A.5

Appendix:

Linkages Among the Financial Statements

Linkages among the financial statements arise from the

combination of accrual accounting with the underlying

economics associated with the firm’s business model.

Understanding these linkages generate predictable

patterns across the statements which in turn can provide

useful insights into future results.

Accrual accounting rests upon two basic principles:

Revenue recognition principle

Matching principle

The revenue recognition principle is that revenues are

reported on the accounting income statement in the period

they are earned and not the period when the contract is

created or the period when cash is collected.

This is an essential part of accrual accounting that

immediately can gives rise to both a current and non-current

balance sheet item usually referred to as “Unearned

Revenues” and an asset referred to as “Accounts Receivable.”

We refer to this as the

revenue cycle.

Similarly, the matching principle is that expenses are

reported on the accounting income statement in the period

they are associated with recognized revenues or the period

in which they were incurred if no direct association with

revenue can be made such as marketing expenses.

Combined the

matching principle results in what we will refer to as the

revenue and expense

cycle.

Understanding the revenue and expense cycle will generate

predictable patterns across the statements and understanding

these patterns can be most useful for predicting future

income as well as assessing the quality of current earnings.

In turn, these patterns provide rich insight into how a

company applies these two principles.

We will illustrate this for the case of 1-800 Flowers

using both Valuation Tutor’s SEC Filings:

A Visual Analysis and Common size Analysis.

The Revenue and Expense Cycle

Consider first the accounting transactions that arise from

booking earned and unearned revenues:

Dr Cash

Dr Accounts Receivable

Cr Revenue (this passes US GAAP’s revenue

recognition tests that the process for earning revenue

is complete)

Cr Current Unearned Revenue (process for earning

revenue is expected to be complete within a year)

Cr Non-Current Unearned Revenue (process for

earning revenue is expected to be complete beyond one

year)

Observe cash can be collected even though revenue is not

earned in an accrual accounting sense.

When the current unearned revenue is earned or the

non-current unearned revenue becomes current then the

process continues with:

Dr Current Unearned Revenues

Cr Sales

Dr Non-Current Unearned Revenue (If process for

completing revenue shifts to being within one year)

Cr Current Unearned Revenue

Under accrual accounting the revenue cycle is completed once

unearned revenue has been earned.

Under cash accounting the revenue cycle is completed

once the cash is collected.

On the cost side the merchant model of accounting (e.g.,

selling inventory) books gross revenue and subtracts away

Cost of Goods Sold or for a service provider subtracts away

cost of sales.

That is, a service related firms report “cost of revenues”

separately from “operating costs” when the costs are

directly associated with revenue as required by the matching

principle. That

is, the cost of revenue side are the costs that directly

support completing the revenue cycle.

Dr Inventory (or Pre-payments if a service firm)

Cr Accounts Payable

Cr Cash

Dr COGS (or Cost of Sales)

Cr Inventory (or Pre-payments)

Dr Marketing and Selling Expenses (Associated with the

current revenue cycle)

Dr Marketing and Selling Prepayments (Associated with

future revenue cycle)

Cr Accounts Payable

Cr Cash

Financial analysts look for confirming activity in

associated accounts to test credibility of growth.

In the above observe that “pre-payment activity” for

a tech stock may serve the same role as inventory for a

retailer or manufacturing stock.

If the stock’s business model is an “agent model” (i.e.,

earning agents or booking fees) then revenue must be

reported as net revenue.

That is, gross revenue less the amount rebated to the

party the firm is acting on behalf of.

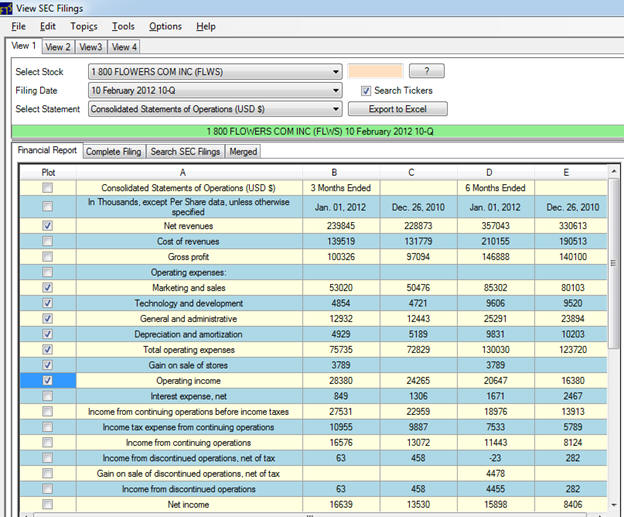

Example 1:

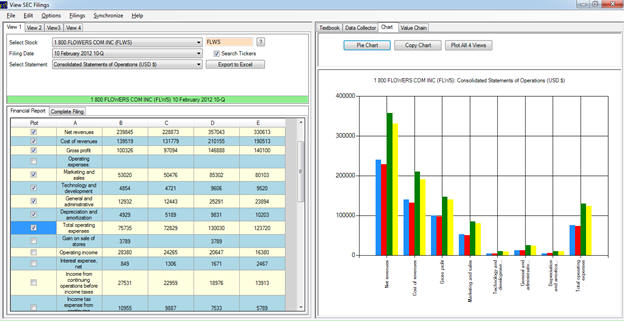

1-800 Flowers Income Statement

Revenue and Cost Cycle for 1-800 Flowers

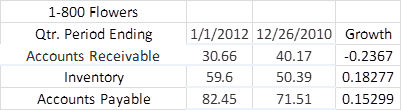

This stock does not have any unearned revenues. And

increased revenues by 4.8% for the December quarter however

much of this was due to growth via new acquisitions as

described above.

The increase in web business is likely to explain the

reduction in accounts receivable (and thus increase in cash

sales) when compared to the same three months a year ago.

However, both inventory and accounts payable have

increased significantly more than sales.

These are flags and in future topics you will learn

how to analyze this at a deeper level by analyzing the

working capital management trends for 1-800 Flowers.

Additional cost behavior analysis related to revenue growth

are the operating cost categories:

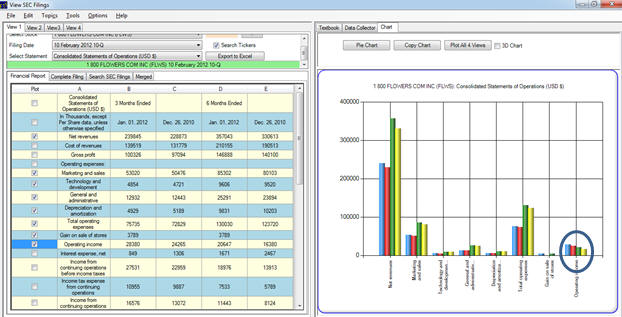

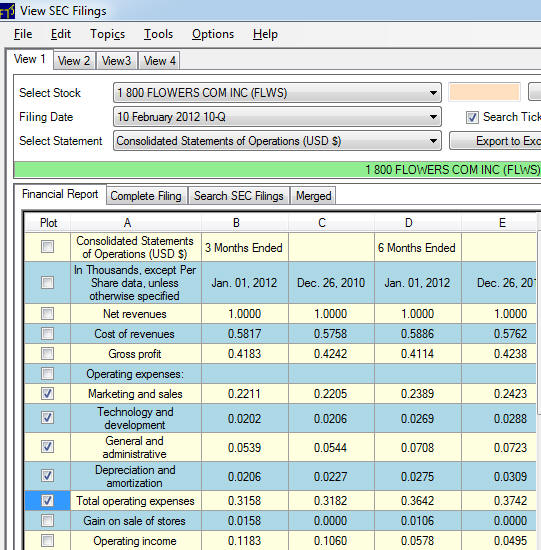

Observe in the RHS of the graph that Operating income for

the latest three months is higher than for the latest six

months and similarly for 1-year ago.

Focusing on the LHS of the screen the elements of

cost of sales and operating expenses are provided as

follows:

First, observe that the 6-months gross profit is larger than

the 3-months gross profit for both years but this reverses

at the operating profit level for both years.

To explore what is going on we will draw from a

higher level of Valuation Tutor which provides common size

analysis:

Click on the second button above:

Question: Why

are the 3-month net operating incomes higher for

1-800-Flowers than the 6-month operating incomes and what is

driving this?

Answering this question requires a common value analysis.

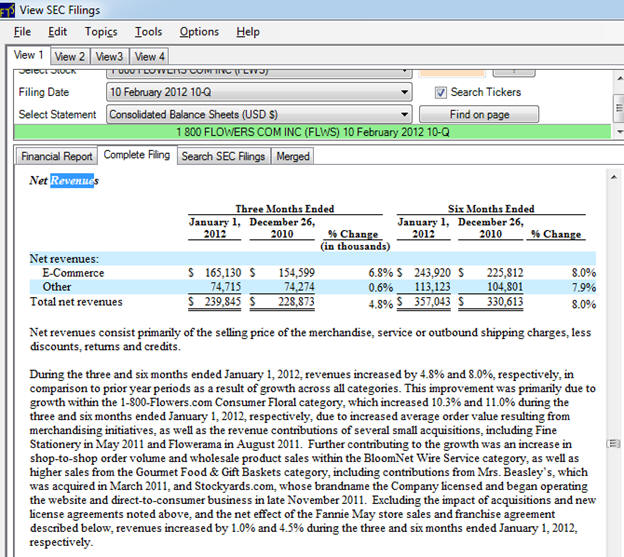

The following screen looks at these quarterly

statements dividing each one by its respective net sales

revenue. A lot

is going on in the following screen so we will consider the

components sequentially:

The middle part of the screen is the control center.

1-800 Flowers quarterly income statement reports

3-months and 6-months for current and a year ago.

The top middle screen provides the statement dates

and so to divide each statement by its respective net sales

select the dates for each statement as indicated in yellow

(highlighted cells) larger circle above.

The smaller circle indicates what the scaling

variable is, which in this case is Net Sales from the

Consolidated Statement of Operations.

The effect of this is observed in the LHS of the screen such

that each statement is now provided in common size form

scaled by their respective net revenues.

See the net revenue line is 1.000 for each financial

report as circled in the LHS.

The net effect now is to rescale the raw statements provided

in the bottom center of the screen to % of Sales provided in

the LHS and which can be graphed in the RHS.

This lets us proceed to answer the question.

Question:

Why are the 3-month net operating incomes higher for

1-800-Flowers than the 6-month operating incomes and what is

driving this?

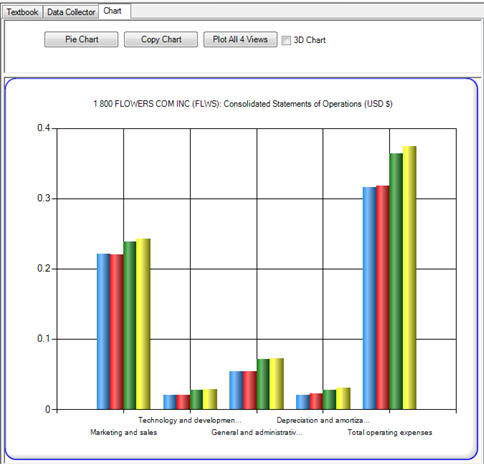

First, observe that the % of cost of sales are relatively

unchanged and between the years.

As a result, because 6-month sales are greater than

3-month sales then 6-month gross margins are higher in total

dollar terms.

This does not carry down to the total operating costs.

The 6-month costs are 36 and 37% respectively for

2011 and 2010 whereas this drops to 32% for the 3-month

figures. Each

of the operating cost categories are higher for the 6-month

period than they are the for 3-month periods even though the

business is highly seasonal (sales are larger at year end).

The common size chart immediately reveals this:

In the above each group of four has the two 3-month % of

sales on the left side and the two 6-month % of sales on the

right side of the four vertical bars.

This leads to the cumulative effect in the LHS plot

(Total operating expenses).

Under the matching principle these are largely period

expenses and thus this reflects that 1-800-flowers allocate

significantly more expenses to their final quarter of their

financial year (ending July 3, 2011) than they do to their

first quarter.

Getting to these timing issues is just one example of the

advantage for conducting common size analysis of financial

statements. In

Valuation Tutor many other advantages are developed

especially when moving into ratio analysis.

Summary:

Answer to the question is that 1-800 Flowers recognizes more

operating expenses in its final quarter (i.e., 10-K report)

than it does in earlier quarter (10-Q reports).

This example, provides interesting insight into how

the matching principle is applied by at least this company.

The Accounting Equation and Linkages Across the Major

Statements

Mathematically the four major financial statements are

linked via the beginning and end of period fundamental

accounting identity, Assets equal Liabilities and Owner’s

Equity. The

income statement and the statement of stockholders’ equity

provide the linkage between the two balance sheets.

These reports are based upon two temporary accounts

that get closed off to the stockholders’ equity section of

the balance sheet every period.

The accounting income summary account is closed off

to (accumulated) “Retained Earnings” and the Other

comprehensive income account (i.e., Consolidated Statement

of Stockholders’ Equity ) is closed off to “Accumulated

Other Comprehensive Income.”

Finally, the Consolidated Cash Flow Statement merely

provides a reconciliation of the opening and closing

balances of Cash and Marketable Securities.

In other words, the underlying driver is the

Consolidated Statement of Financial Position which reflects

at a point in time the basic accounting equation:

Total Assets = Total Liabilities + Owners’ Equity

Example:

Proctor and Gamble

It is one thing to describe the conceptual framework that

underlies modern financial statements.

It is another thing to be able to classify the set of

linkages among actual real world financial statements.

In the next section we consider the set of statements

filed by Proctor and Gamble (P&G) and their linkages.

For the case of a cash flow statement you will quickly

discover that classifications by activity are never

completely clean when working with the real world

statements.

This is because aggregations within the statement will vary

from company to company and cut across category

classifications.

P&G has been selected because it provides a nice

example of reporting combined with an introduction to real

world issues that arise.

Online by working with the Valuation Tutor software in

conjunction with the actual filed statements is that you can

quickly compare across a range of companies to see how

different companies have dealt with aggregation issues with

respect to their external financial statements.

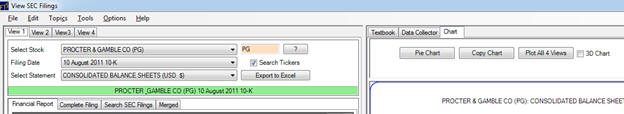

This type of insight can be gained by working with

the 10-K Viewer in conjunction with the four Views as

depicted below.

For example, View 1 being Consolidated Balance Sheet, View 2

the Consolidated Income Statement and so on.

Furthermore, the plot All 4 Views allows for visual

across statement analyses to be performed.

When analyzing the linkages across statements it is useful

to further relate these linkages to the nature of activities

that directly affect the accounts.

In particular,

Operating Activities

Investing Activities

Financing Activities

Dividend Activities

Linkages Among P&G’s Statements

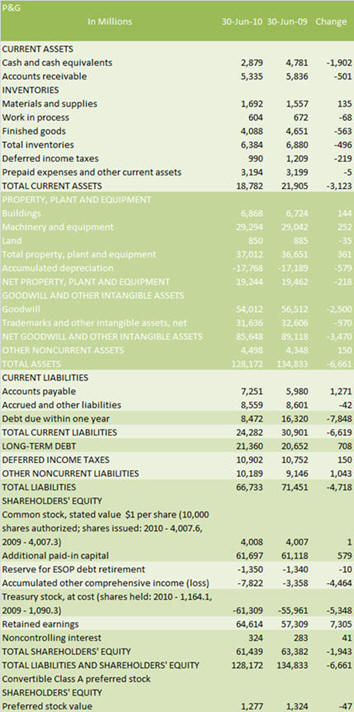

We can color code the balance sheet items to reveal at a

glance whether the major driver of these accounts result

from operating activities (lightest green), investing

activities (darker green) and financing activities

(in-between lighter and darker green).

Classifying these activities in this way is described

in the topic titled:

A Quick Tour of the Balance Sheet.

The above color coded statement the basic set of categories

are described in the topic

“A Quick Tour of the Balance Sheet.”

In later chapters you will learn how to extract even

finer information from these linkages using business ratio

analysis and activity analysis.

Working line by line we have the following items:

Current Assets

Cash and Marketable Securities (Category:

Operating)

Accounts Receivable (Category:

Operating)

Inventory (Category:

Operating)

Prepaid Expenses (Category:

Operating)

Deferred Taxes (Category:

Operating)

Non-Current Assets

Property, Plant and Equipment (Category:

Investing)

Leases (Category:

Investing)

Deferred Taxes (Category:

Operating)

Pension Fund (Category:

Investing)

Long-Term Investments

(Category:

Investing)

Intangible Assets (Category:

Investing)

Liabilities

Current Liabilities

Accounts Payable (Category:

Operating)

Notes Payable (Category:

Operating and Financing)

Current Maturities of Long-Term Debt (Category:

Financing)

Accrued Liabilities (Category:

Operating)

Unearned Revenue or Deferred Credits (Category:

Operating)

Deferred Income Taxes (Category:

Operating)

Non-Current Liabilities

Long Term Debt (Category:

Financing)

Capital Lease Obligations (Category:

Financing)

Postretirement Benefits Other Than Pensions (PRB) (Category:

Investing)

Commitments and Contingencies (Category:

Operating)

Non Controlling Interests (Category:

Financing)

Stockholders’ Equity

Common Stock (Category:

Financing)

Additional Paid-In Capital (Category:

Financing)

Retained Earnings (Category:

Operating)

Accumulated Other Comprehensive Income (Category:

Operating)

Other Equity Accounts (Category:

Financing)

Linkages Among the Financial Statements:

The Consolidated Income Statement

The Income Statement largely reflects the result of a firm’s

operating activities.

In addition, part of the financing decision, interest

on debt financing, is also reflected in the income

statement.

Investing activities also affect the income statement via

depreciation and amortizations but often this is aggregated

with other line items as is the case for Proctor and Gamble

below. However,

these items are itemized in the Statement of Consolidated

Cash Flows considered in the next topic.

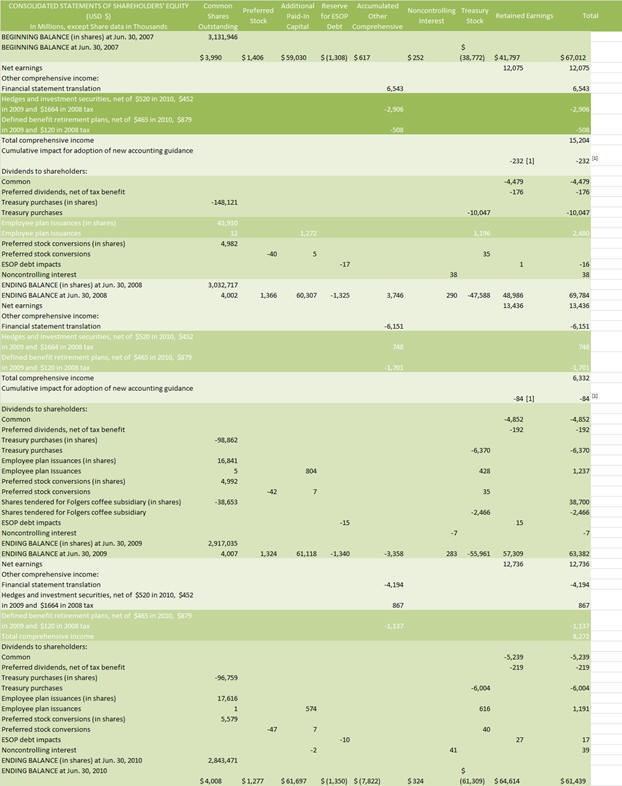

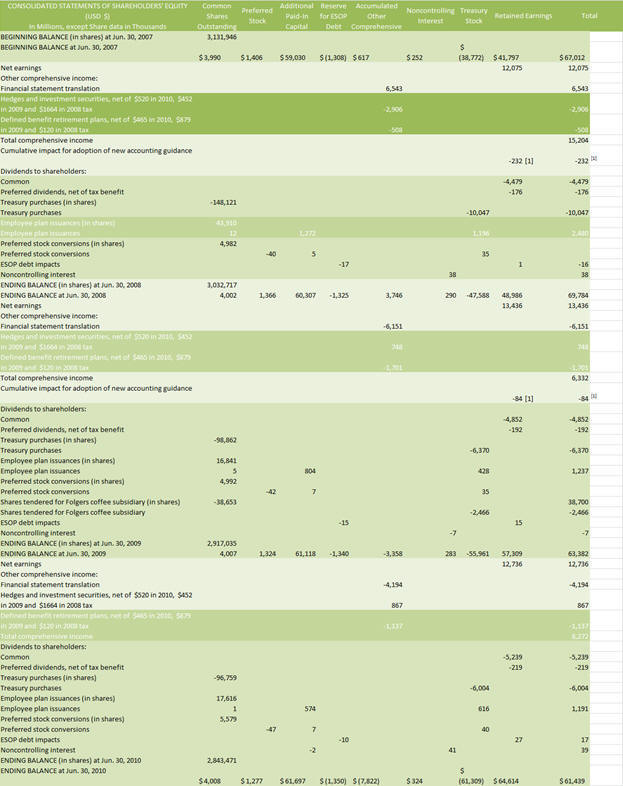

Linkages Among the Financial Statements:

The Consolidated Statement of Stockholder’s Equity

There are four major categories highlighted in the Statement

of shareholders’ Equity which can be classified in terms of

their usual major drivers are as indicated:

Foreign Currency Translations (Operating activities)

Unrealized Gains and Losses (Operating, Investing and

Financing Activities)

Retirement Related Benefit Plans (Investing activities)

Hedge Accounting Adjustments (Operating and Financing

Activities)

The hedge accounting adjustments can arise from hedging both

operating risks (e.g., commodity price increases) as well as

financing risks (e.g., creating synthetic fixed rate loans

using interest rate swaps).

Similarly, unrealized gains and losses can arise from

operating activities (lower of cost or market), investing

activities (gains and losses arising from fair value

accounting for investments), and similarly for financing

activities.

The retirement related benefit plans can be interpreted as

related to human capital, an important component of a firm’s

capacity to produce products and services.

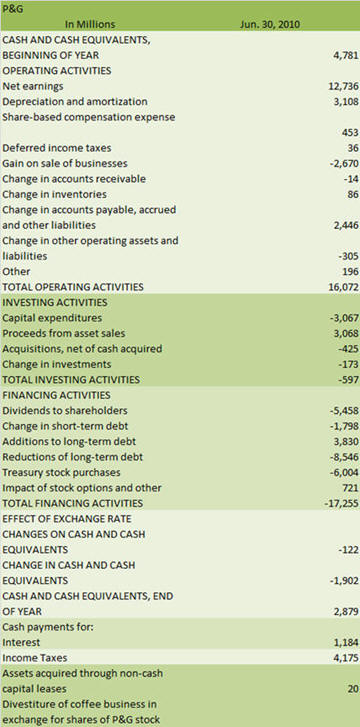

Linkages Among the Financial Statements:

The Consolidated Cash Flow Statement

This is the Statement that draws together the other

statements. It is organized around the business activities

of a firm so the color highlighting below is fairly

transparent.

There is one note to point out.

US GAAP mixes some financing activities into the

operating activities section.

This is due to how US GAAP treats interest expense.

In the P&G example below, observe that the Cash Flow

Statement in the indirect form starts with Net Income after

tax and adds back Depreciation and amortization, the

non-cash expenses.

It then adjusts for changes in working capital and so

on. However,

there is no adjustment for interest expense in the cash flow

from operations and so implicitly this ends up in the

operating activity section of the Cash Flow Statement.

This is not the case for dividends of course.

By the end of this topic you should have a reasonable

working knowledge of the inter-relationships across the

different financial statements.

You are encouraged to repeat this same exercise for a

small sample of firms.

This will let you compare notes to see how different

firm’s treat accounting aggregation differently.