7.18 Forecasting Growth Behavior: Stage 1

A

common way of projecting out future FCFE per share is to assess

the future growth behavior for the firm.

We adopt this approach next in two stages for a going

concern. First, we

will assume that FCFE can grow at some abnormal rate over the

short run (i.e., stage 1) and then at some normal rate in

perpetuity (i.e.,

stage 2). The

latter normal rate is constrained by economy wide constraints to

avoid the undesirable implication that a firm can grow at a

larger rate than the economy as a whole.

Given the importance of this number financial analysts provide

ongoing estimates for growth which today are freely available

over the web.

IBM Example:

Estimating Stage 1 Growth

What is the consensus 5-year growth forecast for IBM? (around

June 2009)

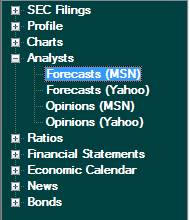

Here we will check two general sources from the web Yahoo

Finance and MSN Money.

These numbers are constantly revised over time in

response to changes in the economy.

For example, around April 2009 these numbers were:

Yahoo Finance

IBM 10.86%, Industry 11.87%

MSN Investor

IBM 10.00%, Industry 15.90%

Thus the current consensus appears to be between 10.86% and

10.0% for 5-years growth.

MSN usually adjusts more frequently their reported 5-year

growth numbers (both sites adjust their shorter forecasts

frequently) plus the MSN abnormal growth number is more

conservative so in this example we will wrk with this estimate.

Note:

The consensus forecast is for 5-year growth.

If you have assumed stage 1 to be more or less than

5-years then you need to decide whether you want to modify the

consensus forecast for your stage 1 or leave it as is.

Important Remark:

The 5-year growth consensus is for Accounting Earnings. As a first pass we will apply this to FCFE growth, however, two immediate observations here are that per share FCFE for IBM is greater than EPS and second, management can manage EPS growth more easily than FCFE growth. As a result, the growth forecast for EPS may be different for IBM than the growth forecast for FCFE. Issues of this nature must be assessed at an individual company level. We will return to these issues later when we do some sensitivity analysis.