7.6 Example: IBM

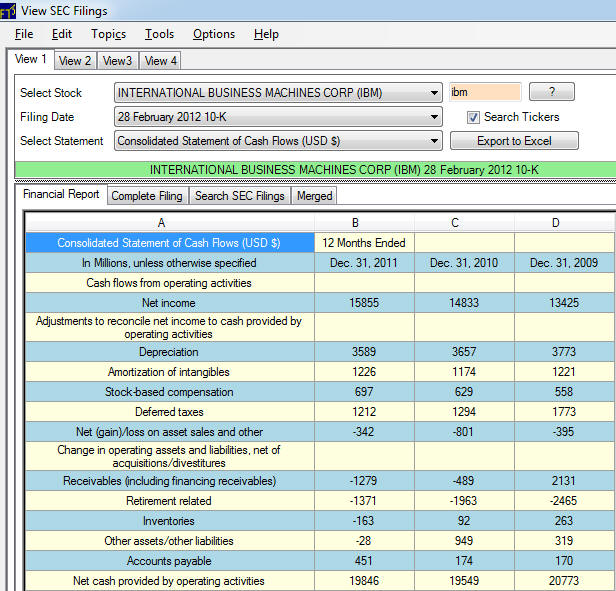

Valuation Tutor lets you immediately access current and past financial statements. For example, consider the following cash flow statement for IBM:

By entering the stock ticker for IBM and selecting the reporting date and statement you can access IBM's cash flow statement as follows:

Now suppose you want to estimate FCFF for 2009, you can verify the following information:

Depreciation and Amortization (DA) = 3,773 + 1,221 = 4,994

Other Non-Cash Items (ONCI) consists of Stock-based

Compensation, Deferred Taxes, Net Gain on Assets and

Liabilities, Retirement Related and Other Assets/Other

Liabilities.

Other Non-Cash Items = 558 + 1,773 - 395 - 2,465 + 319 =

-210

Change in Working Capital (DWC)

= Receivables, Inventories, Accounts payables

Change in Working Capital = 2,131 + 263 + 170 = 2,564

Accounting cash flow from operations (CFO) can now be

calculated as:

CFO = NI + DA + ONCI –

ΔWC

= 13,425 + 4,994 – 210 + 2,564 = 20,773

The next step requires getting additional information from IBM's

statements:

FCFF = CFO + Interest*(1-tc) – CAPEX = NI +

Interest*(1-tc) + DA + ONCI

-

ΔWC

- CAPEX = 20,773 – CAPEX

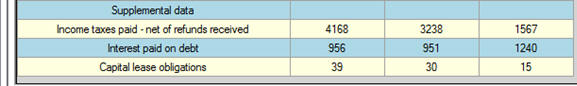

First, the supplementary data part of the Cash Flow Statement

usually provides the required additional information:

Here it is observed that:

Income Taxes Paid = 1567 in 2009

Interest Expense = 1240 in 2009.

The effective tax rate for IBM can be computed from taxes paid

divided by net income before taxes.

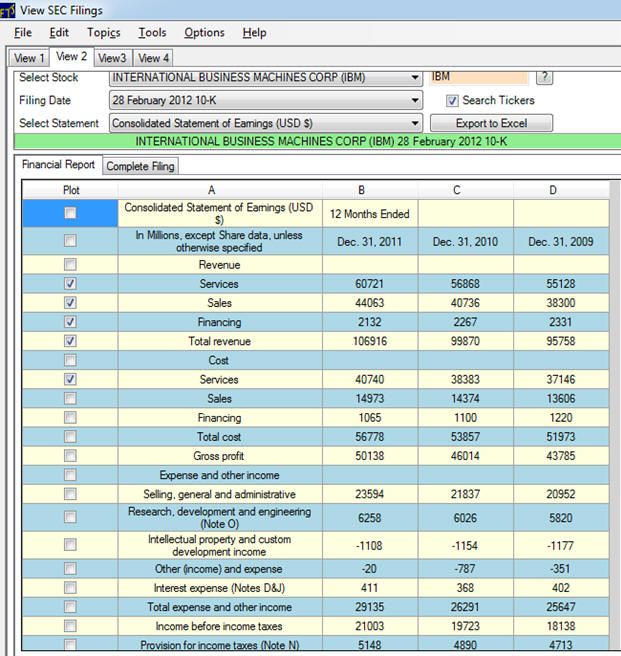

From the Income Statement this number for 2009 is 18138

(see below). As a

result, the effective tax rate for IBM in 2009 is:

Effective Tax Rate = 1567/18138 = 0.087.

Alternatively, you can check IBM’s provision for taxes which

4713 for 2009. From

this provision the effective tax rate is:

Effective Tax Rate (Using the Provision for Taxes from the

Income Statement below) = 4713/18138 = 0.259 or 26%.

The latter estimate seems to be more realistic for IBM’s

effective tax rate.

Interest net of tax 2009 = 1240*(1 – 0.26) = 917.60

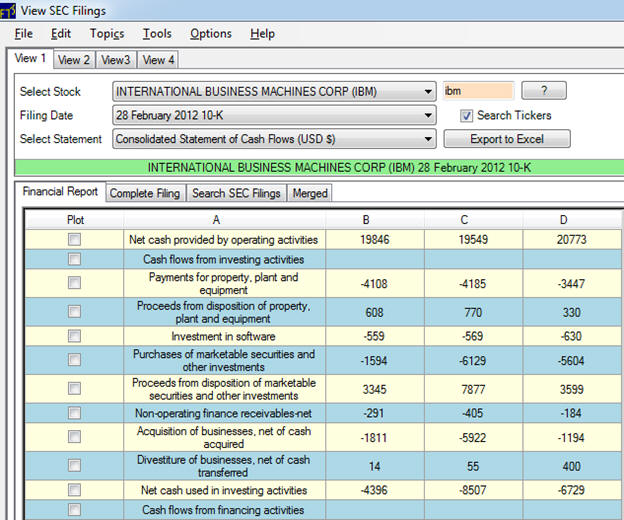

Finally, we can get CAPEX directly from IBM’s Consolidated

Statement of Cash Flows and in particular the Investing

Activities section as follows:

CAPEX equals the purchases made for productive capacity for both

goods and services.

As a first pass we can compute this as follows:

CAPEX = Payments for Property, Plant and Equipment +

Investment in Software

CAPEX 2009 = -3447 – 630 = -4077 (purchases of capacity)

CAPEX comes from the Investing Activities part of the cash flow

statement.

Finally, IBM’s FCFF for 2009 collecting together the above is:

FCFF = CFO + Interest*(1-tc) – CAPEX = NI +

Interest*(1-tc) + DA + ONCI

-

ΔWC

- CAPEX = 20,773 – CAPEX

FCFF = 20,773 + 917.60 – 4,077 = 17,614

When using FCFF for valuation purposes analysts usually apply

additional adjustments to take into account that you are really

interested in projecting what future CAPEX is.