7.14 Accrual Accounting Adjustments to Capital Expenditure

Under

US GAAP each firm must disclose certain items in their change to

Stockholders Equity section that may not flow through the

regular income statement.

These additional items flow in the concept of

“Comprehensive Income.”

Conceptual Note on Capital Expenditure:

In

dirty surplus accounting some items are adjusted to the

stockholder’s equity as opposed to the income statement.

The main three items are:

foreign currency translation, pension liability and hedge

accounting adjustments.

Of these three major items the pension liability

represents the cost of human capital component of capital

expenditure. This

item can fluctuate from year to year and so we will take the

average over the three years provided in the 10-K as a first

pass for “Other Comprehensive Income.”

For example for the case of IBM inspection of the

10-K reveals the following:

Looking at the last three years for the Retirement Related

Benefit Plan which is the sub component of Other Comprehensive

Income, it is evident that the year to year fluctuations are

large. As a result,

by taking the average:

Retirement Related Benefit Plan =

(229+994-93-107+704) +( -136-15245+16-132+640)

+(44+3611-85+1110-2)/3 = (2819) billion.

As a result, an additional adjustment is made to Capital

Expenditure to reflect the human capital and other components of

Capital Expenditure.

CAPEX

Payments for plant,

rental machines and other property (3,447)

Proceeds from

disposition of plant, rental machines and other property 330

Investment in software

(630)

Total CAPEX before Retirement benefit adjustments = 3,747

Adjusted Capital Expenditure = 3.747 + 2.819 = 6.566

billions

From the consolidated statement of earnings the weighted

average number of common shares outstanding for 2009 was

1,341,352,754 (assuming dilution).

FCFF per

share

= 12.381/1.341 = $9.233

Remark:

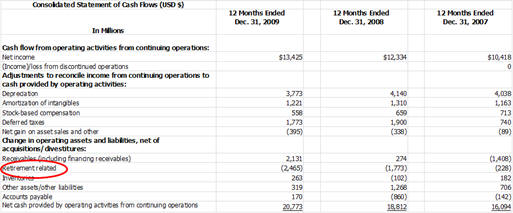

Note that in IBM’s Consolidated Cash Flow Statement from their 2010 10-K the following line item is present in relation to retirement benefits.

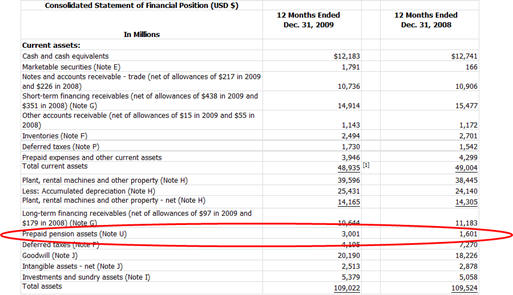

This

results from the fact that pension expense under GAAP is less

then IBM’s pension funding and so the corresponding entry is an

increase in the Prepaid Pension asset on IBM’s balance sheet

from 2008 to 2009:

So the

above adjustments have cash flow implications and are

appropriately accounted for in IBM’s financial statements.

So this leaves the question: what are “Retirement Related

Benefits” in Other Comprehensive Income?

Basically the answer to this arises from defined benefit

retirement plans.

Accounting for retirement

related Benefit Plans is based upon actuarial gains and losses

arising from current defined benefit plans.

This does not have cash flow implications but it does

have economic implications for assessing CAPEX and sustainable

FCFE because it represents a cost associated with human capital.

As a result, the treatment provided in the above example

was to average the amounts relating to retirement benefits in

Other Comprehensive Income across the three years resulting in

2.819 billon additional adjustment to CAPEX.

We next turn our attention to the

measure that is relevant for valuing a stock – this is FCFE.