FTS Interactive Markets:

Trading Simulations with Price Discovery

- Used for Teaching and Experimental Research

- Windows and cloud-based versions

-

Over

3045 ready made trading cases covering-

Security valuation

- Stocks, bonds, options, futures, swaps,...

- Market Efficiency

- Hedging and risk management

- New cases on Ethics and Systemic Risk

-

Security valuation

- Case solutions and teaching guide

- Easily create your own trading scenarios

-

Multiple Market Microstructures including

- Double auction markets

- Call and pre-opening call markets

- Block trades

- Private trades

- Click for more features

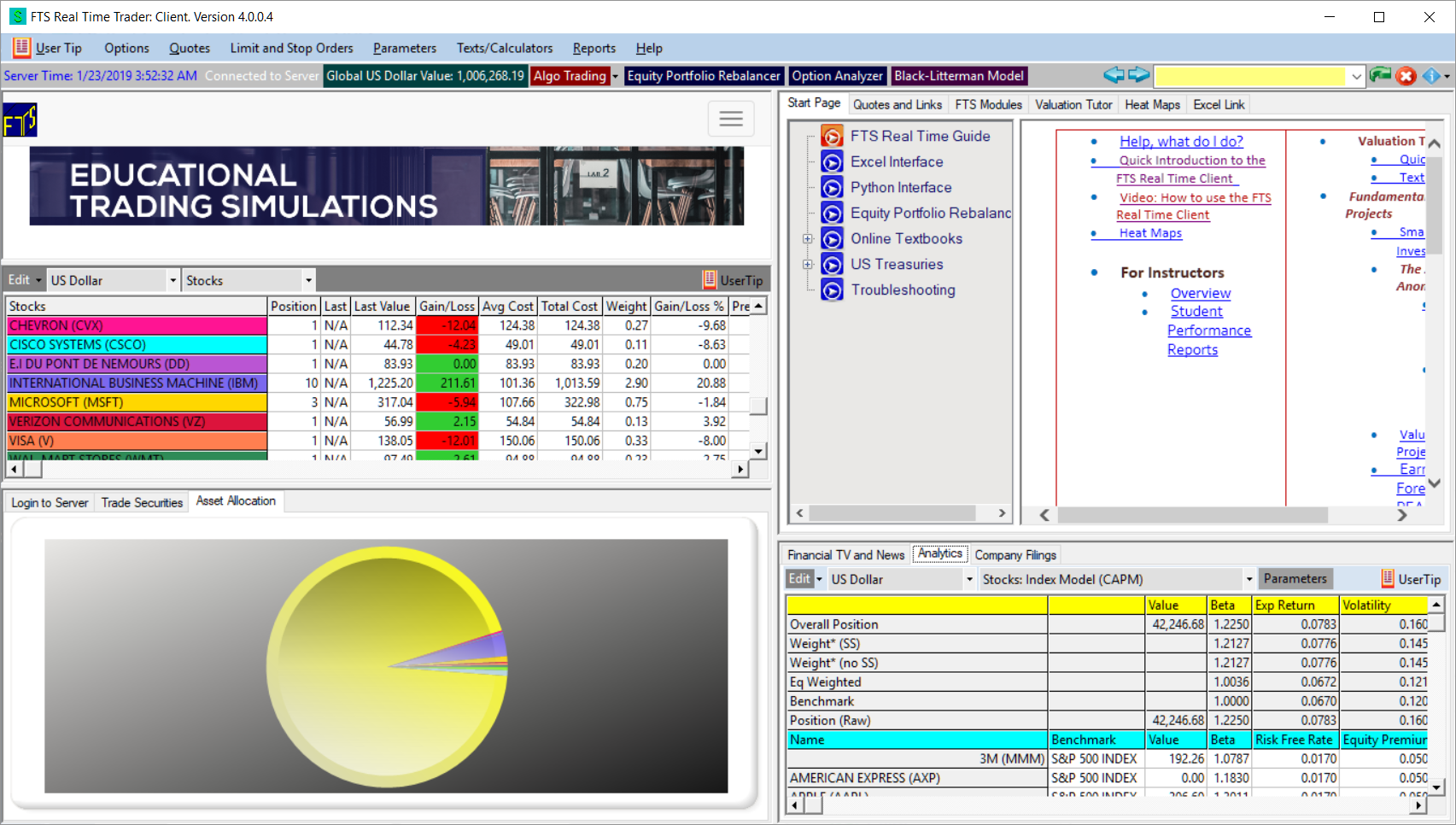

FTS Real Time System:

Advanced Stock Trading Simulation

- Real time algorithmic trading API: supports student applications in R, Python, and other languages

- Windows and cloud-based versions

-

Integrated analytics and tools

- Research and Analytics

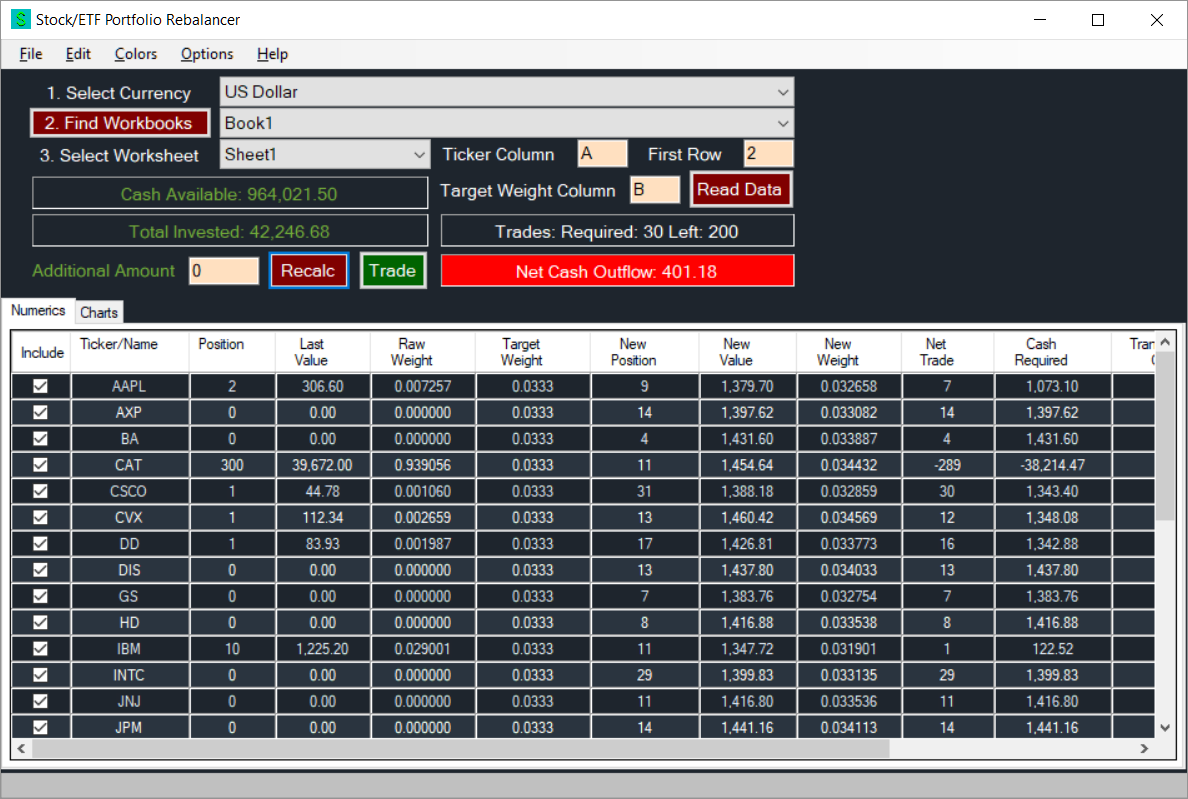

- Equity Portfolio Rebalancer

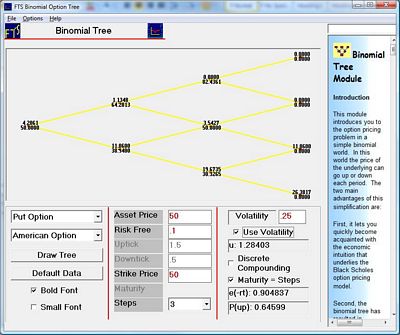

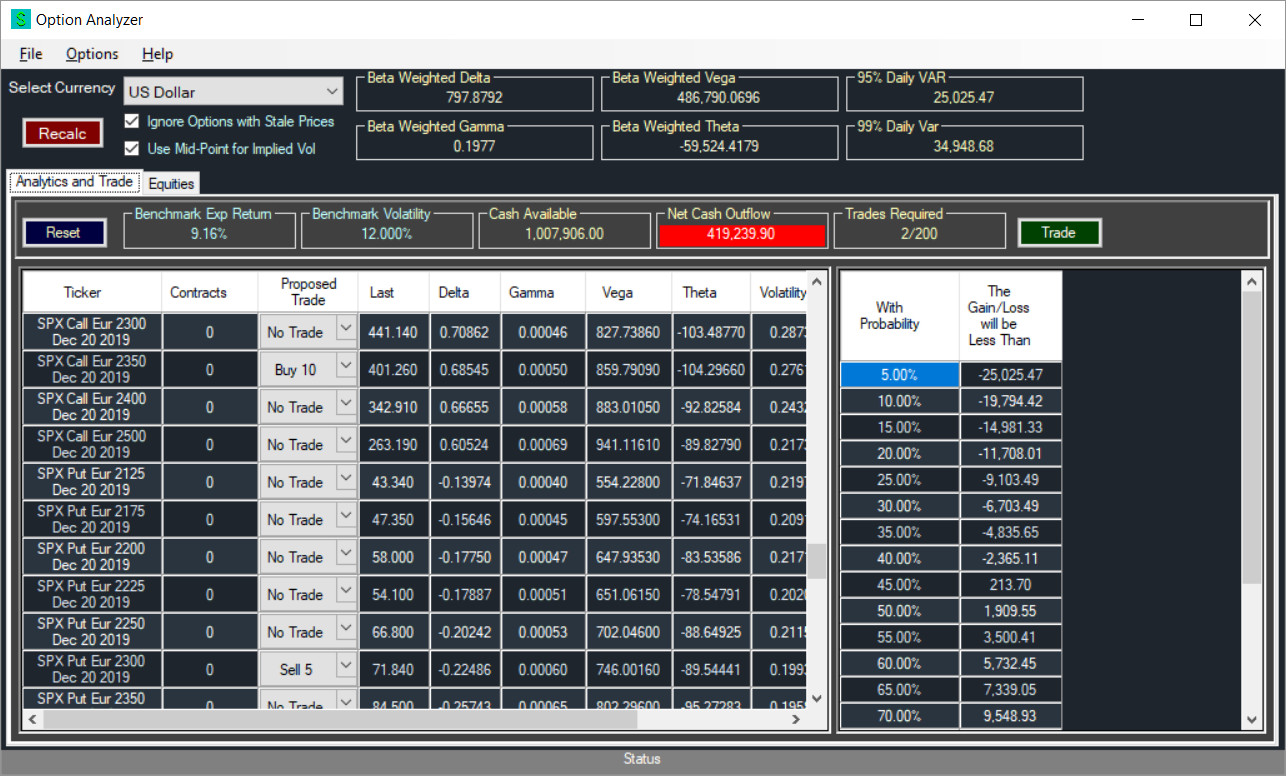

- Option Analyzer

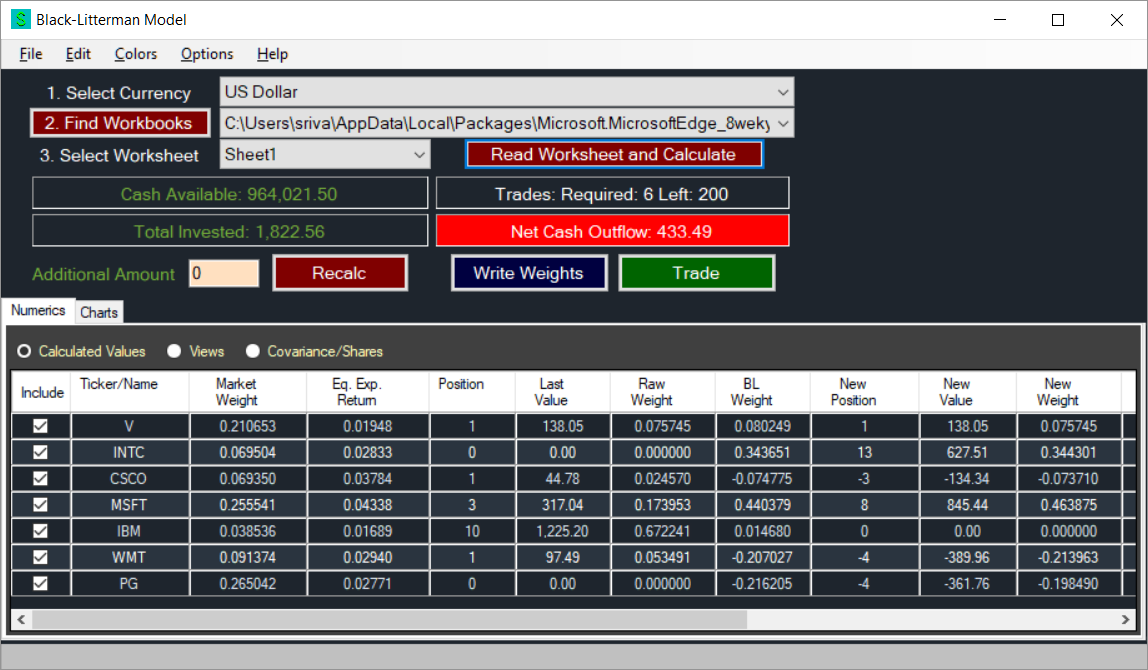

- Black Litterman Model

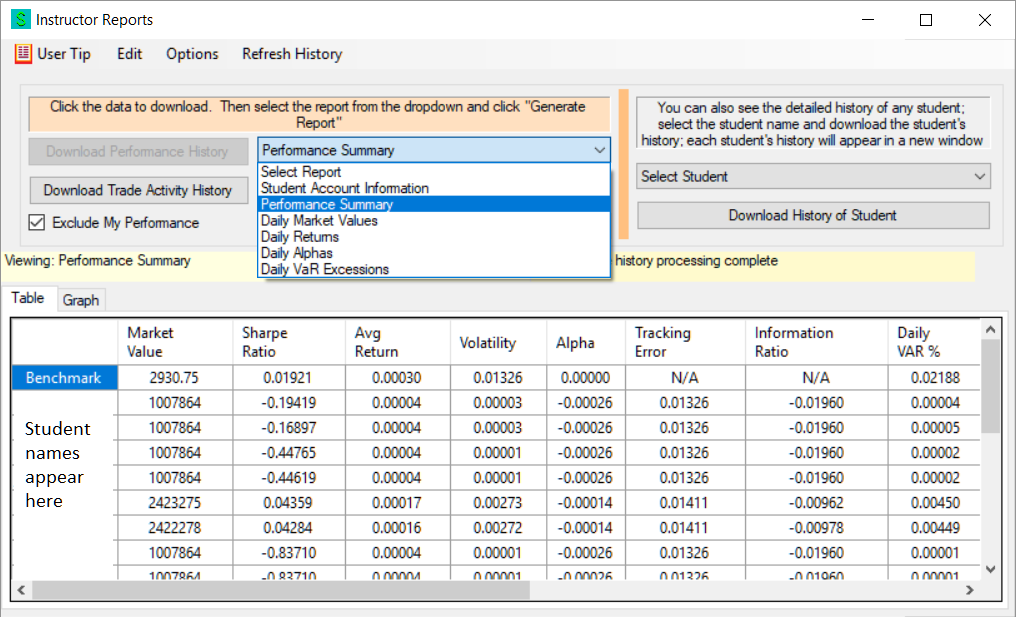

- Detailed Student Reports

- Comprehensive instructor reports

- Fully integrated with Excel: export any report

- Algorithmic trading capability with Python and R

- Ready to use projects and exercises

- Click for other features

- Easy to use: we run the entire backoffice

-

Features

-

Over 45 ready made trading cases covering

-

Security valuation

- Stocks, bonds, options, futures, swaps,...

- Market Efficiency

- Hedging and risk management

- New cases covering Ethics and Systemic Risk

-

Security valuation

-

Multiple market microstructures

Market Microstructures

- Double auction markets

- Call and pre-opening call markets

- Block trades

- Private trades

-

Other features

- Mix and match market making with exogenous prices

- Show or hide the limit order book

- Messaging and private information

- Position dependent payoffs

- Real time Excel link, create trading support and analytics

- Program trading capability

- All data stored in Excel for easy analysis

-

Detailed Reports

- Performance

- Daily Market Values

- P&L report with drill down by security

- All trades with drill down by security

- All limit orders

- All transactions costs

-

Projects covering

- Portfolio Diversification

- Interest Rate Risk

- Trading Currencies

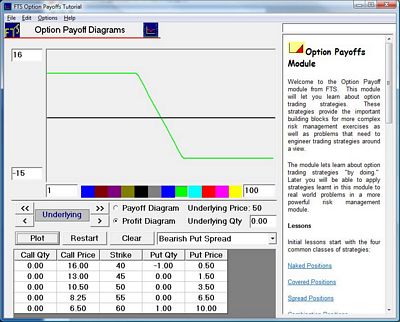

- Options and Futures

- And many more

.png)

.png)

.png)

.png)