8.11 Application IBM Step 2: Comprehensive Income

Residual income is dollar excess return over what is required by

investors in terms of the cost of equity capital times book value of

shareholders equity. As

a result, it can be expressed as follows:

Residual Earningst Excess Return = (Return on Common

Equityt – Cost of equity capital) * Book value of

common equityt-1

In the above the Return on

Common Equityt (ROCEt) is defined as:

Comprehensive Earningst/Book Value of Common Equityt-1.

The two drivers of residual income are ROCE and Book Value plus to

forecast residual income over time requires an assessment of growth

behavior estimates.

IBM Example:

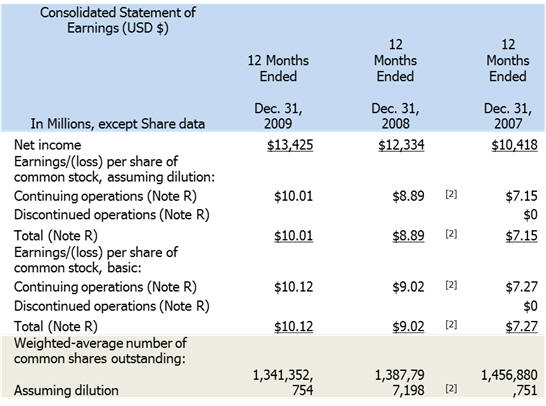

The 10-K Consolidated Income Statement filings from IBM provide the

source data as follows:

Source:

2009 10-K IBM SEC Filing

From the above the Earnings per share = $13.425/1.341 =

$10.011 and as computed earlier the Book Value per Share equals

$16.881.

For Residual Income we are interested in Comprehensive income.

This is defined as follows:

Comprehensive income = Net income + Other Comprehensive income

In the 10-K statements the last three years for “Other Comprehensive

Income” is available in the Shareholders Equity Statement.

Conceptual Note:

In dirty surplus accounting some items are adjusted to the

stockholder’s equity as opposed to the income statement.

The main three items are:

foreign currency translation, pension liability and hedge

accounting adjustments.

As a result, these items can fluctuate from year to year and so we

will take the average over the three years provided in the 10-K as a

first pass for “Other Comprehensive Income.”

The three years provided (2009, 2008 and 2007) respectively are:

Important

Note:

Recall that in this exercise

we are interested in calculating Comprehensive income for valuation

purposes. That is, we

want to estimate sustainable comprehensive income such that we can

apply growth behavior to in order to project the future behavior of

comprehensive income.

In practice this requires some judgment calls and in this case it is

evident that the year to year fluctuations are large for Other

Comprehensive Income.

As a result, to provide an estimate that is likely to be sustainable

we take the average:

Other Comprehensive Income = (3015 +( 18431) + 5487)/3 =

(3309.67)

The Comprehensive income that we will apply for valuation purposes

is:

Comprehensive income = $13,425 + ($3310) = $10115 million

Comprehensive Earnings per share = $10.115/1.341 = $7.543 and as

computed earlier in section IV the Book Value per Share equals

$16.881.