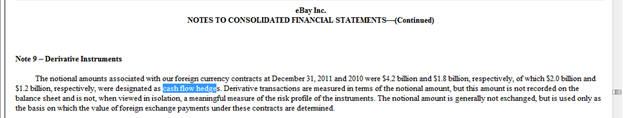

A.4 Appendix: The Consolidated Statement of Stockholders' Equity

A.3 Consolidated Statement of Shareholders’ (or Stockholders’)

Equity

The fourth major financial statement, the consolidated statement of

shareholders’ equity is the least known among the primary

statements. This

statement measures the second concept of income, referred to as

“Comprehensive Income.”

Today, however, this statement is gaining increasing importance from

the role it plays in fair value accounting and in particular hedge

accounting.

Comprehensive Income provides management with additional flexibility

for income smoothing resulting from the application of fair value

accounting. This is

because fair value accounting creates a set of rules with respect to

the recognition and accounting treatment for unrealized gains and

losses. These rules

determine which income statement (if any) that these unrealized

gains and losses must pass through.

This can have

profound implications for the

economy because, for example, they can influence a bank’s

ability to lend by influencing a bank’s capital tiers.

But first one needs to know:

What is comprehensive income?

Comprehensive Income = Accounting Net Income + Other

Comprehensive Income

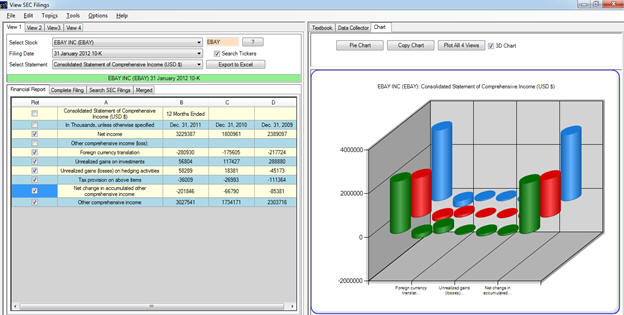

An example of reporting Comprehensive Income is provided below for EBAY:

Other Comprehensive Income contains activities that cause

stockholders’ equity to change but do not pass through the

accounting net income statement.

To reflect this distinction the stockholders’ equity section

of the balance sheet contains two line items titled:

“Accumulated Other

Comprehensive Income” and “Retained

Earnings.”

These are separate line items because the latter results from the

Consolidated Net Income Statement each period and the former results

from the Consolidated Statement of Stockholders’ Equity each period.

Combined accumulated retained earnings and accumulated other

comprehensive income provide the respective components of

comprehensive income that have been retained by the business.

Other Comprehensive Income (OCI)

OCI provides a rich source of information to a financial analyst

because it plays an important role in both fair value and hedge

accounting. For

example, bank lending is influenced by capital tiers and tier 1

capital in particular.

Tier 1 capital is defined relative to stockholders’ equity including

retained earnings but excluding accumulated other comprehensive

income. As a result,

for the banking sector it makes a big difference whether an

unrealized loss from fair value accounting passes through the

accounting income statement versus whether it passes through OCI.

The former case affects the ability of a bank to lend whereas

the latter does not. It

is important therefore, to know what passes through OCI and what

does not.

For a large multi-national corporation OCI typically consist of four

components:

Foreign currency translations (i.e., fluctuations in exchange

rates that impact income)

Unrealized gains and losses resulting from fair value accounting

Additional pension liabilities (arising from defined benefit

pension accounting)

Cash flow hedges from hedge accounting

In addition, to the above four items transfers will occur to the

accounting income statement from OCI, whenever the unrealized gains

and losses become realized in the current period.

Together these items make up the component Other Comprehensive

Income. A summary of

these items is provided next followed by some detailed examples.

Foreign Currency Translations

This item results from SFAS 52 the statement governing Foreign

Currency Translations.

Consolidation accounting requires a consolidated foreign subsidiary

to have a designated functional currency.

This can be either USD or a foreign currency.

For the foreign currency cases unrealized foreign exchange

rate gains and losses pass through OCI whereas if it is USD the

unrealized gains and losses pass through the accounting income

statement. For the

latter hedge accounting can be further applied to shift these

unrealized gains and losses to OCI.

Over time an analyst would expect that these gains and losses would

average out because foreign currency fluctuations do not typically

exhibit trend behavior over the long run.

Unrealized Gains and Losses

These are unrealized gains and losses for available-for-sale (AFS)

on debt and equity securities as governed by SFAS-115.

Classification of a security is based on management’s intent

and ability to hold a particular security.

Retirement Related Benefit Plans

These net of tax items recognize the gains and losses and prior

service costs or credits that pertain to the current period but are

not already recognized under SFAS 87 or related post retirement

statements.

Hedge Accounting Adjustments

These items result from SFAS 133 on hedge accounting.

For a cash flow hedge the derivative’s gain or loss is

initially reported as a component of other comprehensive income. In

addition, for a hedge of the foreign currency exposure of a net

investment in a foreign operation, the gain or loss is also reported

in other comprehensive income.

To illustrate further the specific items it is useful to provide

some examples.

Example 1: Risk

Management and OCI Accounting

Suppose an airline wants to hedge against fuel prices increasing –

they can do so by buying a forward contract on fuel.

This fixes the price the company pays at some future point in

time (e.g., 3-months, 6-months, 9-months or beyond).

If the spot price goes up the company gains because the gain

from the forward contract will approximately offset the loss from

paying higher spot prices.

If the spot price goes down the company loses on the forward

contract but gains from acquiring the fuel at a lower price.

If this example is designated as a “cash flow hedge” and the

company has appropriate support documentation in place, then these

unrealized gains and losses pass through OCI

not regular income.

They are finally transferred to accounting income only when

they are ultimately realized.

The previous example can have long term implications, up to

30-years. For example,

consider a financial institution (or any corporate for that matter)

that enters into an interest rate hedge using a thirty year interest

rate swap contract. How

the institution defines the hedge again becomes important because if

this hedge is specified as a cash flow hedge the unrealized gains

and losses pass through OCI.

If the institution specifies the hedge as a fair value hedge,

under hedge accounting the unrealized gains and losses associated

with both the hedging instrument and the hedged item are coordinated

within the accounting income statement.

This implies that to the extent that the hedge is not perfect

the net unrealized gains or losses from a fair value hedge end up in

accounting income as opposed to OCI for a cash flow hedge.

The above example, motivates why a consumer of financial statements

needs to pay careful attention to the Stockholders’ Equity Statement

because it provides rich insight into a company’s risk management

practices and unrealized gains and losses are shifting around

between the two income statements.

Example 2: Financial

Asset and Liability Classifications

The classification of financial assets and liabilities also has a

direct influence upon which income statement (if any) unrealized

gains and losses pass through.

Held-to-maturity

(Affects Net Income)

Intention

is to hold security until maturity and this is carried on the books

at amortized cost. The

premium or discount for the bond is amortized over life to

accounting income and temporary fluctuations in market value

are ignored.

It is noted that equity securities have no defined life and

therefore cannot be classified as held-to-maturity.

They will generally end up classified as available-for-sale

unless they are held for trading purposes.

Trading Securities (and derivatives)

(Affects Net Income)

Financial securities acquired with purposes of selling in near

future. The accounting

for these securities is that unrealized gains and losses must be

recognized in the Income Statement.

All derivatives are automatically deemed to be trading

securities unless they are documented as part of a hedge.

Available-for-Sale

(Affects Other Comprehensive Income)

This category catches securities that are not classified as either

Held-to-Maturity or Trading.

These are also carried at fair value but their unrealized

gains or losses go through Comprehensive Income (via OCI) not the

regular Net Income Statement.

Finally, another important implication for financial analysts and

other users who are interested in forecasting future Comprehensive

Income it is important to note that three of the above four items

(foreign currency translations and cash flow hedge accounting) we

would expect to average out to zero across time.

That is, have a transitory impact upon comprehensive income,

whereas the remaining items (pension accounting and some unrealized

gains and losses from available-for-sale securities) may have a

relatively more permanent impact upon accumulated other

comprehensive income.

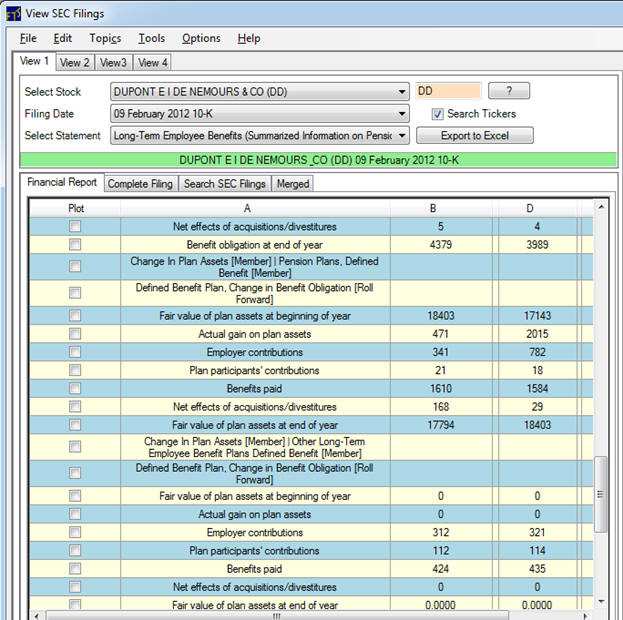

Example 3: Defined

Benefit Pension Plans

For old economy stocks this can be significant.

For example the oldest company, that is a current member of

the Dow Jones Industrial Index, is DuPont who report their defined

benefit pension obligations in millions as follows:

From the above you can see that benefits paid are 1.610 billion for

2011.

Under SFAS 158, company “defined benefit” pension plans must

recognize the difference between the projected $ benefit obligation

and the fair value of the plan’s assets as either an asset or a

liability. Originally

pensions were accounted for by recognizing pension expenses when

payments were made.

However, this led to large liabilities not being recognized in the

financial statements.

SFAS 158 (US GAAP) 2006 improved the financial reporting for defined

benefit pension accounting by communicating the funded status of the

pension plans transparently in the statements as opposed to

relegating this to footnote details.

The reporting net was widened to include liability

obligations to pay medical expenses of retired employees and spouses

by accruing future benefits as a form of deferred compensation.

Defined benefit pension not only creates accounting complexities but

also uncertainties and significant potential conflicts of

self-interests between the firm and employee.

This is because if a company goes bankrupt there are two

choices, reorganize in an attempt to stay in business or liquidate.

The defined benefit pension plan is usually terminated in

re-organization and is always terminated in liquidation.

Defined

contribution plans that are vested with employees avoid these

problems plus are much easier to account for when contributions are

made. As a result,

defined contribution plans are the most common form of pension plan

today. Defined

contribution plans are absent in the next EBAY comprehensive example

as is the norm for tech stocks.

Comprehensive Example:

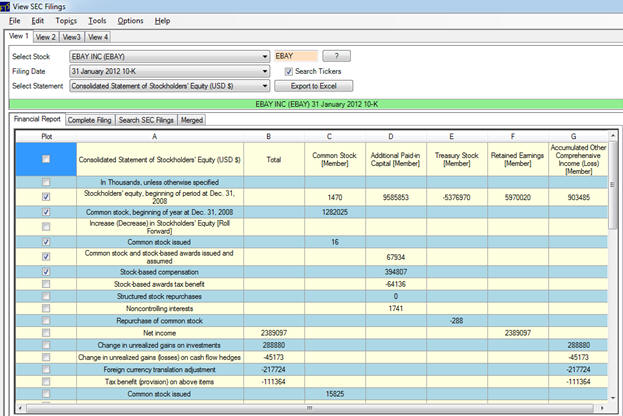

EBAY’s Consolidated Statement of Stockholders’ Equity

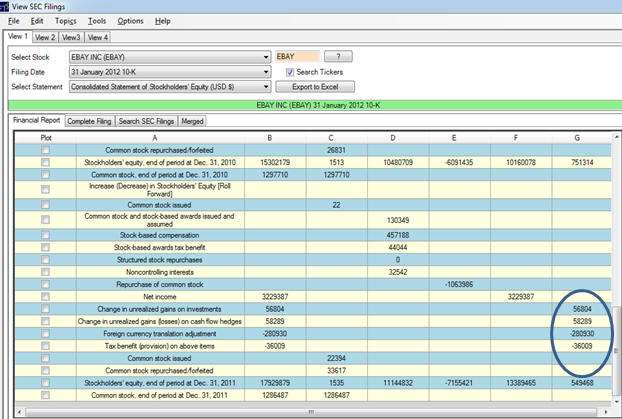

The above presents part of EBAY’s actual statement.

In the actual statement three years are provided (similar to

the Income Statement) but the form of presentation differs because

now time is given by rows and categories are provided by column

(unlike a traditional income statement).

For EBAY we can first consider an additional subset by scrolling to

the bottom as indicated below:

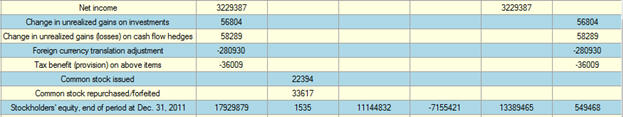

Four aggregated OCI items are circled above.

For EBAY these are expressed in thousands as follows:

First, observe that EBAY is a new economy stock and therefore does

not have defined benefit pension plans.

That is, today the typical pension plan is a defined

contribution plan which simplifies accounting and protects employees

against future restructuring.

So there are no pension related entries in OCI for EBAY.

The other three general categories are all present along with

a separate itemization of tax provisions arising from these three

categories.

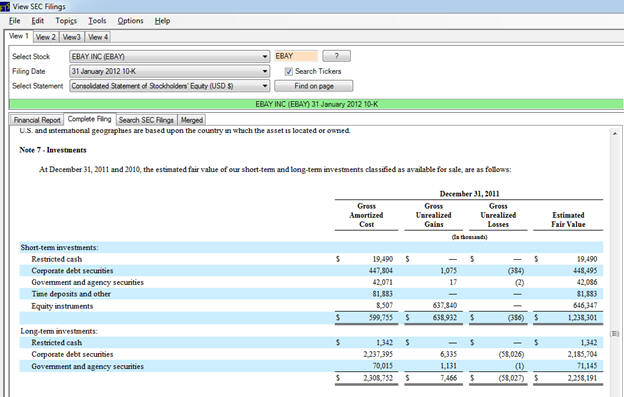

The first category is the change in unrealized gains from

investments. In

supporting footnote disclosure EBAY reports its classification for

investments. For

example, the “Available-for-Sale” category, which makes up the bulk

of the unrealized gain balance, is disclosed as follows:

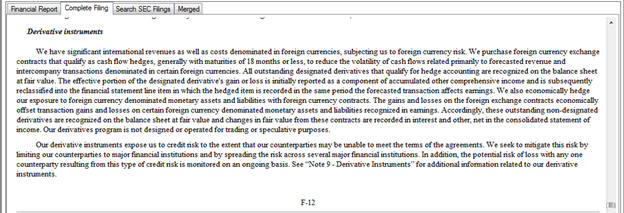

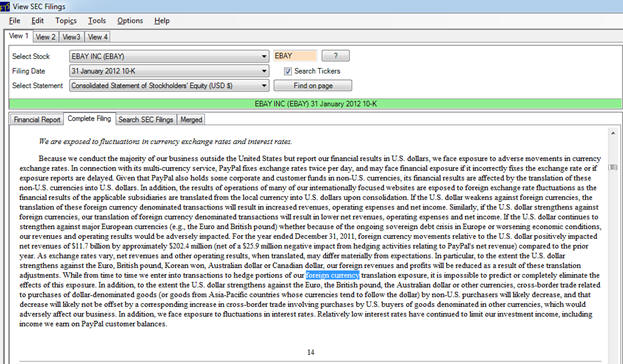

The second category is change in unrealized gains and losses

resulting from cash flow hedges.

Not surprisingly EBAY is a heavy consumer of foreign currency

derivatives given their sizeable exposures to foreign exchange risk

especially with its PayPal transactions which are processed globally

over the web. However,

not all foreign exchange rate fluctuations are hedged as the next

category indicates.

The third category is the foreign currency translation adjustment

which is negative $280 million.

This arises from accounting for foreign currency and can

arise from subsidiaries whose functional currency is not the USD.

EBAY’s foreign currency adjustments have gone against them

each year:

|

EBAY |

2009 |

2010 |

2011 |

|

Foreign currency translation adjustment |

-217724 |

-175605 |

-280930 |

Details of EBAY’s foreign exchange exposures are provided in the

10-K. For example:

Combined, EBAY’s Comprehensive Income for 2011 is:

Comprehensive Income = Net Income + OCI

•

Net Income = 3229387

•

OCI = 56804 + 58289 -280930 -36009 = -201846

•

Comprehensive Income = 3229387 – 201846

= 3027541

This is reported as follows:

Remark: EBAY has

inadvertently labeled “Comprehensive Income” as “Other comprehensive

income” in the last line above.

The values provided equal “Comprehensive Income.”

From Consolidated Statement of Stockholders’ Equity to the Balance

Sheet

The consolidated statement of Stockholders’ Equity in a 10-K

provides the details for the current and previous two years of

comprehensive income.

Across periods other comprehensive income is accumulated and the

current balance is reported in the stockholders’ equity section of

the balance sheet.

Dividends do not affect this accumulated item.

Further fair value accounting will result in OCI containing

unrealized gains and losses, but as noted earlier once these gains

and losses are realized they are transferred out of OCI to

accounting income.

These realized gains and losses ultimately end up in retained

earnings and thus can support the stock’s dividend policy.

It is important for users of the financial statements to

understand these flows to and from Accumulated Other Comprehensive

Income that take place over time.

A summary of the remaining items in the stockholders’ equity section

of the balance sheet will be described next.

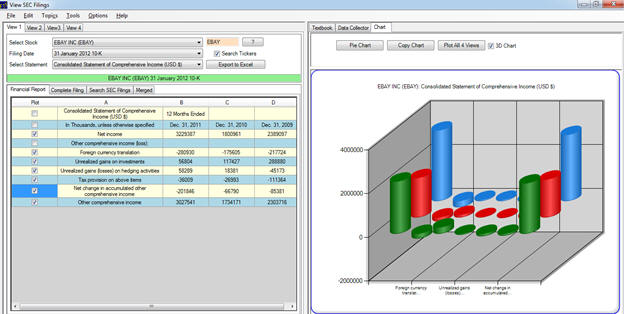

Stockholders’ Equity:

Balance Sheet

Capital Stock

This item reflects the equity financing decision.

It can include different classes of stocks plus it can also

include some rarer items such as ESOP’s.

For IBM depicted above this section is one line:

|

Common stock, par value $.20 per share, and additional

paid-in capital Shares authorized: 4,687,500,000 Shares

issued (2011-2,182,469,838; 2010-2,161,800,054) |

|

The above includes a number of terms and summarizes a lot of

information as follows:

Common stock: These are

the ordinary voting shareholders and represent the residual equity

in the company. Other

types of stock can be issued such as Preferred Stocks but for the

IBM example there is no preferred stock.

Par value: Par value

has little significance other than historical and legal significance

(lower bound for issuing stock). When

shares are issued, accounting records the par amount for common

stock and the remainder is then entered into additional paid-in

capital. However,

for reporting purposes it is common to aggregate these two accounts

as has IBM have (2011 48129, 2010 45418 in millions)

Shares Authorized: The

number of shares that can be issued (4.687 billion)

Shares Issued: The

number of shares actually issued in the market

(2011-2,182,469,838; 2010-2,161,800,054).

However, not all of these shares are currently in the market because

IBM can purchase their own stock, which is referred to as Treasury

Stock. We will cover

this additional item below.

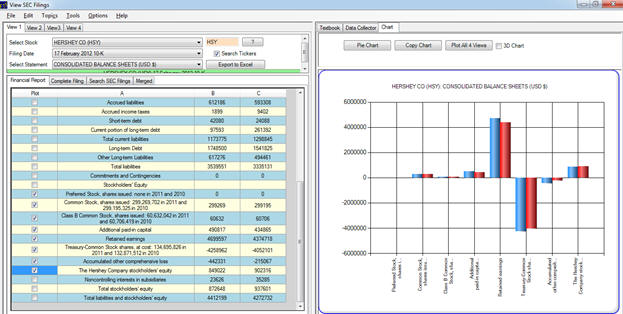

An example, of a little more complex Capital Stock reporting is

Hershey the chocolate company.

The above example contains different classes of common stocks.

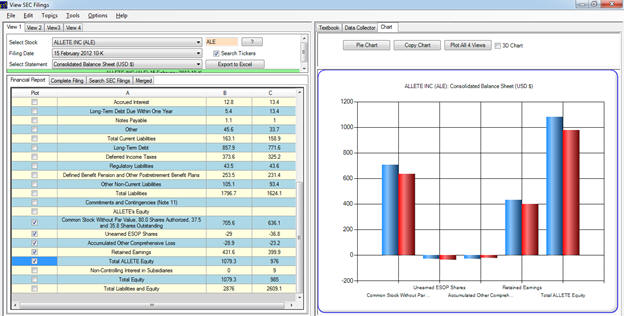

For the case of ALE you can verify the use of ESOP’s:

ESOP’s are a specific Salary package that includes receiving stock

as compensation – must be set up as a trust to get IRS ESOP

recognition. It is a

rarer line item to find.

Retained Earnings

Accounting income summary is a temporary account that determines

accounting net income and is then closed off to retained earnings as

part of a permanent balance sheet accounting.

This item reflects the accounting income that has never been

paid out as a cash dividend.

Each of the above examples have positive retained earnings.

Serious investors such as Warren Buffet place a lot of weight on

this line item because it implies an opportunity cost.

That is, earnings retained should create additional amounts

of shareholder value that are at least equal to what was retained.

Buffet describes these tests as follows in his annual

meetings:

In 1984, Buffett made these comments:

“Unrestricted earnings should be retained only where there is a

reasonable prospect – backed preferably by historical evidence

or, when appropriate by a thoughtful analysis of the future –

that for every dollar

retained by the corporation, at least one dollar of market value

will be created for owners. This will happen only if the capital

retained produces incremental earnings equal to, or above, those

generally available to investors.”

Subsequently he appears to have modified this test as follows:

Buffet Modifies his Approach After Due to the Recession

“I should have written the “five-year rolling basis” sentence

differently, an error I didn’t realize until I received a

question about this subject at the 2009 annual meeting.

When the stock market has declined sharply over a five-year

stretch, our market-price premium to book value has sometimes

shrunk. And when that happens, we fail the test as I improperly

formulated it. In fact, we fell far short as early as 1971-75,

well before I wrote this principle in 1983.

The five-year test should be: (1) during the period did our

book-value gain exceed the performance of the S&P; and (2) did

our stock consistently sell at a premium to book, meaning that

every $1 of retained earnings was always worth more than $1? If

these tests are met, retaining earnings has made sense.”

However, regardless of precise implementation details the important

and valid point is that when management retain earnings there is an

opportunity cost associated with it and good management will meet or

beat this implied cost.

Treasury Stock

A public company in the US can purchase its own stock.

This reflects an alternative method for paying dividends to

shareholders that is popular with technology stocks.

That is, ignoring taxes investors are indifferent between

receiving a cash dividend and receiving a dividend in the form of a

capital gain. In the

presence of taxes the advantage swings towards capital gains and so

many stocks acquire their own shares as an alternative form of

dividend payment.

In the topic covering the cash flow statement the non US GAAP

measure free cash flow was introduced.

Conceptually free cash flow to equity represents the dividend

a company could pay (i.e., economic dividend) without affecting the

value of the stock. As

a result, when Treasury stock is acquired from free cash flow the

per share price is predicted to increase because the number of

shares outstanding is reduced, even though the total value remains

unchanged. As a result,

the financial test relevant to evaluating Treasury stock

acquisitions is whether it is covered by free cash flow to equity.

Accumulated Other Comprehensive Income (AOCI)

Reflects gains and losses not recognized in the income statement but

instead pass through the Consolidated Statement of Stockholders’

Equity. This line item

results from the Consolidated Statement of Stockholders’ Equity as

discussed in this topic.

The balance sheet accounts separately for the Accumulated

Other Comprehensive Income.

Non-Controlling Interests

This item arises from the consolidation process when the company

controls less than 100% of a subsidiary.

Formally, this is not part of Stockholders’ Equity and is

reported separately after stockholders’ equity.

This is illustrated in the earlier IBM and HSY examples.