4.7 Summary of Amazon.com

As you

have learned item 1A of the 10-K usually provides a clear

statement of a firm’s business model.

We have seen that for the case of Amazon that the modern

concept of a dynamic value chain, embracing both physical and

virtual links, is required to accurately describe its business

model. Amazon’s

business strategy can now be described relative to this chain in

the way described earlier.

That is, recall the concept of a business model can be

classified as follows:

The business performs different activities from rivals or,

The business performs similar activities in different ways

The business chooses not to perform certain activities

The first

two of these apply to Amazon’s strategy.

First, the embracing of virtual activities and the

inclusion of dynamic links on the chain are examples performing

different activities from rivals.

That is, initially Amazon’s rivals were Barnes and Noble

and Borders and by choosing a web storefront compared to a

bricks and mortar storefront Amazon’s business strategy was to

perform similar activities in different ways.

The range of goods were then extended to the lofty

objective for offering “Earth’s Biggest Selection…” and so

Amazon’s rivals ultimately became the Wal-Marts, K-Marts,

Targets and other retailing chains as opposed to the Barnes and

Nobles and Borders..

A second

major pillar of Amazon’s strategy was to be “Earth’s most

customer centric ….”

This was feasible with a web based model with real time

database access to each of the primary links on the value chain.

Customers could receive immediate support both in terms of

fulfillment related questions, product information/ratings

issues and even product suggestions.

If Amazon was successful at offering earth’s largest

selection of products then amazon could draw to the attention of

its customers products that they never previously knew existed.

Combined

in this way Amazon’s business strategy was largely built upon

the objective of “Get Big Fast” (GBF) using a value chain that

was internally linked so that it was difficult for a competitor

to attack any specific link.

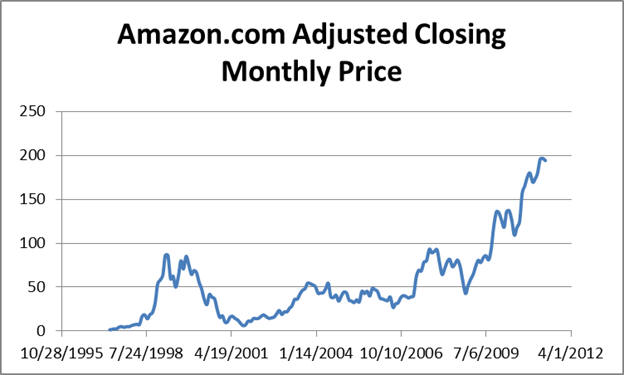

This strategy created large amounts of shareholder value

for Amazon in the 1990’s as the stock price chart below reveals.

However,

you can observe from the above that after an initial phase of

phenomenal price appreciation problems started to emerge for

Amazon as revealed from Amazon’s Return on Equity which was

becoming increasingly negative (1998 ROE = -.90, 1999 ROE =

-2.70).