8.23 Residual Operating Income (ReOI)

This income number is defined

as:

ReOI = NOPATt – (Weighted Average Cost of Capital *

Net Operating Assetst-1 )

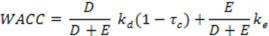

The weighted average cost of capital was defined in chapter 4. A brief description is provided below: The cost of equity capital for the firm as a whole is different from the cost of equity capital for the stock issued by the firm, and the usual formulation is in terms of the after tax weighted average cost of capital.

Where τc is the effective corporate tax rate, kd

is the cost of debt capital and ke is the cost of

equity capital. The

weights are usually constructed relative to market values.

The above equation works with the after tax cost of debt

because interest expense is tax deductible whereas dividend

payments are not.

Net Operating Assets (NOA)

is defined as total assets minus operating liabilities for a

segment.

NOA = Total Assets − Operating Liabilities

Operating Liabilities are usually defined in terms of working

capital liabilities such as Accounts Payables, Income Taxes

Payable, Other Current Liabilities, Other Liabilities, Minority

Interest. That is,

liabilities that do not involve the financing decision.

The remaining liabilities and preferred stock if issued,

are referred to as Net Financial Obligations (NFO) and:

Shareholders’ Equity = NOA - NFO

A

closer inspection of the consolidated balance sheet reveals

that:

So

as a first pass computing for t-1 (= 2008)

NOA is:

NOA

= 8,314 – 4,746 – 487 = 3,081

Now

calculate ReOI as:

ReOI = NOPATt – (Cost of Equity Capital * Net

Operating Assetst-1 )

We

will allocate 3,081 on the basis of relative proportion of total

assets (e.g., North America = 5266/8314 = 0.633).

We

will assume that the required rate of return for Amazon which

equals the WACC (weighted average cost of capital) is provided

by CAPM = 0.0406 + 1.21*0.051 = .1023 because Amazon has very

little outstanding debt especially when we define the weights by

relative market values of stock and bonds.

If you refer to the WACC equation provided earlier you

will see that the debt weighting is Market Value of Debt/(Market

Value of Debt plus Equity).

The

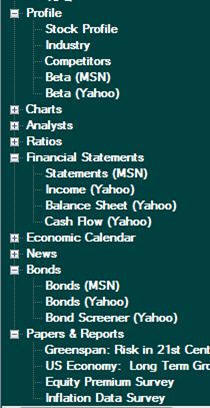

above inputs for CAPM you can get immediately from Valuation

Tutor by clicking on the relevant parts (e.g., beta from Profile

and either Beta (MSN) or Beta (Yahoo), Bonds MSN to get the

30-year bond rate, and finally “Equity Premium Surver” to get

the current consensus (0.051)).

North America = 510.13 – 3081*(5266/8314)*0.1023 =310.49

International = 620.94 - 3081*(1-(5266/8314))*0.1023 = 505.39

From

the first pass it appears that International performs better

than North America.

This may reflect that they have less competition internationally

or it may also reflect the breakdown of total assets and

especially leased facilities.

It is likely that leased facilities are more prevalent in

the international operations and thus accounting for leases

(i.e., operating versus capitalized) should be considered.

Amazon does not break this out by segment in their 10-K

aand they discuss leases as follows:

Leases

and Asset Retirement Obligations

We categorize leases at their

inception as either operating or capital leases. On certain of

our lease agreements, we may receive rent holidays and other

incentives. We recognize lease costs on a straight-line basis

without regard to deferred payment terms, such as rent holidays

that defer the commencement date of required payments.

Additionally, incentives we receive are treated as a reduction

of our costs over the term of the agreement. Leasehold

improvements are capitalized at cost and amortized over the

lesser of their expected useful life or the life of the lease,

excluding renewal periods. We establish assets and liabilities

for the estimated construction costs incurred under

build-to-suit lease arrangements to the extent we are involved

in the construction of structural improvements or take some

level of construction risk prior to commencement of a lease.

But

note Amazon has been careful to separate out the two segments in

terms of capacity:

International

The International segment

consists of amounts earned from retail sales of consumer

products (including from sellers) and subscriptions through

internationally focused websites such as www.amazon.co.uk,

www.amazon.de, www.amazon.co.jp, www.amazon.fr, and

www.amazon.cn. This segment includes export sales from these

internationally based sites (including export sales from these

sites to customers in the U.S. and Canada), but excludes export

sales from www.amazon.com and www.amazon.ca.

So

it would appear that currently International earns a little more

margin.