4.2 DuPont Analysis of Amazon.com

In the last chapter, we started with concept of fundamental or

accounting growth which is defined as:

Fundamental Growth = ROE * Retention Ratio

ROE is Net Income/Shareholders’ Equity and the Retention Ratio

is 1 – Dividend Payout Ratio.

Since Amazon paid no dividends, the retention ratio is

one, and therefore we will restrict our attention to the

Amazon’s ROE.

The DuPont decomposition of ROE is:

ROE = Net Income/Sales * Sales/Total Assets * Total

Assets/Shareholders’ Equity

This decomposition rewrites ROE as the product of three terms,

Profit Margin Ratio, Asset Turnover Ratio and Financial Leverage

respectively.

The following table shows the DuPont decomposition for

Amazon.com over its recent history.

We will look at some of the sub-components below.

Table 1:

Amazon’s DuPont decomposition history

Note that in 2000 – 2002 Amazon had a positive ROE but both the

numerator and the denominator were negative.

This is obviously is not a good sign but does reinforce

the loss of over 90% of shareholder value in 2000-2001.

The trend however reflected steady improvement which was

a good sign, also reflected in the stock price.

Amazon’s financial statements allow additional information to be

extracted. For

example, observe that Amazon’s Total Assets increased

significantly from 1998 to 1999.

To understand why requires digging further into Amazon’s

10-K report for information provided in addition to the major

financial statements.

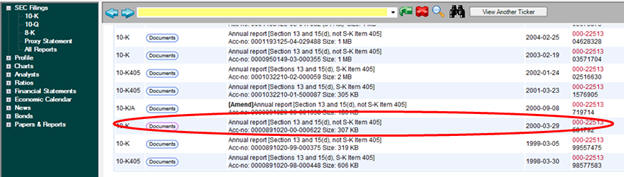

You can use Valuation Tutor to access the historical 10-K for

Amazon. Select Amazon as

the stock to analyze, and in the Information Browser at the

bottom, click on 10-K and then scroll down to find the 2000 10-K

(filed in March of 2001):

Amazon’s 2000 10-K filing covers the period of time ending

December 31, 1999 and is usually released in the first quarter

of the year.

Item 1 of the 2000 10-K reveals:

WAREHOUSING, INVENTORY, FULFILLMENT AND DISTRIBUTION

We significantly expanded our US distribution

infrastructure in 1999 with the addition of new distribution

facilities in Fernley, Nevada; Coffeyville, Kansas;

Campbellsville, Kentucky; Lexington, Kentucky; McDonough,

Georgia; and Grand Forks, North Dakota. We also opened two

new international distribution centers, one in the UK and

one in Germany. On an aggregate basis, these eight new

distribution centers comprised approximately four million

square feet of warehouse space. The geographic coverage of

these distribution centers and their capacity have

dramatically improved our fulfillment capabilities and will

allow us to continue to increase our volume. The new

distribution centers also give us more control over the

distribution process and facilitate our ability to deliver

merchandise to customers on a reliable and timely basis. We

now have a total of 10 distribution centers, including our

facilities in Seattle, Washington, and New Castle, Delaware.

In Item 1 they further observe that:

OUR SIGNIFICANT AMOUNT OF INDEBTEDNESS COULD AFFECT OUR

BUSINESS

We have significant indebtedness. As of December 31,

1999, we had indebtedness under senior discount notes,

convertible subordinated notes, capitalized lease

obligations and other asset financing totaling approximately

$1.48 billion. With the sale of our Premium Adjustable

Convertible Securities(TM), also known as PEACS, in February

2000, we incurred additional debt of approximately $681

million. We may incur substantial additional debt in the

future. :

That is,

Amazon’s investment decision had a significant impact upon its

financial statements.

In particular, the expansion of assets and debt combined

with a significant jump in negative income led to Amazon’s

stockholders’ equity turning negative by 2000.

Armed

with this background information we can return to the DuPont

decomposition for Amazon and how it changed over time.

Applying DuPont Decomposition to Amazon

The

DuPont decomposition lets you track three important ratios:

Profitability

Asset

Utilization

Financial

Leverage

Each of

these three items is key to understanding Amazon’s performance,

especially in light of the significant warehousing investments

made in 1999 that were funded by debt incurred in 1999 and 2000.

Profitability

First,

consider profitability. From

1995 to 2000, there was a “dot com bubble”

where shares of internet companies rose to very high

levels. Many of

these companies did not generate any profits, and Amazon.com was

no exception to this, as described in a colorful manner in the

Fortune Magazine article, as follows:

(FORTUNE Magazine) –

A year ago, getting Jeff Bezos to talk about making money

was a bit like getting Bill Clinton to define sex. Last

fall, when asked when he thought Amazon.com would turn a

profit, he hemmed, hawed, and mumbled something about not

"missing out on the big opportunities of the Internet."

Pressed further, he gave this murky response: "Look at USA

Today; it took 11 years to become profitable."

Beautiful Dreamer, Katrina Brooker,

Fortune Magazine Dec 18, 2000.

It turned out that Bezos was correct

as the following profit margin trends show.

In the chart below you can see that the profit margin

fluctuated wildly in the early years and then ultimately settled

down into a more normal range.

Table 1 reveals how negative net income was.

However, by 2002 Amazon’s profit margin is signaling a

significant change.

It ultimately stabilized in the latter the latter part of the

decade.

Amazon’s

profit margin behavior suggests that the 1999 asset expansion

ultimately proved to be worthwhile for Amazon’s shareholders.

Asset Turnover

The

second major term in the DuPont decomposition asks: how

efficiently assets are being utilized in the company.

The Asset Turnover ratio is calculated by dividing Sales

Revenue by Total Assets.

This ratio provides insight into how efficiently assets

are being utilized to generate sales revenue.

The chart

reveals a positive trend over the early years.

That is, Amazon appears to be learning to utilize its

assets more efficiently during the first decade of the 21st

century. This graph

strongly reinforces Amazon’s decision to expand its warehousing

capability in 1999 as this proved to be important for supporting

the growth in sales exhibited by Amazon (see Table 1).

In addition, the combination of the positive asset

utilization trends with the positive trends in profit margins

provided even stronger reinforcement of the investment decision

made in 1999 and it was not until the economic crisis of

2008/2009 that any real change in trends occurred.

However,

the investment decision did add a considerable amount of debt to

Amazon’s Balance Sheet and so the third major component of the

DuPont decomposition provides insight into how this is reflected

in the financial statements.

Financial Leverage

Finally,

ROE is the product of ROA and Financial Leverage and financial

leverage reflects Amazon’s debt policy.

Financial Leverage only makes sense for firms that have

positive shareholders equity and so the blanks parts in the

graph below correspond to the times Amazon had a negative

shareholders’ equity.

Recall

that Amazon introduced some significant debt when it invested in

its own warehouses.

For example, Amazon’s 2000 10-K reveals that from 1998 to 1999

Amazon’s debt increased significantly:

1998

1999

2000

Long-term

Debt

348,140

1,466,338

2,127,464

The

increasing debt, combined with increasing losses, drove Amazon’s

shareholder equity to be negative.

It took until 2005 before Amazon recorded a positive

shareholders’ equity and the graph depicts a significant

improving trend in financial leverage as Amazon was building up

retained earnings and paying down its debt.