A.2 Appendix: A Quick Tour of the Income Statement

A.2 The Consolidated Income Statement

This financial statement attracts the most attention in the media.

This attention is reinforced by the results from a survey of

managers in the field that found:

�We survey 401 financial executives, and conduct in-depth

interviews with an additional 20, to determine the key factors

that drive decisions related to reported earnings and voluntary

disclosure.

The majority of firms view earnings, especially EPS, as the key

metric for outsiders, even more so than cash flows. Because of

the severe market reaction to missing an earnings target, we

find that firms are willing to sacrifice economic value in order

to meet a short-run earnings target. The preference for smooth

earnings is so strong that 78% of the surveyed executives would

give up economic value in exchange for smooth earnings. We find

that 55% of managers would avoid initiating a very positive NPV

project if it meant falling short of the current quarter's

consensus earnings.�

NATIONAL BUREAU OF ECONOMIC RESEARCH

The Economic Implications of Corporate Financial Reporting

John R. Graham, Campbell R. Harvey, and Shiva Rajgopal

This attention by managers is further reinforced from the results of

a study regarding the incentives faced by CEO�s in the field.

This study concluded:

We find that missing quarterly earnings benchmarks, especially

the analyst consensus earnings forecast, is associated with

career penalties in the form of a reduced bonus, smaller equity

grants, and a greater chance of forced dismissal for both CEOs

and CFOs during the period 1993-2004. These results are obtained

after controlling for the magnitude of the earnings surprise,

operating and stock return performance, and are significant in a

statistical and in an economic sense.

Career penalties for failing to meet the analyst

consensus estimate are higher for firms that give quarterly

earnings guidance and in the post-SOX period. Our evidence

suggests that (i) boards appear to react directly to managers'

ability to meet earnings targets or to the information that is

reflected in meeting such benchmarks; and (ii) senior managers'

preoccupation with meeting earnings benchmarks might be based at

least partly on career concerns.

CEO and CFO Career Penalties to Missing Quarterly Analysts

Forecasts Published: September 24, 2008

Harvard Business School working paper

Authors: Rick Mergenthaler, Shiva Rajgopal, and Suraj Srinivasan

So what is the Consolidated Statement of Income?

Simply it measures the performance of a firm in terms of the income

it generates over a given period of time.

The form of presentation for an income varies across firms

and in particular across industries.

However, in its basic form the following components typically

appear:

Top Line: What revenues

are recognized (e.g., what was sold)?

Less

What did it cost to generate those revenues?

Gross Margin

Less

Period expenses (SG&A, Research and Development)

Income from Operations

Less

tax expenses (period expenses)

Bottom Line: Net Income

Remarks:

The mode of presentation for the income statement varies in

practice. For example,

under US GAAP both single-step and multiple-step income statement

formats are acceptable.

The multiple-step format provides intermediate measures of net

income such as gross profit, operating profit, profit before taxes

and so on. The

single-step format groups categories of revenue and categories of

expenses together, before arriving at the net income number.

In practice statements can be in part single and in part

multiple steps. This is

an important distinction to be aware of when working with the real

world statements because you will usually find it useful to recast a

single step or partial single step statement into a multiple-step

statement for comparison and other purposes.

US GAAP requires some items to be reported separately in the income

statement, such as extraordinary items and discontinued operations.

Extraordinary items are prohibited under IFRS.

Discontinued operations, on the other hand, is highlighted

under both systems for assets held for sale or to be disposed of,

provided that no significant future continuing cash flows will be

generated.

In summary this statement provides the primary source of information

relevant to assessing the profitability of a company.

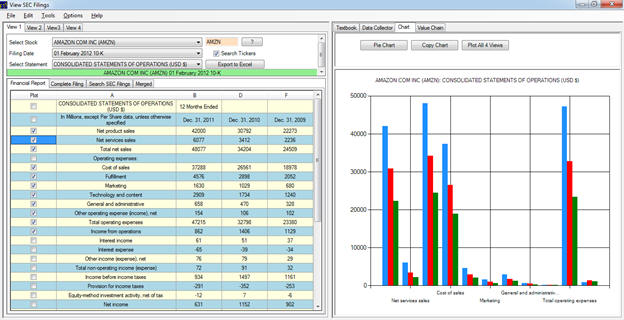

Understanding the Income Statement with Valuation Tutor

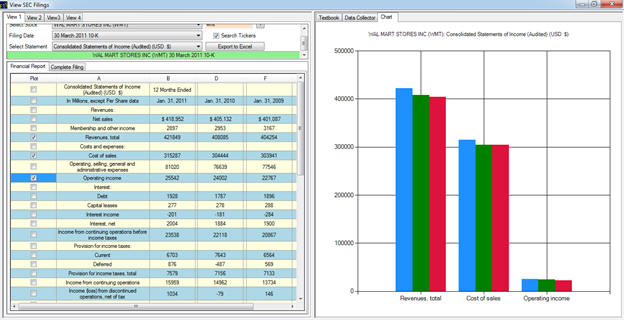

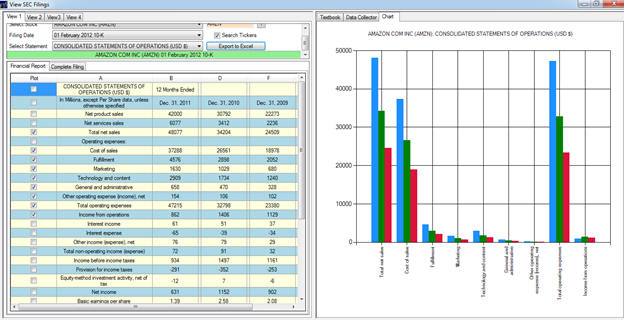

By selecting the Consolidated Statement of Operations for Amazon

from the 2011 10-K reveals the following:

First, observe that Amazon reports in a partial single step income

statement format. The

gross margin for example is not reported even though the cost of

sales is provided. As a

result, an analyst would likely immediately recast Amazon�s

statement into the following generic format:

Net Sales

Less Cost of Sales

Gross Profit

Less Selling and General Administration Expenses

Less Other Expenses

Net Income Before Interest and Taxes (Equivalently EBIT)

Interest Expense

Net Income Before Taxes (Equivalently EBT)

Tax Expense

Net Income After Taxes

You can observe that Amazon already classifies on the basis of

Income from Operations (EBIT (Earnings Before Interest and Taxes))

and then Income Before Taxes (EBT) and finally Net Income (NI).

The Consolidated Income Statement represents a flow concept in the

sense of providing important insights into how a company has

performed between two points in time. The 10-K for additional

comparison purposes requires three years of income statements are

presented for comparison purposes.

Elements of the Income Statement

Net Sales

This contains the aggregate of sales revenue given the revenue

recognition criteria which is usually discussed in the critical

accounting judgments section of the 10-K.

The net part refers to sales revenue net of an allowance for

bad and doubtful debts.

Sales Revenue is a difficult area in general for accounting.

The major difficulty is in applying revenue recognition

criteria.

That is, when does revenue become earned?

Loosely the answer to this question is when goods are transferred or

services rendered irrespective of cash payments under accrual

accounting. Formally,

there are two models for revenue recognition, the Merchant Model and

the Agent Model. These

models will directly impact the format of income statement reporting

in relation to whether cost of goods sold is formally recognized or

not. In practice it is

not uncommon for a firm today to measure some sales revenue under

both models and an alert analyst will read the 10-K closes to

identify what combination of models is actually being used.

We describe these models briefly next.

Merchant Model:

Under this model the merchant bears all of the risk of the

inventory and therefore books the selling price as revenue when sold

(Gross Revenue Recognition) and the cost of the inventory as

COGS. This is often

referred to as the �gross revenue reporting method� because COGS is

itemized separately.

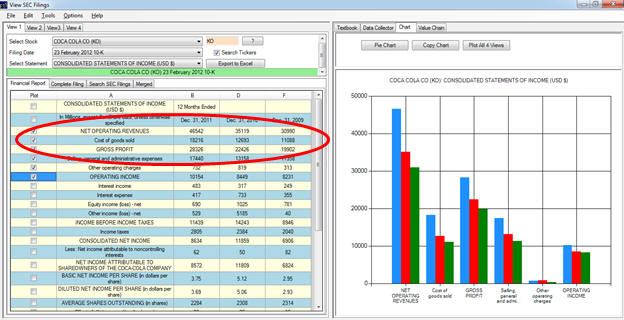

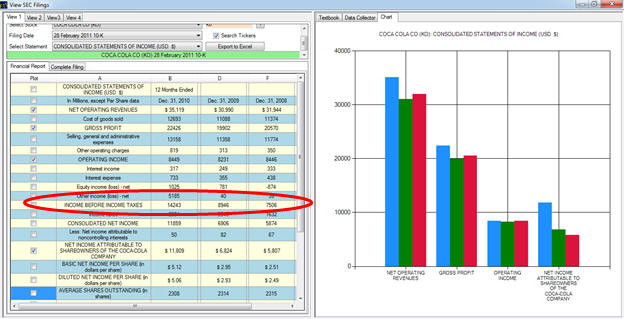

For example, Coca-Cola uses this model in its 10-K and itemizes

Gross Profit as follows:

Agent Model:

an agent provides a service to a customer (facilitating the purchase

of a ticker but not providing the actual product/service) and under

this model the agent is permitted to book the agent�s fee or

brokerage fee as revenue (Net Revenue Recognition).

Under this method there is no COGS.

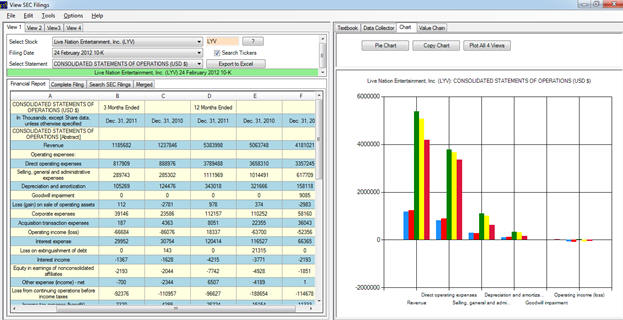

An example of the Agent Model is provided by Live Nation

Entertainment:

Observe there is no Cost of Goods Sold when selling tickets for

entertainment.

Cost of Revenue (Cost of Goods Sold) Summary

These items include the costs associated with selling or providing

the goods and services that generate the net revenue.

Cost of Revenue largely consists of direct or variable costs

associated with generating sales.

Cost of Revenues is defined relative to the firm�s business model.

For example, consider a traditional example of cost of goods

sold, Walmart versus a new economy example of cost of sales, Google.

Cost of Sales Walmart

Walmart buys and sells inventory.

Cost of sales includes actual product cost, the cost of

transportation to the company�s warehouses, stores and clubs from

suppliers, the cost of transportation from the company�s warehouses

to the stores and clubs and the cost of warehousing for our Sam�s

Club segment.

Cost of Revenues Google

Google�s revenues consist primarily of traffic acquisition costs.

Cost of revenues are traffic acquisition costs.

These consist of amounts ultimately paid to our Google

Network members under AdSense arrangements, certain other partners

(our distribution partners) who distribute our toolbar and other

products (collectively referred to as access points), and otherwise

direct search queries to our website (collectively referred to as

distribution arrangements). These amounts are primarily based on the

revenue share and fixed fee arrangements with our Google Network

Members and distribution partners.

Gross Profit (a component of a multiple-step income statement)

This measures the difference between net revenues and the cost of

sales. If Gross Profit

is reported it is calculated prior to accounting for operating

expenses such as selling and administration.

Under segment reporting this is provided by functional lines

of business.

Sales less Cost of Sales determines the Gross Profit or Gross Margin

A Non US GAAP Popular Variation

A further adjustment made by most analysts in a multiple-step income

statement is to measure EBIT (Earnings Before Interest and Taxes) to

keep the investment and financing decisions for the firm whereas US

GAAP treats interest expense as part of operations.

The impact from the investment and financing decision is

separated as follows:

Gross Margin

Less Operating Expenses (not including any financing expenses)

EBIT (Earnings Before Interest and Taxes)

Less Financing expenses

EBT (Earnings Before Taxes)

We next summarize the above structure.

Operating Expense and EBIT

Accrual Accounting Income applies the matching expenses to revenue

test to identify operating expenses.

The matching principle imposes a hierarchical test as

follows:

�

Test 1: Match expenses

to revenue (product expense)

�

Test 2: Match expenses

to the period (period expenses)

That is, if the expense cannot be related to the revenue recognized

then it is matched to the period of time that the revenue is

recognized in under this principle.

Most operating expenses are period expenses although some

such as selling can be product expenses.

Today, fair value accounting further extends the matching

principle to impairments of operating assets (current (e.g.,

inventory) and non-current (Property Plant and Equipment, Capital

Leases, Intangibles).

This generates additional sources of operating expenses because an

impairment is an unrealized loss.

Formally, SFAS 144 defines an impairment loss to be recognized if

the carrying amount of a long-lived asset is not recoverable (e.g.,

via a sale) and exceeds its fair value.

That is, the fair value of the asset is below the existing

book value so that impairment results in writing down the asset to

its fair value on the books.

In turn another important standard, SFAS 157 formally defines fair

value as the �price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market

participants at the measurement date.�

That is, the transaction cannot be within a consolidated

group but instead be what is often referred to as an �arms-length�

transaction.

Some specific items in operating expenses are listed below.

These include selling, administration and related expenses.

Related expenses are the indirect costs associated with

generating revenue such as depreciation and amortizations and lease

expenses.

Selling, General and Administration Expenses (largely period

expense)

Depreciation and amortization

(period expense)

-

Includes capital lease adjustments (today is subject to an

impairment test)

-

Amortization of intangibles is based on impairment tests

Research and Development Expenses (period expense)

Lease Expenses (period expense)

Repairs and Maintenance (period expense)

Combined in a multi-step format this results in operating profit or

EBIT (Earnings Before Interest and Taxes) as it is often referred

to.

Operating Profit (EBIT)

This item measures the profit from the company�s operations.

It reflects how well the company is implementing its

investment decision ignoring how it has financed its assets.

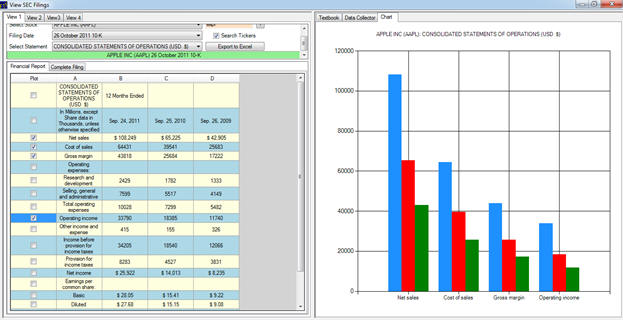

Some Practical Notes

In practice there are large differences in the external reporting of

operating expenses. For

example, consider three well-known companies:

Wal-Mart, Apple and Amazon.

For the case of Wal-Mart operating expenses is a single line item:

And for the case of Apple two line items as follows:

This is because Research and Development is a more significant item

for Apple relative to Wal-Mart.

Amazon on the other hand provides the most detailed reporting

of this category by providing five sub-categories as follows:

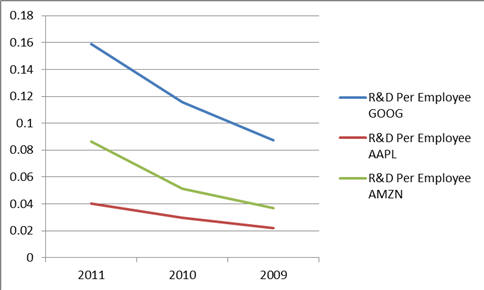

For technology firms operating expense categories provide useful

information and in particular in relation to their Research and

Development Expenditure is US GAAP requires expensing (with the

exception of software).

To put this into perspective it is informative to compare the

average R&D per employee for some technology firms:

That is, Amazon spends more than Apple but both are less than Google

on a per employee basis.

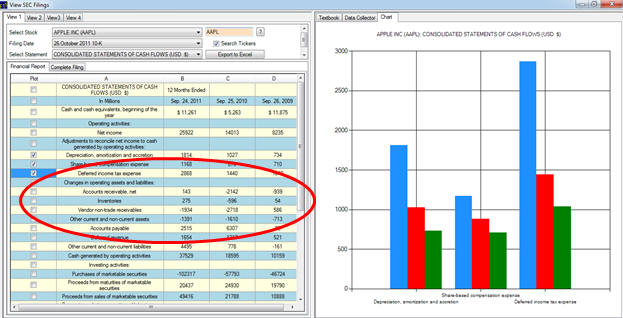

Another practical note is that depreciation expense can be included

in both cost of revenues as a product cost and operating expenses.

However, it is always disclosed separately in the

consolidated statement of cash flows.

As a result, you may always find a finer breakdown of

operating expenses in the cash flow statement than the actual income

statement which provides more aggregated disclosures.

For example, for the case of Apple additional details are provided:

Other Income or Expenses

This item includes revenues and expenses from other sources that are

not the firm�s operations.

This can include dividends or interest expenses associated

with other investments.

This can also include items arising when the company accounts for

its investments using the equity method.

These items can sometimes be very large.

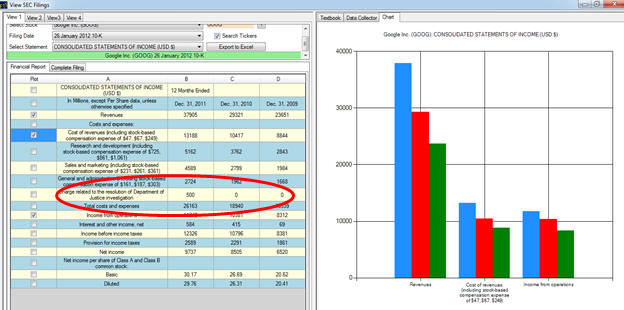

For example, consider the case of Google.

In 2011 they were the subject of a Justice Department probe

and it was conjectured that they may have to pay $500 million in

fines.

Google May Pay $500 Million After Ad Probe By The Justice

Department

By MICHAEL LIEDTKE 05/11/11 07:58 AM ET Associated Press

SAN FRANCISCO -- Google Inc.'s lucrative online advertising

system is facing a U.S. Justice Department investigation that is

expected to cost the Internet search leader at least $500

million.

The disclosure made by Google on Tuesday in a quarterly report

to the Securities and Exchange Commission serves as the latest

reminder of the intensifying regulatory scrutiny facing the

Internet's most powerful company.

It turned out that the $500 million was correct and in their 2012

10-K Google accounted for this transparently as follows:

Finally, Fair Value Accounting is having an increasing influence upon the income statement. In particular, SFAS 159 (actually now ASC 825-10) gives entities the option to account for some assets at fair value that otherwise would be accounted for under the equity method (for the case of a 20-50% ownership). This was the case for intangibles with Coca-Cola�s acquisition of bottling plants. By electing this fair value option Coca-Cola accounted for the gain from their purchase as follows:

Earnings Before Taxes (EBT)

This measures the earnings before income tax expenses are accounted

for. It is relevant to

analysts to assess what the company’s effective tax rate is.

This ratio is calculated by dividing income tax expense by

the earnings before taxes.

Effective tax rates can vary significantly from corporate tax

rates for a variety of reasons including the result of operations in

foreign countries. Many

corporations will provide additional details in relation to taxes

paid in their footnotes to the accounts.

Special Items

Under US GAAP extraordinary items are permitted and are disclosed as

a separate category.

The common special items are:

Extraordinary Items (US GAAP not IFRS)

These are unusual items plus items that are not expected to re-occur

including one time adjustments from accounting changes.

A major difference between US GAAP and the International

Financial Reporting Standards (IFRS) is that the latter does not

separately itemize extraordinary items.

Discontinued Operations

Other (accounting standard changes and other items)

Net Earnings or Net Income or Net Profit

This is referred to as the “bottom line” which is the major focal

point of an income statement.

Additional Categories

There is a variety of additional information provided in an income

statement. First, is

the major ratio EPS (earnings per share).

Earnings Per Share

This is the net income available to the weighted average number of

common shares outstanding over the year. US GAAP requires that if a

company has a complex financial structure that includes embedded

derivatives such as convertible securities then the earnings per

share needs to be expressed in two forms.

EPS Basic versus Diluted

Basic uses the common stock outstanding whereas Diluted assumes that

convertible securities are exercised so that the number of issued

shares would increase.

Additional line items provided by companies filing under US GAAP

provide this EPS information broken up into Continuing and

Discontinuing operations.