6.11

Tutor Break: One Stage Dividend Model

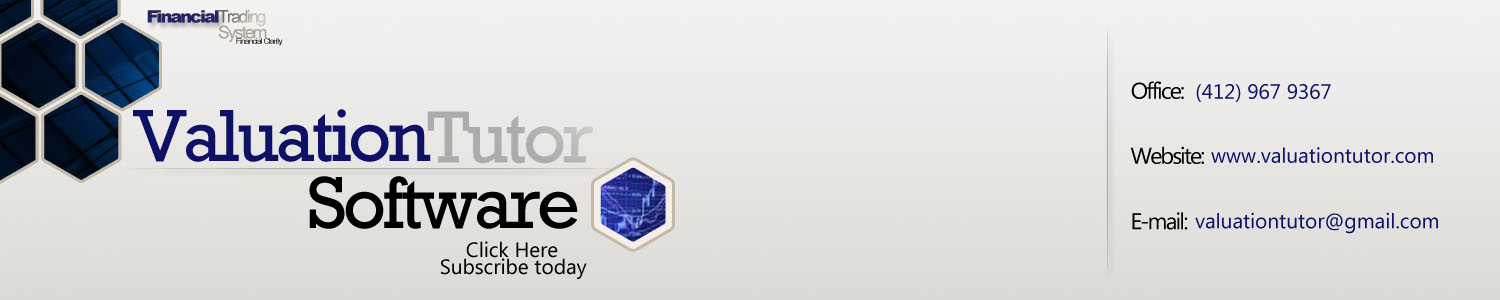

Let’s

apply our estimates to IBM.

The current annual dividend for IBM is 2.191.

What should we use as the growth rate?

Currently, analyst forecasts for IBM’s earnings growth are

5.53%. If we use this

number, we get:

Besides the

calculated value, Valuation Tutor provides two other calculations:

the “implied expected return” and the “implied growth rate.”

The implied expected return is the ke that would

make the intrinsic value equal to the market price.

The implied growth rate is the growth rate that would make

the intrinsic value equal to the market price.

In this example, you can think of it as saying either that

the “market is pricing IBM as if it has a cost of capital or

discount rate of 7.338%” or as saying that the “market is pricing

IBM as if it had a growth rate of 6.085%.”

This inference is very important in making judgments about

the value of the stock; if the implied growth rate is too high to be

plausible, then you may feel that the market price is too high

relative to the intrinsic value.

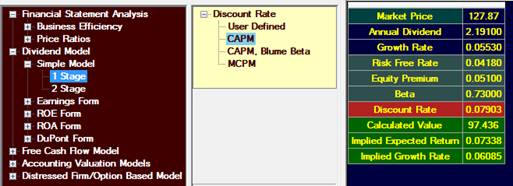

Let’s go back

to the historical growth rate of dividends we calculated earlier.

We had found that over the last 50 years, IBM’s dividend has

grown by about 8%. What

if we use g=8%?

The model would

not work so well. The

growth rate would be greater than ke, and so the value

would actually be infinite.

Valuation Tutor would actually report a negative value; it

calculates d1/(ke-g) and if ke < g

while d1>0, the answer is negative.

You could argue

that the discount rate is too low, perhaps because we are using the

low end of consensus estimates for the equity premium. If we used

5.7% and the 7% growth estimate, we would get:

This is much

higher than the market price.

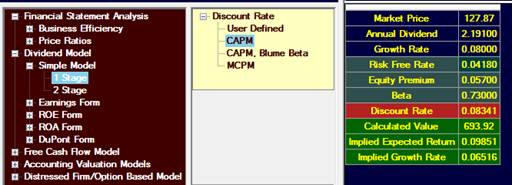

However, let us work a little longer with CAPM.

One observation about beta’s is that over time, betas tend to

drift towards 1. So if

a beta is low, it tends to become high, if a beta is greater than 1,

it tends to adjust downwards

The Blume adjustment accounts for this; it replaces beta by

Blume Beta = Beta *0.67 + 0.33 = 0.8191

If we use this in the IBM example, we get

This obviously brings down the intrinsic value, and also gives you

some insight into how sensitive the model is to the inputs.

Finally, we mention some other consistency checks you can perform.

For example, since stockholders only get paid after

bondholders, IBM’s stock must be riskier than IBM’s bonds.

Therefore, ke for IBM must be at least as great as

the yield on IBM’s bonds.

This yield depends on IBM’s debt rating, and you can

typically find information about the rating in their 10-K (Part 2,

Item 7):

The major rating agencies’ ratings on the company’s debt securities

at December 31, 2009 appear in the table below and remain unchanged

from December 31, 2008. The company’s debt securities do not contain

any acceleration clauses which could change the scheduled maturities

of the obligation. In addition, the company does not have “ratings

trigger” provisions in its debt covenants or documentation, which

would allow the holders to declare an event of default and seek to

accelerate payments thereunder in the event of a change in credit

rating. The company’s contractual agreements governing derivative

instruments contain standard market clauses which can trigger the

termination of the agreement if the company’s credit rating were to

fall below investment grade. At December 31, 2009, the fair value of

those instruments that were in a liability position was $1,555

million, before any applicable netting, and this position is subject

to fluctuations in fair value period to period based on the level of

the company’s outstanding instruments and market conditions. The

company has no other contractual arrangements that, in the event of

a change in credit rating, would result in a material adverse effect

on its financial position or liquidity.

In addition, they provide the following table:

If the information is not available in the 10-K, you can look up the

current rating of the debt using the Bonds link in the information

system::

On the resulting screen, enter the ticker (say IBM) and you will see

a list of bonds issues by the company, their yields, as well as

their Fitch ratings.

If bonds are not listed, you can simply enter the ticker and

“credit rating” into your search engine; when we did this for IBM,

we found various reports that it had been upgraded to A+.

What is the yield on an A+ rated corporate bond?

Various bond rating sites give you this information; a free

source is the US Federal Reserve Board, which each provides Moody’s

seasoned rates for both Aaa and Baa bonds of a 10 year maturity.

At the time of this example these were:

Aaa = 4.89%

Baa = 6.28%

You can linearly interpolate to get:

Aaa = 4.89%

Aa = 5.35%

A = 5.82%

Baa = 6.28%

We will need to add a small “spread” to this to adjust for the fact

that we are using a 30-year Treasury yield (since we are discounting

over the long term). If

we add 1% (the Treasury 30 year yield at this time is 0.92%, or 92

basis points, above the 10-year treasury yield), we get 5.82 + 1.00

= 6.82%. This would be a

lower bound for ke.

An upper bound is 9.28% = 4.18% + 5.1%, which is CAPM applied

to a firm with beta equal to 1 and since IBM’s beta is less than 1.

This gives you a reasonable range for the ke.

At the lower rate, with a growth estimate of 5.53%, the value

comes out to 179.24; at the high discount rate, it comes out to

61.65. You can see the

interplay between the growth rate and the discount rate; if we use

the 8% growth rate and the high discount rate, the calculated value

is 184. If you think the

growth rate is somewhere between the analysts forecast of 5.53% and

the historical growth rate of 8%, then you can see that market price

is consistent with a discount rate somewhat higher than the CAPM.

Criticism of the One Stage

Model

The one-stage

model is obviously quite simple. For example, it assumes that IBM’s

dividend grows forever at a constant rate.

In reality we observe that

firms go through a life cycle, and so the growth rate over the near

term may be quite different from the long run growth rate.

This idea is captured by the two stage growth model, which

was also first analyzed by Williams in 1938.

The idea can be extended to multi-stage models, e.g. a three

stage model.