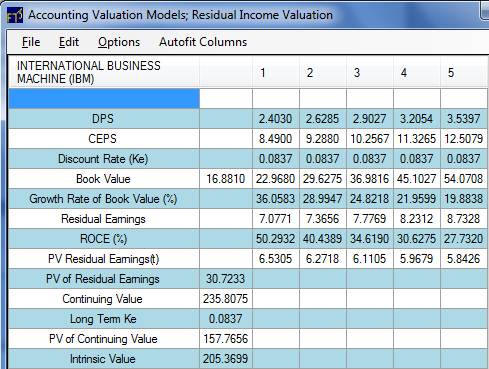

8.21 Sensitivity Analysis

By how much do we need change the value of

key inputs to make IBM’s calculated value more consistent with

the market price?

Answering this question lets you understand what the

current market price implies for the important variables that

are predicted to drive IBM’s intrinsic value.

Your goal is to understand the underlying

economics of the company you are valuing in terms of comparing

your assessments of inputs with market implied assessments.

Valuation Tutor’s calculator has been constructed to make

this easy by allowing you to directly edit input values to see

what value equates the intrinsic value to the spot market price.

This will provide important insights into whether you

assess the current market price to be reasonable or not.

This will also provide useful experience for assessing

the relative importance of the various inputs into this

intrinsic value exercise.

For the Residual Income Model the initial

inputs to examine are the cost of equity capital, comprehensive

income and the growth behavior assumptions for IBM.

Furthermore, by inspecting implied growth rates for Book

Value of Owners Equity, you may want to take a close look at

Comprehensive Earnings projections.

The support screen that provides these implied values is

critical to this type of analysis.

Here you want to stand back and compare dividend growth,

comprehensive income growth and so on with what you think is

reasonable including conducting a similar comparison against the

previous five or more years.