4.16 Analyzing

Financial Leverage

It is an

open question whether the financing decision adds value to

shareholders or not.

We will make two observations here.

First, we will see that increasing financial leverage has

a positive impact upon ROE.

However, it also increases risk and so equity investors

will require a higher rate of return.

If this higher rate of return exactly offsets the

positive impact from financial leverage then it is all awash and

the financing decision has no impact upon shareholder value.

If the financing decision interacts with the investment

decision, for example as per a financial institution then the

financing decision matters.

We now

examine how both Wal-Mart and Target have approached the

financing decision.

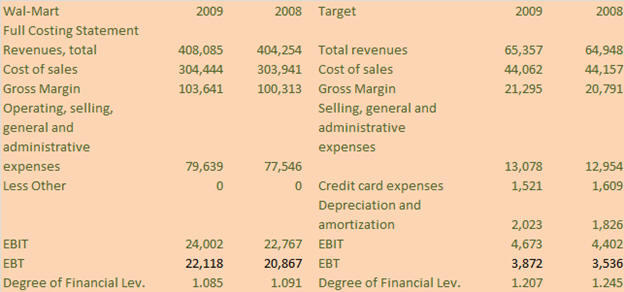

Example: Wal-Mart

versus Target

As a

first pass the DuPont analysis and the Debt Ratio reinforce the

conclusion that Target is carrying more leverage than Wal-Mart

although Target appears to be currently reducing its leverage to

bring it more in line with Wal-Mart’s.

However,

to focus more sharply upon the firm’s financing decision the

Debt ratio is further refined into the Debt to Equity Ratio

which traditionally is expressed as:

Debt to Equity Ratio = (Long-Term Debt + Value of

Leases)/Shareholders Equity

Long Term Debt to Equity Ratio = Long-Term Debt/Shareholders

Equity

However,

in today’s world traditional financing approaches have changed

significantly with the use of derivatives and in particular

interest rate swaps.

As a result, much financing is done short term and then swapped

into desirable long term patterns using interest rate swaps that

can extend out to 30-years.

This implies that the Debt to Equity and the Long Term

Debt Ratios be redefined to include

short term debt.

Debt to Equity Ratio = (Total Debt + Value of

Leases)/Shareholders Equity

Term Debt to Equity Ratio = Debt Issued / Shareholders

Equity

The above

ratios provide insight into the extent of debt leverage for the

firm and immediately raise questions regarding the amount of

interest coverage the firm has.

The first ratio is relevant to a traditionally financed

firm that matches long term investment with long term financing

and the second ratio is relevant to a modern firm that exploits

derivatives and swaps to manage its financing decision.

Both

firms exhibit a business model built around ownership as opposed

to leasing. This is

reinforced from the following excerpts from their respective

10-K’s:

Wal-Mart 2010 10-K

ITEM 2. PROPERTIES

The number of discount stores, supercenters, Neighborhood

Markets and Sam’s Clubs located in each state in the United

States and the number of units located in each of the

countries in which we operate are disclosed as of fiscal

year-end January 31, 2010 in our Annual Report to

Shareholders under the caption “Fiscal 2010 End-of-Year

Store Count” and are incorporated herein by reference.

Portions of such Annual Report to Shareholders are included

as an exhibit to this Annual Report on Form 10-K.

United States.

As of January 31, 2010, in the United States, we

owned 3,214 of the buildings in which discount stores,

supercenters and Neighborhood Markets operated and 483 of

the buildings in which our Sam’s Clubs operated. Land on

which our stores are located is either owned or leased by

the company. In the United States, we lease the remaining

buildings in which our stores and clubs operate from either

commercial property developers pursuant to capital or

operating lease arrangements or from local governmental

entities in connection with industrial revenue bond

financing arrangements. All store leases provide for annual

rentals, some of which escalate during the original lease

term. In some cases, the leases provide for additional rent

based on sales volume. Substantially all of the company’s

store and club leases have renewal options, some of which

include escalation clauses causing an increase in rents.

International.

We operate our International segment stores and

restaurants in a combination of owned and leased properties

in each country in which our International segment operates.

As of the end of fiscal 2010, we owned 33 properties in

Argentina, 161 properties in Brazil, 117 properties in

Canada, 125 properties in Chile, 1 property in China, 69

properties in Costa Rica, 9 properties in El Salvador, 14

properties in Guatemala, 7 properties in Honduras, 52

properties in Japan, 530 properties in Mexico, 25 properties

in Nicaragua, 11 properties in Puerto Rico and 239

properties in the United Kingdom. The remaining operating

units in each such country are leased on terms that vary

from property to property. We utilize both owned and leased

properties for office facilities in each country in which we

are conducting business. As of the end of fiscal 2010, our

International operations are supported by 132 distribution

facilities. Of these 132 distribution facilities, we owned

and operated 34 and leased and operated 37. Third parties

owned and operated the remaining 61 distribution facilities.

Target 2010 10-K

The following table summarizes the number of owned or leased

stores and distribution centers at January 30, 2010:

(a)

Properties within the "combined" category are

primarily owned buildings on leased land.

(b) The 38

distribution centers have a total of 48,588 thousand square

feet.

As a

result, for the debt ratios we will compute relative to Debt and

ignore leases. The

degree of Financial Leverage in terms of Net Income as follows:

Degree of Financial Leverage = EBIT/EBT

Wal-Mart 2009

Operating Income =

$24,002

Earnings Before Tax = $22,118

Degree of Financial Leverage = 1.085

Target 2009

Operating Income

= $4,673

Earnings Before Tax = $3872

Degree of Financial Leverage = 1.207

The above

is revealing of differences in the two firm’s financing

strategies whereby Target has a higher degree of financial

leverage than does Wal-Mart.