2.6 Highlights of the main statements

In the appendix, we describe the contents of each of the four major

financial statements in detail.

These details are important, and we put them in the appendix

so that you can look them up easily when needed.

The last part of the appendix describes the linkages between

the statements. Here,

we highlight the main parts of each report, using Amazon’s January

2011 10-K as an example.

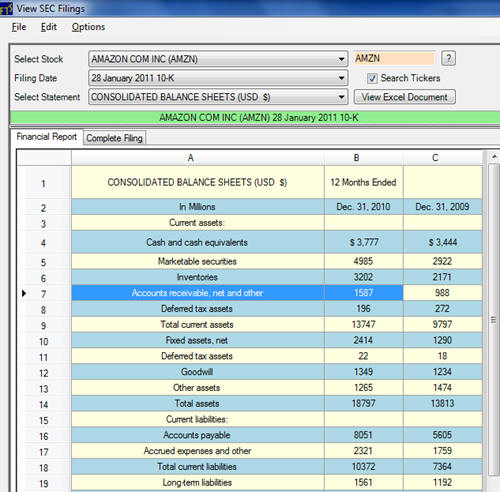

2.6.1 The Consolidated Balance Sheet

Also known as the “statement of financial position,” this statement

summarizes the assets and liabilities of the company:

You can see the items that make up the assets and liabilities.

There is a distinction between short term assets (called

current assets) and other assets, and similarly for liabilities.

The statement tells you at a glance what the company owns and

what it owes.

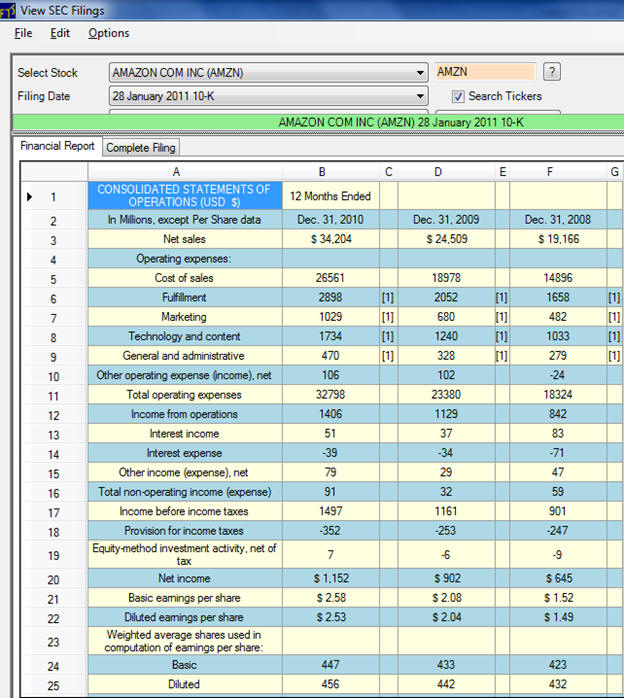

2.6.2 The Consolidated Income Statement

Also called the “consolidated statement of operations,” this

statement tells you about the profitability of the company:

Revenue from sales is at the top, and then payments are subtracted

to arrive at the net income (also called earnings or profit).

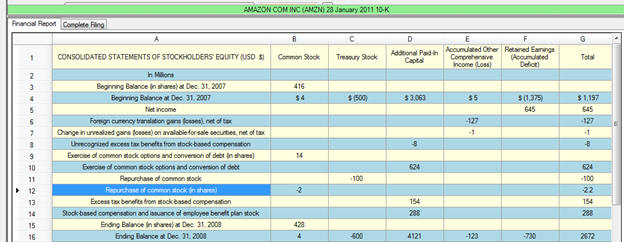

2.6.3 The Consolidated Statement of Shareholders (or Stockholders)

Equity

Intuitively, the value of what the shareholders (or stockholders or

owners) own is the difference between the assets and the

liabilities. One way to

think about it is to understand what happens if the firm was to be

sold. The value of the

assets would be received and the liabilities would have to be paid

off; the rest would be divided among the shareholders. The

components that affect shareholders equity are shown in this

statement. For example,

retained earnings (profits minus dividends) add to shareholders

equity. Treasury stock

is stock that has been issued but has been repurchased by the

company and so reduces shareholders equity.

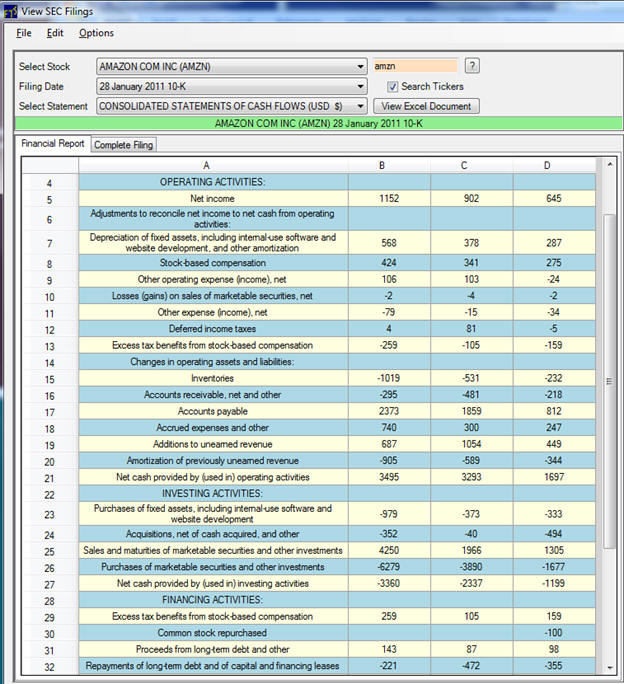

2.6.4 The Consolidated Statement of Cash Flows

This statement tells you about cash inflows and outflows during the

period covered by the statement.

Cash and cash equivalents (holdings that can be readily

converted to cash, like Treasury bills) change because of three

activities: operations (payments for goods, cash received from

sales), investments (e.g. gains and losses from financial assets,

sale of assets), and financing (e.g. issuing debt, payment of

dividends):

office (412)

9679367

office (412)

9679367