7.4 Concept 1: Free Cash Flow to the Firm (FCFF)

The starting place for assessing the intrinsic value of a stock is to assess the cash flows a firm can distribute without affecting it's value. We can break up these cash flows into two important components. The first is cash that is required to sustain the value of the firm’s investment decisions. we will refer to as “Capital Expenditure.” This is the expenditure made to support the capacity of the firm to generate goods and services and results from purchases of real assets.

The second is cash that can be distributed by the firm without affecting the firm’s value. We call this “Free Cash Flow to the Firm (FCFF).” This is the cash generated from producing the goods and services net of the firm's capital expenditures.

Both Captial Expenditure and the Free Cash Flows are estimated from the firm's financial statements. Usually the easiest statement to work with for this purpose is the cash flow statement but these concepts can also be estimated from the balance sheet and income statements. In this topic we introduce the base form of these important concepts and then present variations in the next few topics.

Capital Expenditure (CAPEX)

The best source of information for CAPEX is the Consolidated Statement of Cash Flows. This statement reconciles the closing balance of cash and marketable securities with the opening balance of cash and marketable securities by organizing changes into three sets of activities: operating, investing and financing. CAPEX can be identifies from a subset of the investing activities that relate to the cost of acquiring additional real assets.

Example: Calculating CAPEX from the Cash Flow Statement

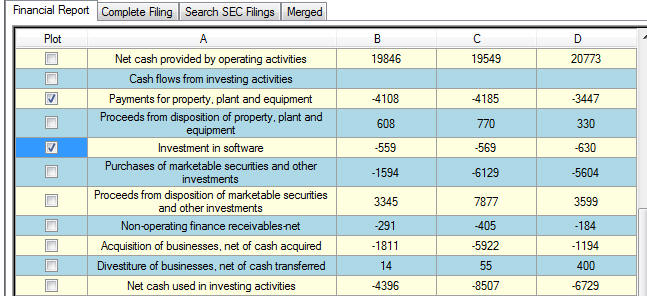

Suppose the investing activities are provided as follows for technology firm:

CAPEX equals the sum of Payments for property, plant and equipment plus Investment in software = 4108 + 559 = 4667.

If the Cash Flow Statement is not available a reasonable proxy for CAPEX can be calculated by reconciling the change in real assets. That is, suppose CAPEX primarily arises from Property, Plant and Equpment (PPE) then CAPEX can be computed indirectly as follows:

CAPEX = Closing Balance of PPE less Opening Balance of PPE + Depreciation Expense

Similar adjustments can be made for other real assets on the balance sheet.

Free Cash Flow to the Firm

(FCFF

Free Cash

Flow to the Firm can be expressed in various equivalent ways

depending on where you start.

For example, you could start with Cash flow statement

using Cash Flow from

Operations or the Income Statement using either Net Income or EBIT (Earnings before Interest and

Taxes) or EBITDA (Earnings before Interest, Taxes Depreciation

and Amortization).

The approaches are equivalent, as shown in the following

sections.

Cash Flow from Operations

Form of FCFF

An accounting cash flow statement

is presented in three sections:

cash flow from operations, cash flow from investing

activities, and cash flow from financing activities.

We start with cash flow from operations and then compute

free cash flow to the firm by adjusting for cash outflows from

investing activities referred to as capital expenditure.

FCFF

= Cash Flow from Operations – Cash Flow from Investing

Activities (Capital Expenditures (CAPEX))

The above requires

one additional adjustment to account for how interest expense is

treated in a cash flow statement, as described next.

Interest Expense under US GAAP versus IFRS

The accounting treatment of interest

expense can vary between US GAAP and IFRS in the following way.

Under IFRS interest paid can be classified in a cash flow

statement as either an

operating or financing activity whereas for US GAAP it is

classified as an operating

activity.

Implications for FCFF

Because interest expense is classified as an operating activity under US GAAP the accounting number for cash flow from operations taken from a cash flow statement must be adjusted when computing the FCFF. That is, Interest Expense net of tax should be added back. IFRS may or may not require this adjustment depending upon how the cash flow statement has been prepared. This is because IFRS permits the choice as described above. If FCFF requires this adjustment, you do it as follows:

FCFF

= Cash Flow from Operations + Interest*(1 – Tax Rate) - Capital

Expenditures (CAPEX)

1)

Recall from Chapter 4 that

the appropriate discount rate for the firm as a whole was the

after tax weighted average cost of capital (WACC).

The after tax adjustment for interest expense is

consistent with the actual cash flows, given that interest

expense is tax deductible, and similarly is consistent with the

application of WACC to FCFF if we were discounting future FCFF.

In this text we will use the shorter

notation Interest*(1-t0) for Interest*(1 – Tax Rate).