6.8

The Discount Rate

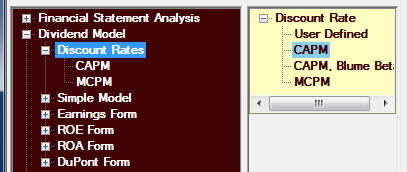

In the one stage model, you need to

specify the interest rate at which you discount future

dividends:

User Defined just means that you have already estimated the discount rate that you want to use from some model. You can enter this rate directly under this option.

CAPM refers to the Capital Asset Pricing Model, perhaps the most widely used model to obtain discount rates, is described briefly below. A variation of the CAPM adjusts a parameter (the beta) following a study by Blume. This takes into account the fact that over time betas will vary and tend to mean revert. That is, high betas tend to revert to towards 1 from above, and low betas tend to revert towards 1 from below. Taking this into account in CAPM adjusts the estimate for the cost of equity capital.

Tip: Using Blume adjusted betas are useful in a two stage growth model for intrinsic value (covered later) where stage 2 applies to all remaining time after some finite period of time as defined in stage 1.

MCPM is a market based

model for the cost of equity capital due to McNulty, Yeh,

Shulze, and Lubatkin,

Harvard Business Review (October 2002).

You may not find this in a textbook, but we include it

for interested readers because it frequently provides much

better estimates of discount rates.

We discuss the model in the appendix.

Note: By using the “Discount Rates” topic you can work with the inputs to these

modes;

we will use this in the MCPM discussion in the Appendix,

where we will also compare the CAPM and MCPM.