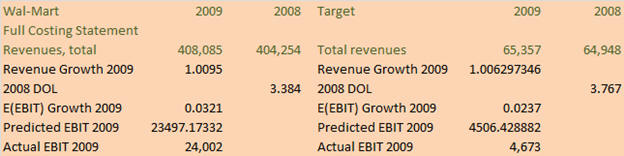

4.15 Example:

Interpreting Degree of Operating Leverage

Suppose

Wal-Mart’s TTM Sales are expected to increase by 5% and fixed

costs remain unchanged.

By how much do Operating Earnings change by?

You can

verify that Operating Income has increased by 14.935% = Sales

Growth *DOL = 5*2.987.

Now

consider what actually happened from 2008 to 2009.

Actual sales revenue increased by only 0.95% for Wal-Mart

and 0.63% for Target.

As a result, the predicted increase in operating income

is 3.21% growth for Wal-Mart and 2.37% for Target.

The actual versus predicted is provided below:

Both

companies outperformed this prediction.

It is instructive to understand how.

It should

be noted, however, that this assumes that fixed and variable

costs remain unchanged under the increased sales growth.

For example, both Target and Wal-Mart attained better

COGS in 2009 compared to 2008.

That is, after the economic crisis it appears that

procurement for both companies were able to negotiate more

aggressive terms.

To get to

the bottom line, however, requires one additional step which is

to understand the impact of financial leverage.