Chapter 4: Interpreting Business Ratios:

Case Studies

In

the last chapter you learned how to construct business ratios

and conduct activity analysis.

In this chapter we show you how to use the ratios in real

world situations. We

first use them to analyze the performance of Amazon.com over

time. Then, we use

them for a comparative analysis of Wal-Mart and Target.

In each case, you will see how the interpretation depends

on the company’s business model and strategy.

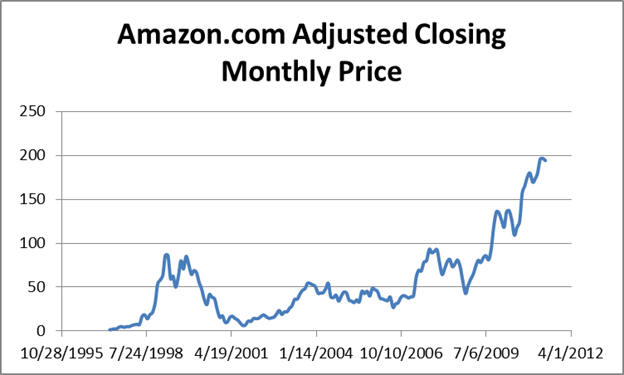

4.1 Amazon.com Stock Price

History

To appreciate the importance of financial statements in

understanding performance, consider the stock price history of

Amazon.com.

The stock price was $2.40 on July 1, 1997, rose to $86.03 on

April 1, 1999, and was at $89.06 in November of 1999, but then

started to fall. In

January 2000, it was $64.56.

On February 1, 2001, it was at $10.19 and fell further to

$5.97 by September of 2001.

Then started a slow and fairly steady increase through

2008, and was followed by very strong gains though June 2011.

On June 1, 2011, the stock price was $191.63.

Amazon’s performance in the first decade of the 21st

century has been impressive, especially considering that the

stock market (as measured by the S&P 500 Index) lost 7.67%

between January 2000 and June 2011.

The price history also shows that Amazon lost over 90% of

its shareholder value in 2000-2001and then recovered very

strongly.

So what happened?

We will analyze Amazon’s performance in two ways.

First, we will look at the business ratios over time.

Then, we will look at how Amazon changed its business

strategy and how this was reflected in both the ratios and the

stock price.

As background, we will refer to an article in a Fortune Magazine

dated December 18, 2000 by Katrina Brooker. The article

describes Amazon’s focus on growth (“GBF or “Get Big Fast”) and

an obsession with customer satisfaction.

It will be useful to keep this in mind as we take you

through the analysis.

A much more detailed account of the early history of

Amazon.com is in the book “Amazon.Com: Get Big Fast” by Robert

Spector (April 2000).

It contains fascinating details about the growth of the

company and the evolution of its strategy over time,

particularly at the end of the 1990’s.