A.5 Appendix: Common Size Analysis

Introduction

The major purpose for preparing

financial statements is so users can extract useful

information from them about a company.

The first step is to understand how financial

statements are constructed and what the various line items

mean. This was

covered earlier in the introduction to financial statements.

In this topic we explore a technique designed to let

users extract additional information from the financial

statements.

This technique is referred to as common size analysis.

Common size analysis re-expresses an entire financial

statement relative to a single item referred to as the “base

item.” Typical

base items are Total Assets and Revenue for general

purposes, but the depending upon the purpose many other base

items are relevant for specific purposes.

Common size analysis creates a simple ratio between

every item on the financial statement and the selected base

item. Ratio

analysis provides a refinement of common size analysis

designed to extract and summarize additional information

relative to key categories such as profitability, risk,

solvency and liquidity.

Vertical and

Horizontal Common Size Analysis

There are two types of common size

analysis, vertical and horizontal.

Vertical

analysis restricts common size analysis to one reporting

period and typically focuses upon the composition within a

report. For

example, vertical analysis provides immediate insight to

users regarding asset, financing and cost structures within

a firm.

Horizontal analysis

applies common size analysis to focus upon trends and

changes over time.

For example, how has a firm’s gross margin changed

over time?

Both vertical and horizontal common

size analysis can be further extended to comparing across a

set of competitors or other firms to tease out additional

information. As a

result, common size analysis is an important tool that is

immediately applicable to the financial reports.

Valuation Tutor lets you work

interactively and visually with the financial statements

provided to investors in a 10-K, 10-Q, and 20-F.

This is a powerful tool lets you take common size

analysis to new heights permitted by today’s technology.

This tool allows for the common size analysis of any

of the latest as well as past interactive statements so that

easy comparisons can be made over time and among immediate

competitors or other stocks being screened.

This ensures that you are extracting timely

information from these reports that can be compared to

responses in the stock market after the reports are publicly

disclosed such as in “earnings’ season.”

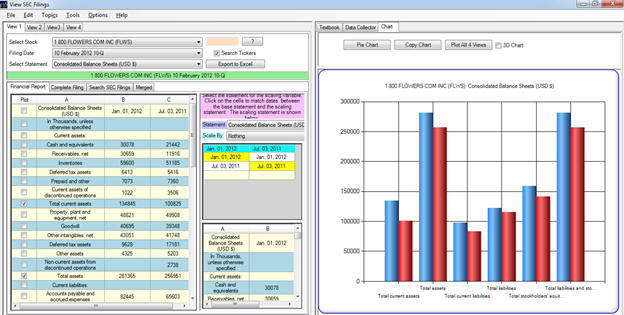

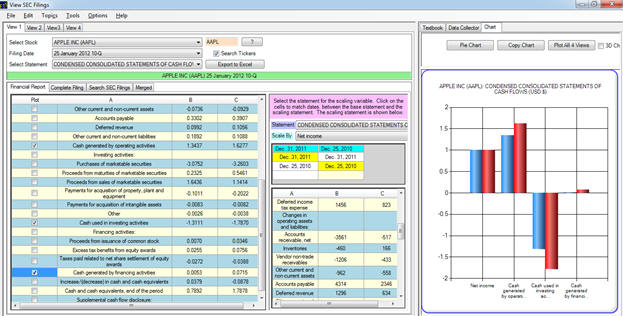

The opening screen appears as follows:

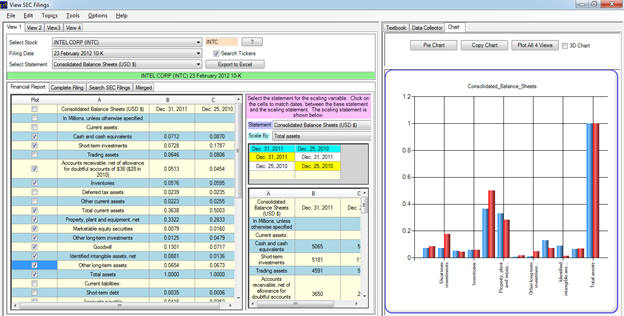

The top LHS of the screen is where you

enter the ticker and select the statement you want to apply

common size analysis to.

The bottom LHS of the screen is the statement you

have selected to apply common size analysis to, the center

part of the screen is the base variable that you select to

scale by (which can come from another statement) and the RHS

of the screen is the results of your graphical analysis.

First we consider the default

Consolidated Balance Sheet and scale it by Total Assets.

We then extend this analysis to the Income other

statements.

Common size Analysis

of the Balance Sheet

The common size analysis of a balance

sheet can immediately highlight some important issues such

as:

What is the composition of assets (real

versus financial assets)?

What is the financing composition (debt

versus equity)?

How does the asset composition change

over time?

Has the financing composition changed

over time?

What does a strong versus a weak

balance sheet look like?

Vertical analysis provides answers to

the first two questions and horizontal analysis provides

answers to the second pair of questions.

Combined, both forms of analysis provide some

relevant information for the last question.

Example:

Common Size Analysis using Total Assets for Apple

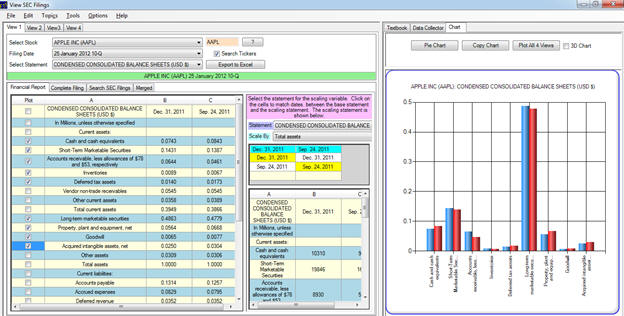

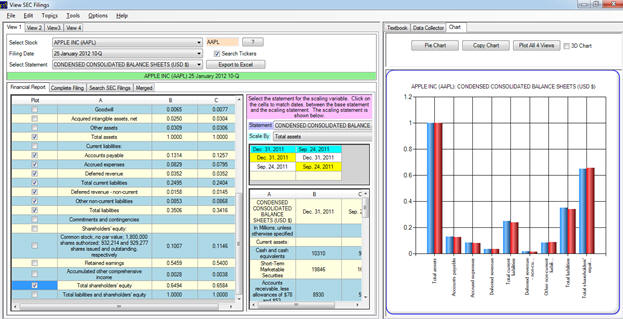

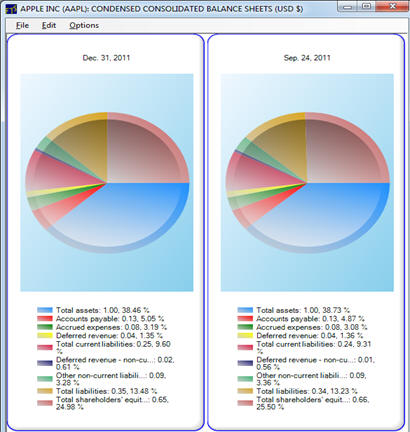

In the above screen a common size

analysis of the January, 2012 balance sheet for Apple is

provided scaled by Total Assets.

The LHS of the screen provides the results of the

analysis and the RHS of the screen presents these results

graphically.

A few immediate observations jump out.

First, the relative importance of Property, Plant and

Equipment to Apple is not large.

This reflects the fact that manufacturing hardware

such as the Apple iPhone is outsourced.

The relative importance of Financial Assets is

immediately clear.

The big spike is “Long term marketable securities.”

In general the asset composition is a much greater

emphasis upon financial as opposed to real assets for Apple.

Furthermore, this is an increasing

trend over time.

For example the relative percentage of total assets

for PPE is declining, because Apple’s financial assets are

growing. This

is especially the case for investment related financial

assets however Apple’s working capital assets, such as

inventory and accounts receivable, are also growing.

This reflects the current growth and the expectations

for immediate future growth.

The composition f liabilities for Apple

also reflect strength.

Apple has no debt and the composition is heavily

skewed toward current liabilities (long term liabilities are

approximately 10% of total liabilities).

Compared to Total Assets Apples total liabilities

are low, less than 40% implying that the stockholders’

equity is relatively large (65%).

The composition can be decomposed to

reveal greater detail in a more traditional pie chart

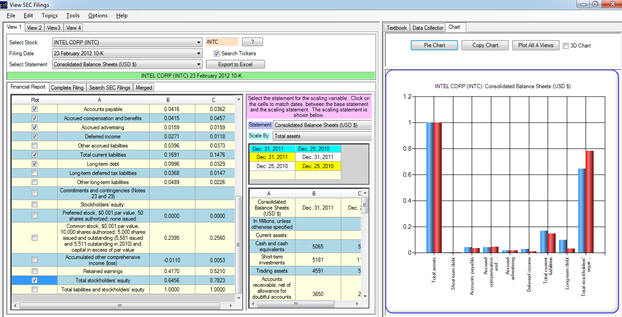

How does Apple compare to Intel, a

manufacturer that does not rely heavily on outsourcing?

Immediately the difference for real

assets is apparent.

Intel’s PPE has increased from 28% to 33% in contrast

to Apples decrease to 5.6% from 6.7%.

This reflects the fact that Intel manufacture in

their own plants.

Similarly, on the liability side investment in real assets implies the financing decision is more important to Intel than it is to Apple.

The relative % of Owners Equity has

declined for Intel to just over 60% from a very high 78%

which is largely due to the additional long term debt

financing taken on over the last year – presumably to take

advantage of the very low rates currently available to fund

its increased investment in real assets.

Example:

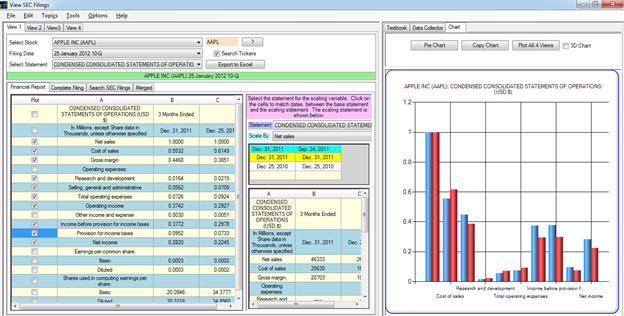

Common Size Analysis using Revenue for Apple

Common size analysis applied to Apple’s

2012 10Q reveals the strength in earnings for this company.

First, Gross margin, Operating and Net Income have

all increased.

Every cost category has declined with the exception of

provision for taxes which understandably increased.

Apple’s Gross Margins are large and

growing (45%, 35% respectively for 2011, 2010 December

quarters).

Example:

Common Size Analysis of the Cash Flow Statement for

Apple

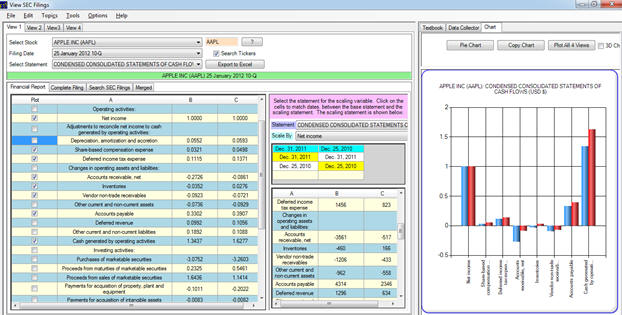

Common size analysis of the cash flow

statement provides additional insights into the Operating,

Investing and Financing activities of the firm.

For example, scaling these activities by Net Income

reveals that Apple is achieving large amounts of growth

without increasing their investments:

However, the Cash Flow from Operations

as a % of Net Income is declining which raises the

interesting question why:

Why has Apple’s Cash Flow from

Operations relative to Net Income declined

significantly?

Graphically you can observe this from

the RHS plot relative to the LHS plot (which is Net

Income/Net Income = 1).

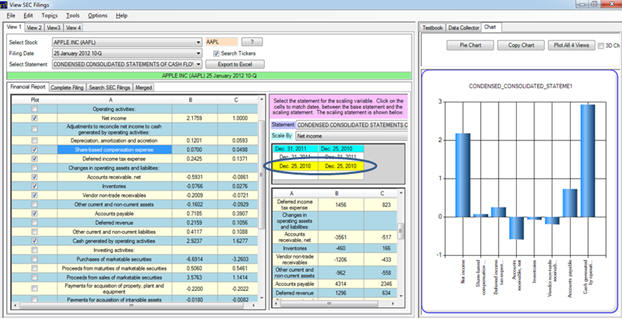

To clarify this consider scaling both

cash flow statements by the net income for the 2010 quarter.

This is achieved by selecting both 2010 statements

circled below:

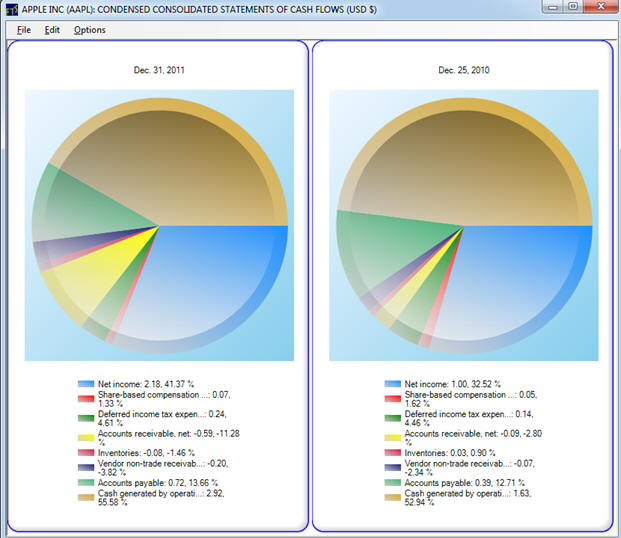

Now all is relative to the 2010 Net Income. This common size analysis immediately reflects the strong growth Apple is currently experiencing. That is, the increase in December quarter’s net income was 218%! Common size analysis immediately reflects how each category has grown relative to Net Income. This reveals that along with this rapid growth Apple was positioning itself for even stronger growth especially with respect to the working capital items such as Inventory, and accounts payable. Also reflective of the quarter’s realized growth was the sharp jump in accounts receivable. Combined these working capital items implied that the rate of increase in net income greater than the rate of increase in cash flow from operations. The pie chart depicting composition makes this clearer:

In the above scaled by 2010 Net Income

the growth in Net Income for the same quarter 2011 was 218%

but the growth in cash generated from operations is

2.92/1.63 = 179%.

This is largely driven by Accounts Receivable jumping

from -2.80% to -11.28% (i.e., a use of cash), Inventory

jumping from 0.90% to -1.46% (a use of cash) and Accounts

Payable increasing from 12.7% to 13.7% (a use of cash).

These jumps when growth is strong indicates the

expectation of even stronger growth to come.

Exercise:

Apply the Valuation Tutor to the 1st

quarter of 2012 to further check these trends.