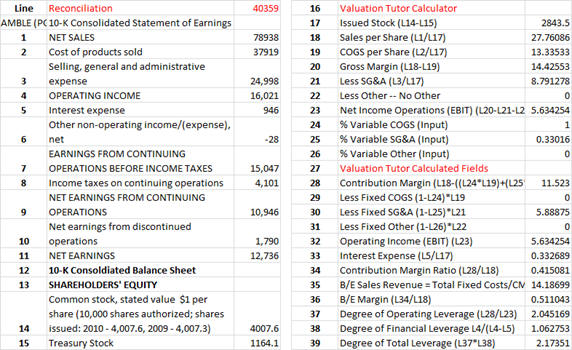

Tutor Reconciliation:

Proctor and Gamble (PG)

Our objective is to reconcile the following from the 10-K:

Step 1:

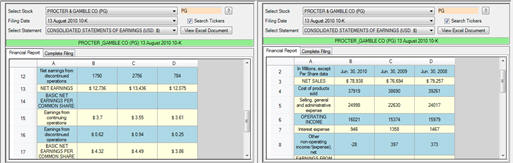

Now bring up two Income Statements for Proctor and Gamble as

described in section 3.2 as displayed below.

For Proctor and Gamble you can see that the Cost of products sold =

$37,919 and the “Selling, general and administration” expense

=$24,998. Plus now

Interest Expense is $946.

To recast the income statement from its full or absorption costing

format to a direct or variable costing format we need to break up

these costs into their fixed and variable components.

For reconciliation purposes suppose we assume that 80% of the

COGS are variable and 20% of the SA&G expenses are variable.

These percentages can be subject to more refined analysis

later but for now we are more concerned with mastering the

operational details.

Step 2:

Click on Calculate and we can verify the input and derived

fields for the following:

The above demonstrates the power of recasting the income statement

in this manner. This

lets you estimate the Degree of Financial Leverage as well as the

Break Even points for Sales Revenue and implied Margin of Safety

(i.e., Sales minus B/E Sales.

The Degree of Total Leverage is the product of the Degree of

Operating Leverage and the Degree of Financial leverage.

The reconciliation from the Income Statement is provided below.