7.26 Chapter 7:

Questions and Cases

Question 1:

The

intrinsic value of a stock is defined as the present value of

expected dividends discounted back at the cost of equity capital.

Suppose you are attempting to value a stock that pays no

dividends. How can you

assess its intrinsic value?

Question 2:

Describe what Capital

Expenditure (CAPEX) is.

Question 3:

Are working capital items such as Inventory, Accounts

Payable, Accounts

Receivable included in an estimate of Capital Expenditure?

Question 4:

Under US GAAP is interest expense included in Cash Flow from

Operations?

Question 5:

What major firm decision should cash flow from operations

reflect?

Question 6:

What is an operational definition of Free Cash Flow to the

Firm (FCFF)? Provide an

intuitive description of what this measures.

Question 7:

What is Free Cash Flow to Equity (FCFE)?

Provide one operational definition of FCFE.

Question 8:

When is Free Cash Flow to the Firm (FCFF) the same as Free

Cash Flow to Equity (FCFE) and when is it different?

Question 9:

Can Free Cash Flow to Equity (FCFE) be greater than Free Cash

Flow to the Firm (FCFF)? Provide reasons in support of your answer.

Question 10:

Can Free Cash Flow to Equity (FCFE) be less than Free Cash

Flow to the Firm (FCFF)? Provide reasons in support of your answer.

Question 11:

Describe precisely how Depreciation and Amortization

influences Free Cash Flow to the Firm (FCFF).

Question 12:

Define how you estimate Free Cash Flow to the Firm (FCFF)

using EBIT (earnings before interest and taxes).

Question 13:

IBM

Management, when estimating Free Cash Flows in their 10K, subtracts

away an item described as “Financing Receivables” from their Cash

Flow from Operations.

Why would they do this?

Question 14:

Should Capital Expenditure reflect human capital?

Question 15:

If a company is viewed as having a target debt ratio (that is

over time roll over debt to keep the ratio Debt /Total Assets

approximately fixed), how can this be used to simplify assessing

Free Cash Flow to Equity (FCFE)?

Question 16:

The

debt to Total Assets ratio is sometimes used to simplify the

estimating the cost of equity capital.

Does this technique apply to a financial institution?

(Provide reason in support of why or why not).

Question 17:

What

is the difference between the cost of equity capital and the

weighted average cost of capital for a firm?

Describe briefly the differences, including how these numbers

are used to value assets.

Question 18:

Can you estimate Free Cash Flow to the Firm using either the

Cash Flow Statement or the Income Statement?

If yes describe briefly how you do this and if no provide

reasons why not.

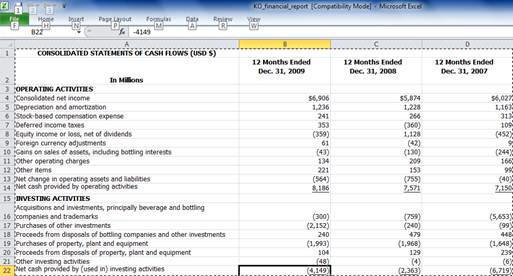

Data for next three questions

The following

provides the Consolidated Cash flow Statement for Coca Cola from

their 2010 10-K:

Question 19:

Referring only to the data provided for Dec 31, 2009,

estimate Capital Expenditure (CAPEX) for Coca-Cola.

Provide support reasons for your estimates.

Question 20:

By taking into account the data provided for three years

ending Dec 31, 2009 estimate Capital Expenditure (CAPEX) for

Coca-Cola. Provide

support reasons for your estimates.

Additional information on

Accumulated Other Comprehensive Income for the next question:

Question 21:

By taking into account the data provided for three years

ending Dec 31, 2009 in Accumulated Other Comprehensive Income are

there any items you would include in Capital Expenditure (CAPEX) if

estimating Free Cash Flows for valuation purposes.

If no why not and if yes why and what amount would you

include?

Question 22:

Referring to your answers to the three previous questions,

estimate Free Cash Flow to the Firm (FCFF) for Coca-Cola.

Provide reasons in support of your answer.

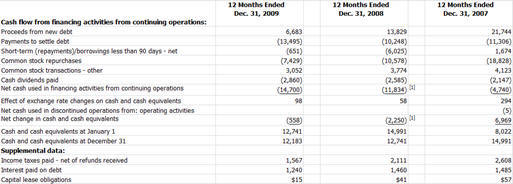

Question 23:

Refer to the

following data from IBM’s Consolidated Statement of Cash Flows:

Net income

above is net income after tax.

In section 4 of

this chapter FCFE for IBM was calculated using the Target Debt Ratio

approach.

The Debt to Total Assets Ratio (i.e., Debt Ratio) = (21,932 +

4,168)/109,022 = 0.239

FCFE = FCFF + Debt Ratio*Adjusted CAPEX =12.381 +6.519*0.239

=13.939 billion because recall that FCFE is higher than FCFF for

a firm financed by both debt and equity.

Suppose you

were to compute FCFE using the general definition provided in

section 3 of this chapter.

That is:

FCFE = FCFF – Interest*(1 – Tax Rate) + Net Borrowing

For this method compute Net Borrowing as the average from the 2007 to 2009 statements provided above. What is FCFE under this method and which estimate do you think is better for assessing IBM’s intrinsic value?

Real World Exercise: Assessing

Intrinsic Value using FCFE Approach

Select two

companies from the Current FTS Dataset that are competitors, or at

least are in the same industry even if they do not directly compete

with each other.

Prepare an

analysis of each stock’s intrinsic value by applying the Free Cash

Flow to Equity Model.

You should identify the major inputs you need from the Valuation

Tutor’s Calculator.

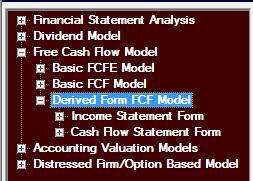

The different

categories for Free Cash Flow Models all represent the same model

how they start at different levels for inputs.

For example, Basic FCFE Model assumes you have already

computed FCFE, Basic FCF model assumes that you are starting with

FCFF and then stepping down to FCFE whereas the “Derived Form”

Models assume that you start with one of the major financial

statements:

Each model also

requires growth and discount rate (i.e., cost of equity capital

inputs) and you are recommended to first refer to the real world

projects at the end of Chapter 4 when completing these parts.

Identify the

major inputs required to assess the intrinsic value using the FCFE

approach including the important assumptions you have made to come

up with this assessment.

You should discuss issues that arose when implementing this

model. That is, what

are the critical variables that underlie your analysis and how

reliable do you assess your estimates for these variables to be when

valuing your two stocks.

What is the

intrinsic value for your two stocks and what is your forecast of

Expected Return (Implied Expected Return in the calculator).

Finally, what

is your bottom line analyst recommendation for your two stocks?

This should be a recommendation from: Strong Buy, Moderate

Buy, Hold, Moderate Sell, and Strong Sell.