8.15 Application IBM Puting it Together

We now turn our attention to working directly with the FTS Valuation Tutor, to compute the intrinsic value and the expected return from IBM given the spot stock price. This latter number lets you forecast future stock prices such as IBM's price in year's time.

In addition, Valuation Tutor will show you how the calculations were

performed for your personal learning purposes..

Step 1:

Launch

Valuation Tutor and Select Accounting Valuation Models

Step 2:

Click beside

Accounting Valuation Models to Reveal the Residual Income Model

Click on

Residual Income Valuation and the following fields are

available in the Calculator:

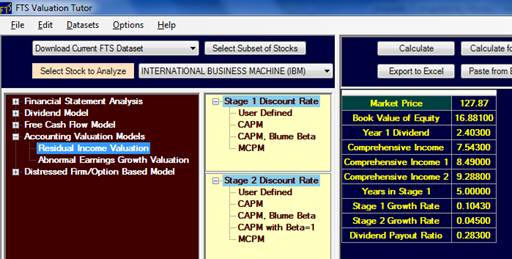

Market Price

Book

Value of Equity

Year

1 Dividend (Next Year)

Comprehensive Income 1 (Next Year)

Comprehensive Income 2 (Following Year after Next)

Years in Stage 1

Stage 1 Growth Rate (Abnormal growth rate for number of years in

Stage 1)

Stage 2 Growth Rate (Normal

Growth)

Dividend Payout Ratio

Then click

beside Stage 1 Discount Rate and Stage 2 Discount Rate to expand the

choice set for the discount rates.

For each stage select CAPM.

Plus

because CAPM was selected the inputs to CAPM follow:

Stage 1 Risk Free Rate

Stage 1 Equity Premium

Stage 1 Beta

And

similarly for Stage 2

Stage 2 Risk Free Rate

Stage 2 Equity Premium

Stage 2 Beta

For

simplicity we will keep both Stages the same for CAPM.

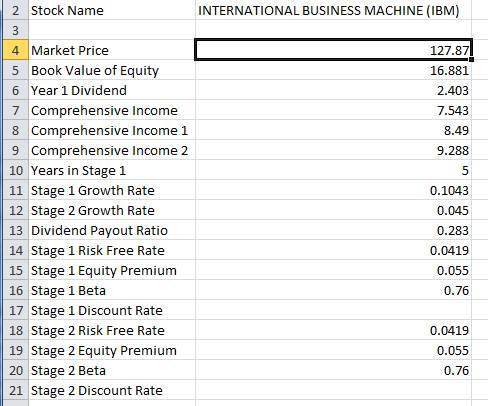

We can now enter directly the numbers we have generated in

the above example:

Current Summary of Key Inputs:

Book Value per Share

= Total Shareholders’ Equity/(Shares issued – Treasury Stock) =

22.637/1.341 = $16.881 equals the book value per share.

Dividend Payout

Ratio:

0.283

Comprehensive EPS FY 2010

$7.543*1.1255

= $8.49

Comprehensive EPS FY 2011

$8.49*1.094 = $9.288

5-Year Growth

= 0.1043

Normal Growth = 0.045

Projected Dividend Per Share (2010) =

$8.49*0.283 =

$2.403

Years in Stage 1:

5-years

For both Stage 1 and Stage 2:

Risk Free Rate = 0.0419

Equity Premium = 0.055

Beta = 0.76

CAPM for both Stages 1 and 2 Calculated from Valuation Tutor): = 0.0837

Working with the Valuation Tutor Calculator

You

can enter the inputs directly into the cells of the calculator.

You should double click on a cell, delete the contents either

by either right clicking your mouse and selecting Clear Value or

just use the Delete key on the keyboard.

Finally, you can type in a new number directly into the cell.

Valuation

Tutor Tips:

The easiest method is to enter the values directly into the

calculator. To do this

double click on any input field, delete the existing number and

enter the number you want. Alternatively,

you can select the field, use the right mouse click and clear the

value or paste in a value to any field from some other source.

Finally, if you edit numbers in the calculator don’t forget

to save your work if you want to refer to this later.

To save your work select the menu item Datasets and click on

Save Dataset using the filename of your choice.

Working

directly with Excel:

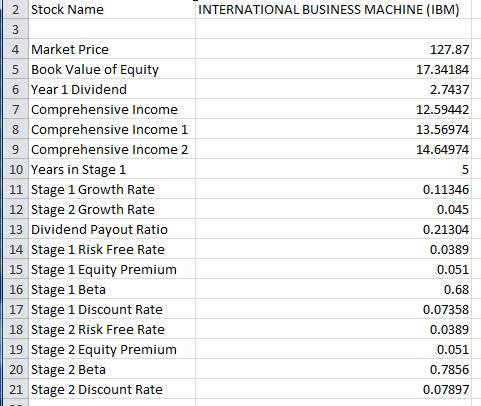

Alternatively, you may want to collect all of your analysis

in an Excel workbook.

You can then work directly with the calculator via Excel.

To do this, click on the button Export to Excel.

This automatically exports the current contents of the

calculator into Excel.

You can then edit the values in Excel, copy the field name(s) and

value(s), and paste them back into Valuation Tutor.

Note that by exporting the field names, you will make sure

that the field names are spelled correctly.

As an

example, we exported the relevant information for IBM (your numbers

may be different, depending on what data you are using):

You can

then edit these values with the numbers from the above example.

The two derived fields (Stage 1 and Stage 2 Discount rates

can be left blank because they will be re-derived automatically by

Valuation Tutor) :

You

should save your work from within Valuation Tutor, but you can also

save your work in Excel as a backup.

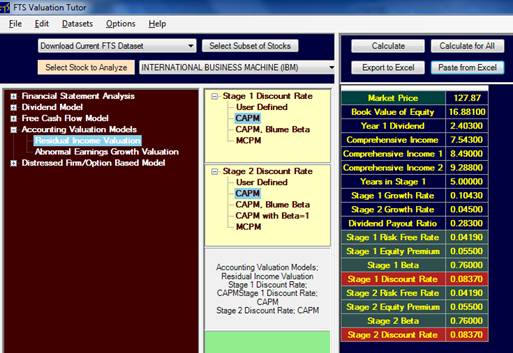

Next

copy the first two columns from the spreadsheet from rows 2 to 21

into the Windows clipboard and then use the button in Valuation

Tutor to Paste from Excel.

The calculator now appears as follows:

The red fields are derived so far which are the two CAPM estimates

for cost of equity capital.

Once you have entered all values as depicted above you can

proceed to step 3.

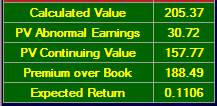

Step 3:

Click on Calculate to generate the Derived Fields

Derived Fields

Calculated Value

PV Abnormal Earnings

PV Continuing Value

Premium over Book Value

Expected Return

These are displayed above for the lower part of the calculator.

Tip:

If any of the screen does not appear on your personal

computer you can drag the separating lines from the different screen

areas up or down by holding cursor over them and clicking the mouse

to drag down to make the calculator part of the screen longer so you

see the derived fields.

An additional important part of the screen is to see the calculation

details screen which shows you where the numbers come from, to

understand how.