A.3 Appendix: The Consolidated Statement of Cash Flows

At the end of the day investors want management to generate earnings

consistently and convert these earnings to cash flows.

In an earlier section we presented the income statement and

in this section we present a statement that measures management’s

performance with respect to converting earnings to cash.

You will see that in the most popular form of this statement

information is presented in precisely this format.

That is, it reconciles the change in cash over the period of

time starting with accounting earnings.

As a result, this statement is popular with a large number of

participants in the financial markets because it is both informative

and relatively transparent to users who have limited accounting

accrual knowledge. It

further helps consumers of corporate financial reporting with

respect to a wide range of every day decisions including:

Ability of the stock to generate cash in the future

Ability of the stock to meet its obligations

Managements’ investment decisions

Managements’ financing decisions

Managements’ dividend decisions

This statement is required from SFAS 95 and technically this

statement has evolved from narrowing the definition of a fund in a

“source and use of funds” statement to “Cash and Marketable

Securities.” That is,

this statement is designed to answer the following simple question:

How did balance of cash and marketable securities change over the

current accounting period?

The consolidated statement of cash flows answers this question by

organizing activities around the following three categories:

Operating Activities

Investing Activities

Financing Activities

In addition, at the end of the statement additional “supplemental

cash flow Information” is also provided.

Understanding the Structure of a Cash Flow Statement

Before taking a closer look at real world cash flow statements it is

useful to understand the structure.

Fortunately, unlike other major accounting statements the

structure is well defined within two broad methods:

Direct and Indirect Methods.

The objective of

each method is to reconcile the closing balance of cash (and

marketable securities) with the opening balance of cash (and

marketable securities).

The direct method organizes activities into the set of activities

that directly affect the cash flow “T” account.

The indirect method starts with accounting net income and

undoes the effects from accrual accounting to identify cash income.

This latter method is by far the most prevalent for large

companies but both are used in practice.

Direct Method for Constructing the Consolidated Statement of Cash

Flows

This method tracks the movement of cash through the consolidated

entity for the accounting period.

That is, the direct method provides the report in the

following form:

Cash on Hand at Beginning of Period

+ Cash received during the period

- Cash disbursements during the period

= Cash on hand at the end of the period

Organization of the Direct Method

To extract more information out of this flow of cash through the

entity it is organized by activities:

Operating Activities,

Investing Activities

Financing Activities

For each set of activities the direct method lists the Cash Receipts

and Disbursements

Example of the Direct Method:

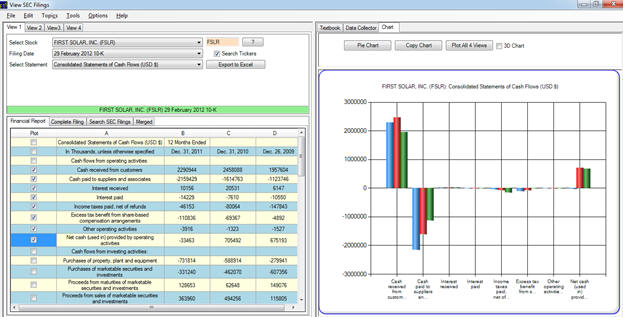

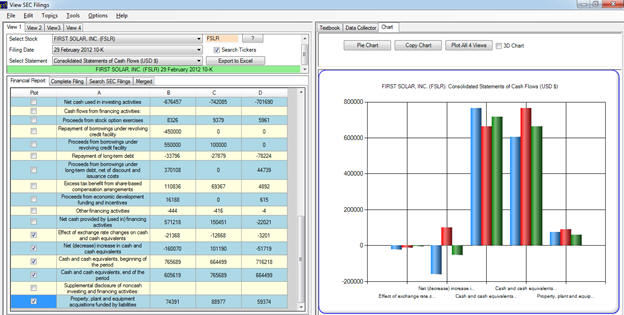

First Solar (Ticker FSLR)

Cash Inflows and Outflows from Operating Activities typically

include:

Cash received from customers

Cash paid to suppliers

Interest revenues

Dividends received from equity investments

Realized

revenues from trading securities (classification of financial

securities)

Changes in Working Capital (excluding cash and marketable

securities) can be either a source or use of cash including:

Inventory purchases

Operating expenses and payables

Accounts Receivables

Interest payments

Tax payments

Bottom Line: Cash

Flow from Operating Activities

The next category is cash flows from

Investing Activities

Typically these include:

Revenue from sales of Plant Property and Equipment

Realized Returns from loans

Realized

Revenue from sale of financial assets

Typically the outflows include:

Acquisition of long lived assets

Loans to other entities

Purchase of financial assets

Bottom Line:

Cash Flows from Investing

Activities

Remark: Cash flows from

financial assets and/or liabilities include available-for-sale or

held-to-maturity securities but not trading securities.

Trading securities are deemed part of operating activities

(SFAS 102)). In

addition, sale of cash equivalents are excluded because these are

already reflected in the balance of Cash and Marketable Securities.

Recall, this the account being reconciled by this statement.

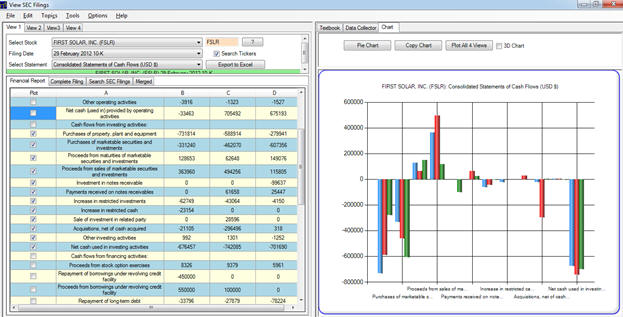

For the case of First Solar, their Cash Flows from Investing

Activities, is:

The final category is cash flows from

Financing Activities

Typically these include:

Proceeds from borrowing

Proceeds from issuing own stock

Repayments of debt principal

Treasury Stock acquisitions

Payments of Dividends

Redemption of Employee Stock options

Bottom Line:

Cash Flows from Financing

Activities

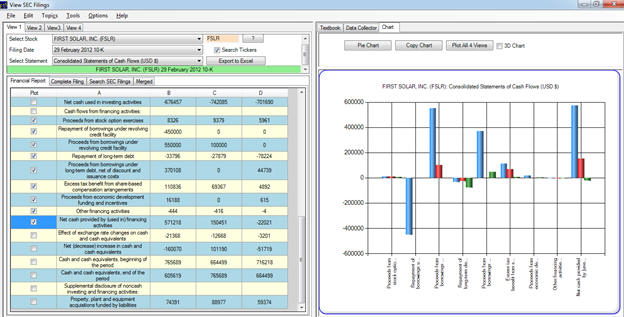

Again for First Solar, the Cash Flows from Financing Activities is

presented as follows:

Finally, a set of supplementary information is provided at the end

which for First Solar is:

This includes foreign currency adjustments to cash and cash

equivalents as well as usually dividend information.

For the current example First Solar does not pay dividends

and so no dividend information is provided.

The direct method, as the name suggests, lists the sources and uses

of cash classified by the three activity categories (Operating,

Investing and Financing).

Indirect Method for Constructing the Consolidated Statement of Cash

Flows

The second, and more popular method, is referred to as the

Indirect Method.

This method provides a reconciliation of the change in cash

starting with accounting net income and undoing the impact from

accrual accounting.

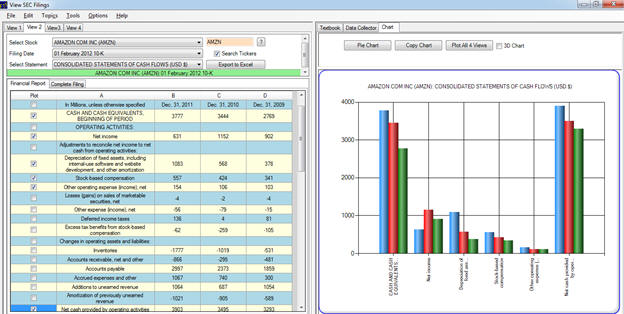

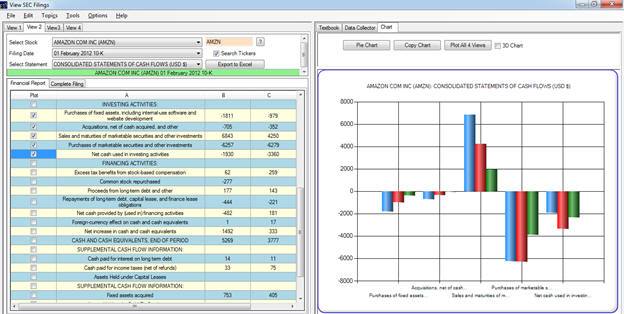

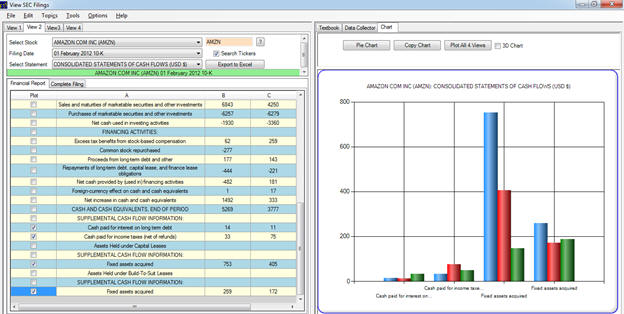

We can illustrate the above for Amazon.com.

Amazon places a lot of weight on their Cash flow Statement

and Free Cash Flows in general.

As a result, they provide a very detailed cash flow statement

as follows:

Example of the Indirect Method:

Amazon (Ticker AMZN)

Operating Activities for Amazon:

Operating activities are the principal revenue generating activities

of a firm.

The operating activity section for Amazon is pretty detailed as

illustrated below:

The actual line items provide a pretty good representative example:

The above includes operating activity accruals such as depreciation

and amortizations, the contribution to cash if working capital

decreases and use of cash if working capital increases, and revenue

recognition adjustments.

There is always some judgment required to classify items.

For example, if the cash receipts and disbursements are

related to transactions that can be identified with financing and

investing activities then the classification of these cash flows is

in these other categories.

Similar comments apply gains and losses included in the

profit or loss but again are related to cash flows from investing

activities.

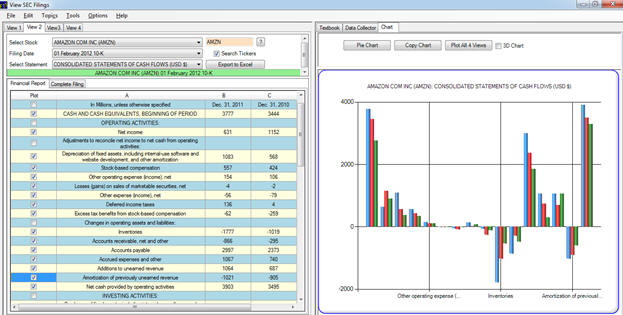

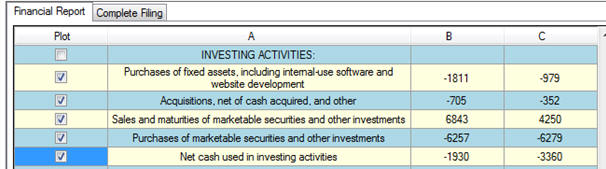

Investing Activities for Amazon:

In particular, these activities change the productive capacity of a

stock and the details of the line items are as follows:

You can observe that the above includes traditional items such as

purchases of fixed assets and technology related expenditures.

It also includes the impact of financial assets and

liabilities other than instruments classified as cash equivalents or

held for trading. That

is, financial assets and liabilities that are classified as

“Held-to-Maturity” or “Available-for-Sale” unless they are

classified as financing activities.

Finally, for the case of financial assets and liabilities

that are accounted for as a hedge then the appropriate

classification in a cash flow statement is that they are accounted

for in the same manner as the cash flows from the underlying hedged

item. That is, if this

relates to financing activities then this is classified in the

financing activity section.

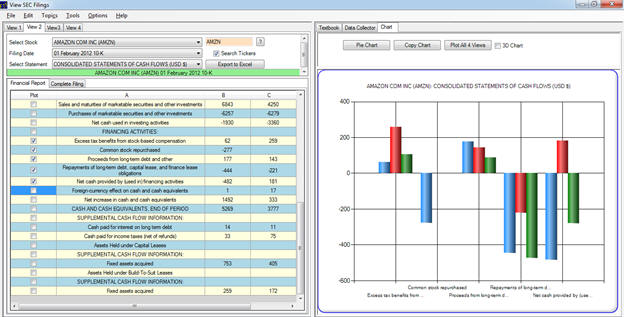

Financing Activities for Amazon:

The financing activities provide details about cash raised, rolled

over and repaid during the accounting period arising from both debt

and equity:

Examples of cash flows arising from financing activities are

provided above which are cash proceeds from issuing debt, equity or

related instruments.

Other examples, not included above are cash flows arising from

payments made by a lessee for the reduction of an outstanding

liability relating to a capital (under US GAAP) or a finance (under

IFRS) lease.

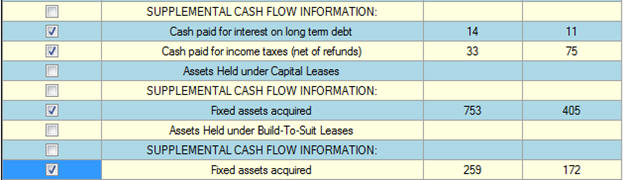

Supplemental Information for Amazon.com:

The supplementary information provided by Amazon provides a sample

of the items included in this section:

Again, for the case of Amazon no dividend information is included

because Amazon does not pay dividends currently.

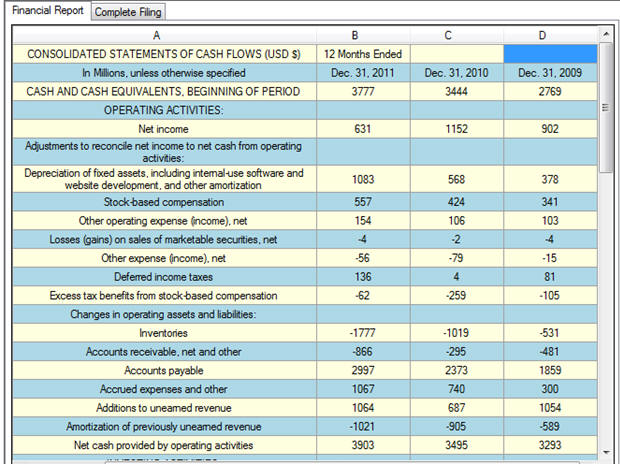

Reconciling A Cash Flow Statement for Real World Companies

In a textbook example it is straightforward to reconcile the changes

in balance sheet accounts over the period with the indirect method

for constructing a cash flow statement.

For example, the change in accounts receivable is either a

source of cash if accounts receivable decreases and a use of funds

if accounts receivable increase.

Similarly, an increase in inventory is a use of funds and a

decrease in inventory is a source of funds.

Combined, the changes in the working capital provide a net

source or use of cash.

Typically, public companies use the indirect method for reporting

their cash flow statement.

However, rarely do the changes in the balance sheet amounts

appear to match what is on the consolidated cash flow statement.

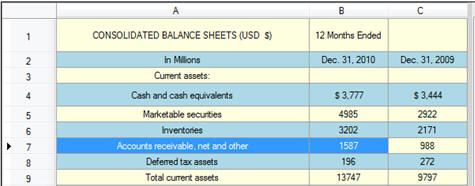

For example, Amazon reports the following in their Balance sheets:

That is, the change in Inventory equals 3,202 – 2,171 = $1,031 (use

of funds) in the Balance sheet depicted above versus the report

number in the cash flow statement of 1,019 as a use of funds.

Often an even greater discrepancy appears on a company's cash

flow statement.

So the question arises is whether there is something wrong?

The answer is no because discrepancies between the consolidated

statements can arise for various reasons.

1. Assets can be

written off due to impairments, retirements and other reasons that

lead to reclassifications.

2. Foreign currency

translations are made at different times -- end of period for the

consolidated balance sheet but at the time of the transaction for

the subsidiary.

3. Changes in the

entities being consolidated due to acquisitions and sales.

These differences can lead to differences in the line items on a

cash flow statement but ultimately the cash balances are reconciled

e.g., Cash and Cash Equivalents at beginning and the end of the

period should be directly reconciled.

In the above Amazon reports:

Cash and Cash Equivalents, January 1: 3,444

Cash and Cash Equivalents December 31:

3,777

These same amounts can be verified in Amazon’s Consolidated Balance

Sheet depicted above.

In other words, companies impose as a constraint that opening and

closing cash balances reconcile even though individual line items

will vary.