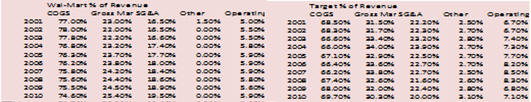

4.11 Balanced

Scorecard Implications for Target

From a

business strategy perspective, Target has implemented a strategy

designed to work on multiple dimensions:

Customer, Process and Growth in response to declines in

financial performance from the recent recession. Target has

tightened its control over costs and especially procurement

activities in terms of both procurement costs and increased in-house

brands to enable it to compete more aggressively on price as well as

recovering margins.

Target has broadened its Customer perspective to embrace a

5%-discount card program to be launched in the fall of 2010.

Target has also cut back on the Growth perspective in terms

of opening fewer new stores to reduce its capital expenditure.

Barron’s

reported that Target planned to open 10 new stores in 2010 (compared

to hundreds prior to 2010) and 20 new stores in 2011.

This reduces capital expenditure but Target is still trying

to promote growth via an aggressive remodeling strategy that will

save capital expenditures compared to opening new stores.

This is a remodeling strategy of existing (non Super Target)

stores with plans extending to 1100 of its nearly 1500

general-merchandise stores.

Overall, these measures have resulted (and expect to result)

in improved financial measures (earnings forecasts and free cash

flow forecasts) and overall the market is responding positively with

a recovery in stock price from a recent low just below $25 in March

2009 to just over $50 in August 2010.

In

summary, when the economy is strong Target’s comparative advantage

has been on shopping experience and profit margins.

When the economy weakened Wal-Mart’s comparative advantage

was Every Day Low Pricing and asset turnover.

By modifying its business strategy towards the Wal-Mart,

Target was able to reverse its negative stock price trends and

rebuild shareholder value.

That is, Target was able to modify its comparative advantage

to better fit current economic conditions.

It will be interesting to observe Target’s response when the

economy improves because the management has built a strong

foundation to benefit from the recovery.