7.5 Accounting Income Form of FCFF

The concept of Free Cash Flow to the Firm can equivalently be estimated from either the cash flow or income statements. This follows immediately if you consider the indirect form of a cash flow statement. In ths form the change in the balance of cash and marketable securities is reconciled starting with the opening cash balance and adding back net income. As a result, cash flow from operations is computed directly from net income in the indirect form of the cash flow statement.

Calculating Cash Flow from Operation Starting with Net Income

When starting from Net Income (NI), we have to add back Non-Cash Items such as Depreciation, Amortization Deferred Taxes and so on and then subtract any increase in Working Capital (i.e., changes in working capital items which are either a source of funds (e.g., decline in accounts receivables) or a use of funds (e.g., increase in inventory). These adjustments to Net Income get us to the Cash Flow from Operations under US GAAP:

Cash Flow from Operations (CFO) = Net Income (NI) +

Depreciation and Amortizations + Other Non-Cash Items (NCI) –

Change in Working Capital (ΔWC)

The last item, change in

Working Capital is subtracted because an increase in working

capital is a use of funds as opposed to being a source of funds.

The definition of Working Capital in the cash flow

statement excludes financing related activities such as

short-term debt or the current portion of long term debt.

The Change in Working Capital calculation also eliminates

cash and cash equivalents because we are attempting to explain

how cash changes over time.

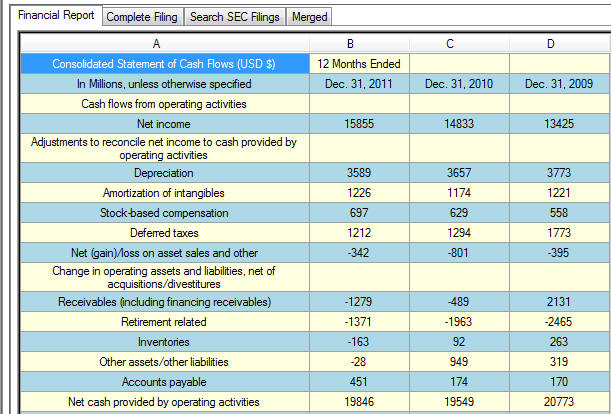

Example: Calculating CFO from NI

The following illustrates working from Net Income to Cash Flw from Operations:

The above structure is immediately evident from the above statement. The sign presented in the statement depends upon whether it is a source of cash or a use of cash. As a result, a positive net income is a source of cash.

Net Income = 15855

Depreciation and Amortization are non cash expenses that result in reducing net income. As a result, they are added back as follows:

Add back Depreciation and Amortization = 3589 + 1226 = 4815

Other Non Cash Items again are added or subtracted on the basis of whether they have reduced or increased net income as follows:

Other Non-Cash Items (ONCI) = Stock-based compensation + Deferred Taxes + Net Gain/loss on asset sales and other + Retirement Related + Other assets/other liabilities = 97 + 1212 - 342 - 1371 - 28 = -432.

Finally, the sign of the working capital items result from whether this is a source or use of cash. An decrease in Accounts Receivable implies that cash has been collected and so decreases are added. A decrease in inventory implies that less cash is tied up in inventory and again decreases are added back. Finally, an increase in Accounts Payables implies that the firm has delayed paying out cash and therefore an increase is added back. Together this results in the following set of items:

Change in Working Capital = Change in Accounts Receivables + Inventories + Accounts Payable = -1279 - 163 + 451 = -991.

That is, accounts receivable have increased, inventory has increased and accounts payable have increased in the above example.