8.16 Understanding the Numbers

The

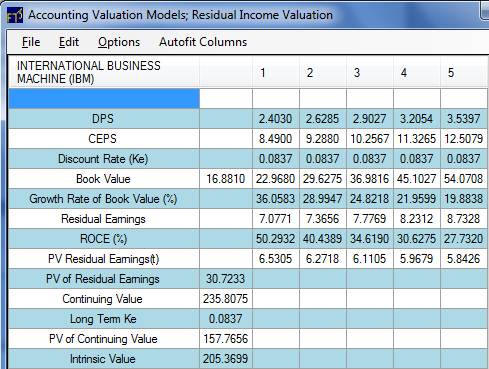

following screen provides a breakdown of the valuation model

into its pieces.

First in this current example time 0 = 2009 and we define the

intrinsic value of IBM as the PV of future residual earnings.

The time line for the IBM example is:

1 = 2010, 2 = 2011, 3 = 2012, 4 = 2013, 5 = 2014.

In the following screen the calculations are broken down into

their spreadsheet form. You

can verify the numbers (within rounding) using Excel.

Interpretation of

the rows above:

DPS = Dividend per Share.

For 2010 2.4030 = 8.49 * 0.283 = 2010 projected residual

earnings times the dividend payout ratio

CEPS = Comprehensive Income per share for each year, 2010, 2011,

2012 ….. In the

above screen the CEPS for 2009 = 7.543.

Recall the assumed growth behavior was as follows:

Year 1: 2010 =

7.543*1.1255

Year 2: 2011 =

8.49 * 1.094

Year 3: 2012 =

9.288 * 1.1043

Note:

The above convention is consistent with typical textbook

presentations where the 5-year growth forecast is applied over

years 3-5. However,

a variation that you can use is to compute the implied growth

forecasts for years 3-5 from the 1-year, 2-year and 5-year

forecasts. This is

computed as follows:

Computing Implied forecast for years 3-5:

Recall for 2010 IBM’s growth was forecast to be 0.125, for 2011

this is 0.094 and for the next 5-years 0.1043.

As a result, the annual growth forecasts for 2012, 2013,

2014 is implied from the above three numbers.

That is, 1.125*1.094*x*x*x = 1.1043.

Solving for x yields x= 0.1007.

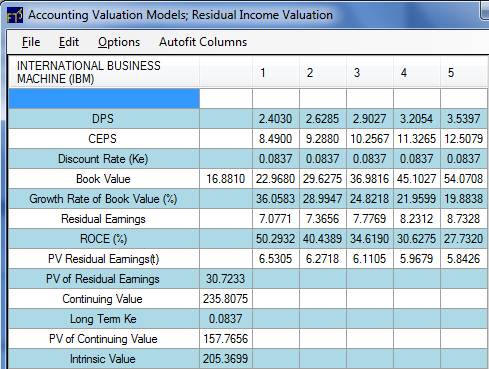

If you prefer to use this internally consistent number then

change the Stage 1 growth phase number to 0.1007 (for Stage 1

growth because the stage 1 growth is applied to years 3-5 in

this model only because you have direct estimates for CEPS1 and

CEPS2 i.e., years 1 and 2).

If you did this, the calculation details would appear as:

This is a refinement that uses an internally consistent set of

Growth Forecasts.

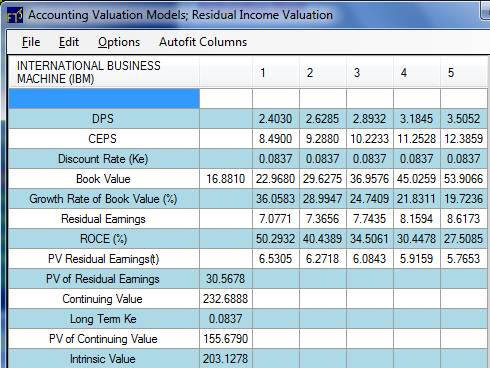

This can be contrasted with the initial set of numbers (see

below which reveals intrinsic value initial estimate = $205

versus $203). Such

a refinement makes a small difference to the projected intrinsic

value, which may explain why many ignore this and just work

directly with the 5-year growth forecast left.

So we will work with the original abnormal growth number: