4.8

Wal-Mart and Target: Strategic Differences

In the case of Amazon, we saw how getting strategy into balance

had a major impact upon stock price performance.

We now examine the impact of different strategies on

ratios and stock prices by comparing Wal-Mart and Target.

Our objective is to apply Financial Statement Analysis to

identify the relative strengths and weaknesses of these

companies (which are immediate competitors).

The tools

we will use in this case study were introduced in Chapter 3.

An overview of how we will analyze the companies is shown

in Figure 1:

Figure 1: Summary of

Business Ratio Analysis

We will

start with the stock price performance of Wal-Mart and Target.

Then, we will become acquainted with the business model

and business strategy.

After that, we will compare them along three dimensions:

profitability, operating efficiency and financial leverage.

From this, we will

identify the comparative strengths and weaknesses of Target

compared to Wal-Mart.

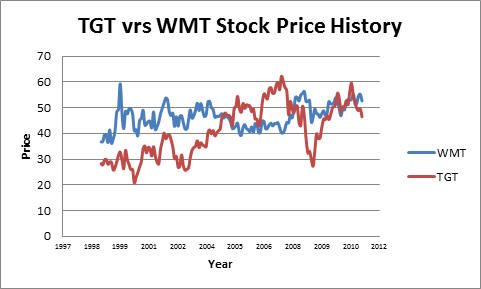

Stock Price Performance

Consider

the recent history of stock price performance of Wal-Mart and

Target shown in Figure 2:

Figure 2: TGT and WMT Stock Price

This

reflects a relative performance that is quite different even

though the two companies are immediate competitors.

First, you can see that WMT was less volatile than TGT.

In 2001 and 2002, there was a recession, and both stock

prices fell. You can

see that TGT recovered strongly, until the deep recession of

2008, which affected TGT much more than WMT.

Again, TGT has recovered from the decline of 2008.

Even though WMT declined in 2008, it was a much smaller

decline than TGT.

Why is

the price behavior of these two firms so different?

To answer

this question, let us first become acquainted with their

respective business models and strategies.

Business Model and Strategy

We start

with Item 1 from Target’s and Wal-Mart’s 2010 10-K.

You have already seen that this section of the 10-K

contains a lot of useful information about what the firms do and

how they do it. So

let’s see if their business models and strategies are different.

|

Target (TGT)

PART I

Item 1.

Business

General

Target Corporation (the Corporation or Target) was

incorporated in Minnesota in 1902. We operate as two

reportable segments: Retail and Credit Card.

Our Retail Segment includes all of our merchandising

operations, including our large-format general

merchandise and food discount stores in the United

States and our fully integrated online business. We

offer both everyday essentials and fashionable,

differentiated merchandise at discounted prices. Our

ability to deliver a shopping experience that is

preferred by our customers, referred to as "guests," is

supported by our strong supply chain and technology

infrastructure, a devotion to innovation that is

ingrained in our organization and culture, and our

disciplined approach to managing our current business

and investing in future growth. As a component of the

Retail Segment, our online business strategy is designed

to enable guests to purchase products seamlessly either

online or by locating them in one of our stores with the

aid of online research and location tools. Our online

shopping site offers similar merchandise categories to

those found in our stores, excluding food items and

household essentials. |

Wal-Mart (WMT)

PART I

ITEM 1. BUSINESS

General

Wal-Mart Stores, Inc. (“Wal-Mart,” the “company” or

“we”) operates retail stores in various formats around

the world and is committed to saving people money so

they can live better. We earn the trust of our customers

every day by providing a broad assortment of quality

merchandise and services at every day low prices

(“EDLP”) while fostering a culture that rewards and

embraces mutual respect, integrity and diversity. EDLP

is our pricing philosophy under which we price items at

a low price every day so our customers trust that our

prices will not change under frequent promotional

activity. Our fiscal year ends on January 31 for our

U.S., Canada and Puerto Rico operations. Our fiscal year

ends on December 31 for all other operations. During the

fiscal year ended January 31, 2010, we had net sales of

$405.0 billion.

Our operations comprise three business segments:

Wal-Mart U.S., International and Sam’s Club.

Our Wal-Mart U.S. segment is the largest segment of our

business, accounting for 63.8% of our fiscal 2010 net

sales and operates retail stores in different formats in

the United States, as well as Wal-Mart’s online retail

operations, Wal-Mart.com

|

These two

firms have a similar business model designed primarily around a

traditional physical value chain.

You can

see that they have chosen to

perform similar activities

(retail) in different ways.

The initial paragraphs in Item 1 of their respective

10-K’s make clear they have different business strategies with

respect to their marketing and sales activity.

Wal-Mart is committed to “saving people money” which can

only be implemented via a low price strategy for all the

merchandise in their stores.

Target on the other hand is committed to delivering a

“shopping experience that is preferred by our customers,” who

are referred to as “guests.”

Target therefore is committed to higher marketing

expenditure within their stores and a higher level of customer

service.

Target continues to add that their products are “both everyday

essentials and fashionable differentiated merchandise at

discount prices.”

Thus although low prices are important to their strategy,

they are not as important a component of their business strategy

compared to Wal-Mart.

Item 1

reveals a lot of interesting information about their business

strategies.

Financial statement analysis will reveal the extent to which the

strategies are working.

In fact, one of the objectives of financial statement

analysis is to assess how the managers of a company are

performing given the stated objectives of the corporation.

We will see below how the differences in strategy are

reflected in profitability, operating efficiency, and financial

leverage