4.18 Growth

and Degree of Total Leverage

This number relates a firm’s operating and financial leverage to

its net income.

With respect to Net Income:

Degree of Total Leverage = % Change in Net Income /% Change

in Sales

In terms of the Contribution Margin format of the Income

Statement this is:

Degree of Total Leverage = Contribution Margin/Net Income =

Contribution Margin/EBIT * EBIT/Net Income

Degree of Total Leverage

= Degree

of Operating Leverage * Degree of Financial Leverage

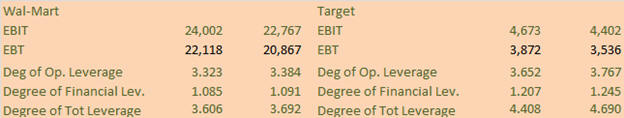

For Wal-Mart and Target collecting together parts of the above

analysis:

Wal-Mart:

TTM Degree of Operating Leverage = 3.32

Target: TTM

Degree of Operating Leverage = 3.65

Wal-Mart:

TTM Degree of Financial Leverage = 1.085

Target: TTM

Degree of Financial Leverage = 1.207

Wal-Mart:

TTM Degree of Total Leverage =3.606

Target: TTM

Degree of Total Leverage = 4.408

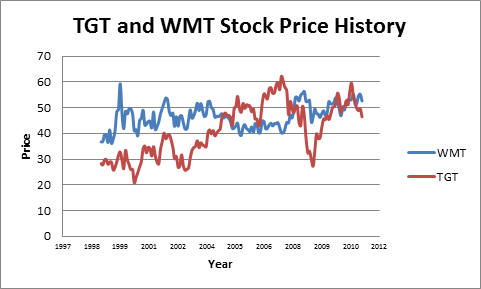

Target as revealed above carries more financial leverage and

therefore it is more sensitive to sales fluctuations than is

Wal-Mart. Recall

from the price chart (repeated below for your convenience) that

Target is more sensitive to the business cycle than is a

“Wal-Mart.”

The degree of total leverage analysis above reinforces the

conclusion that Target is riskier than Wal-Mart because of its

greater operating and financing leverage.