2.2 Impact of Technology upon Accounting Disclosure: Interactive Data Disclosure

The SEC summarized its

Interactive Data Disclosure requirements as follows (adopted

in Securities Act Release No. 9002, 2009):

SUMMARY: We are adopting rules requiring companies to

provide financial statement information in a form that

is intended to improve its usefulness to investors. In

this format, financial statement information could be

downloaded directly into spreadsheets, analyzed in a

variety of ways using commercial off-the-shelf software,

and used within investment models in other software

formats. The rules will apply to public companies and

foreign private issuers that prepare their financial

statements in accordance with U.S. generally accepted

accounting principles (U.S. GAAP), and foreign private

issuers that prepare their financial statements using

International Financial Reporting Standards (IFRS) as

issued by the International Accounting Standards Board

(IASB). Companies will provide their financial

statements to the Commission and on their corporate Web

sites in interactive data format using the eXtensible

Business Reporting Language (XBRL). The interactive data

will be provided as an exhibit to periodic and current

reports and registration statements, as well as to

transition reports for a change in fiscal year. The new

rules are intended not only to make financial

information easier for investors to analyze, but also to

assist in automating regulatory filings and business

information processing. Interactive data has the

potential to increase the speed, accuracy and usability

of financial disclosure, and eventually reduce costs.

This was optional in 2010

and is required in 2011.

An important unit of the SEC is the Division of

Corporation Finance (DCF).

This unit is responsible for reviewing filings by

companies for conformity with accounting standards, full

disclosure, and comparability.

These filings are

added to the SEC’s EDGAR Database which today is the primary

source of data for researching a company.

Interactive Data Reporting requires that the filings

with SEC are electronic in XBRL:

Extensible Business Reporting Language, form.

The objectives for this are described as follows:

(source www.XBRL.sec.gov).

“Interactive

data can provide investors quicker access to the information

they want in a form that's easily used and can help

companies prepare the information more quickly and more

accurately.”

The SEC’s interactive data

approach to financial reporting is also becoming the new

standard for international financial reporting.

They report a growing list of countries are now

beginning to incorporate interactive data into their

disclosure systems, including: Australia, Belgium, China,

Committee of European Banking Supervisors (CEBS), Ireland,

Japan, Singapore, Spain, Sweden, and the United Kingdom.

Interactive data has a

simple objective:

to enable the users of financial information to

perform faster and more accurate analysis of business data.

This includes being

able to quickly and easily access the data.

There are four major

financial statements:

·

Consolidated Statement of

Income – presents results over a period starting with the

top line (sales) down to the bottom line (net income).

·

Consolidated Balance Sheets

– presents the financial position at the end of a period.

·

Consolidated Statement of

Cash Flows – presents information about cash inflows and

outflows summarized by operating, financing and investing

activities.

·

Consolidated Statements of

Shareholders’ (Stockholder’s) Equity – presents a

reconciliation of the beginning and ending balances of

accounts appearing in the Shareholders’ equity section of

the balance sheet

You will quickly learn that

in practice, companies use multiple names to refer to the

same statement.

For example Amazon and Wal-Mart refer to their Consolidated

Statement of Income respectively as:

·

Consolidated Statement of

Operations (USD $).

·

Consolidated Statement of

Income (Audited) (USD $)

There are many supporting

statements to these main statements.

These are referred to as the Notes to the Financial

Statements.

These communicate assumptions, changes in accounting

policies and additional information.

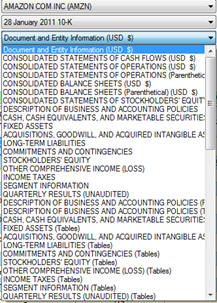

Valuation Tutor provides convenient access to those

notes that are filed as part of the Interactive Statements

in a drop down menu.

In the 2011 10-K, the set of Amazon’s support

statements was large and the following example lists about

half of the total number.