4.14 Analyzing

Capacity Activity and Productivity

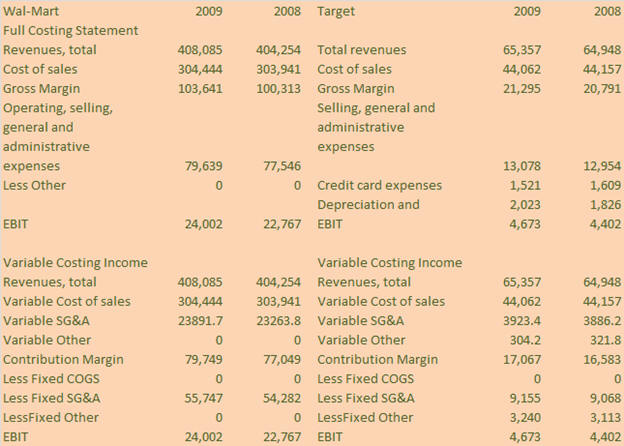

First we

need to convert the gross margin form of the income statement to

a variable costing for both Wal-Mart and Target.

Note:

Valuation Tutor requires

you to specify the percentage of the total that is allocated to

variable costs, with fixed costs making up the remainder.

For a retailer we expect the majority of COGS to be a

variable cost because they are turning over inventory at a quick

rate as revealed in the working capital analysis.

So we will assume the allocation is 100% variable for

COGS. For SG&A we

will assume a traditional 30% variable.

and for other costs these are generally fixed so we will

assume 5% variable for other.

Armed

with these assumptions we can convert the income statement into

a variable form. The

table below contains both full costing and variable costing

forms of the income statement.

Notes:

Variable

COGS = 100% of COGS

Variable

SG&A = 30% of SG&A

Variable

Credit card expenses Target = 20%

Depreciation and amortization Target 100% fixed

In the

above we allow for the fact that Target has one additional line

item “Other” which is primarily fixed cost.

Observe that the fixed component of both costs is a

little higher for Target than Wal-Mart.

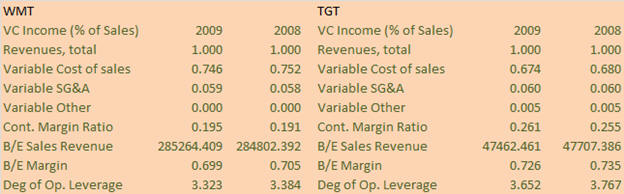

Finally,

a firm’s operating leverage is defined as the percentage change

in the firm’s operating earnings (EBIT less any non-operating

income), that accompanies a percentage change in the

contribution margin.

That is, the operating income elasticity with respect to the

contribution margin.

In other words, this tells an analyst that a percentage change

in sales revenue will result in a percentage change in operating

earnings. This is a

useful number to estimate especially as the consensus sales

revenue forecast is readily available in the form of high, low

and average which can then be related to earnings forecasts via

the following relationship:

Degree of Operating Leverage (DOL) = % Change in operating

income/% Change in sales revenue

Equivalently,

Degree of Operating Leverage (DOL) = Contribution

margin/EBIT

This

important measure reflects the fact that a change in Sales can

lead to a more than proportional change in earnings from

operations. In

particular, the higher the degree of operating leverage the

higher the predicted change.

However, the relative size of the Degree of Operating

Leverage is affected by how close the firm is to their

break-even point.

The closer the higher is the DOL.

Contribution Margin Ratio = Contribution Margin/Sales

Revenue

Contribution Margin Ratio = (Sales Revenue – Total Variable

Costs)/Sales Revenue

Break Even (B/E) Analysis ($Sales Revenue)

= Total Fixed Costs/(Contribution Margin Ratio)

Break Even (B/E) Margin = B/E $Sales Revenue/$Sales Revenue

From the

above variable costing income statement for the year ending:

Wal-Mart 2009

Contribution Margin Ratio (CMR) = 0.195

Break-even (B/E) Sales Revenue = Total Fixed Costs/CMR =

$285,264

Break-even (B/E) Margin = 0.699

Degree of Operating Leverage = 3.323

Target 2009

Contribution Margin Ratio (CMR) = 0.261

Break-even (B/E) Sales Revenue = Total Fixed Costs/CMR =

$47,462

Break-even (B/E) Margin = 0.726

Degree of Operating Leverage = 3.652

In the

above example observe that Target has a higher contribution

margin than does Wal-Mart.

Thus all other things being equal Target is prepared to

spend more on advertising because the dollar contribution from

increased sales is higher.

However, observe the degree of operating leverage is

higher for Wal-Mart than Target.

This implies increasing advertising expenditure to

increase sales will have a greater impact on Operating Income

for Wal-Mart than Target.

That is, the latter measure takes into account both fixed

and variable costs.

Income from Operations is an important number in later

assessments of intrinsic value.

As a result, it is a number that provides a broader

measure of expenditures upon a firm’s assessed value.