5.4 Example 1: Using

P/E Ratios in Valuation Tutor to Compare Stocks

Note:

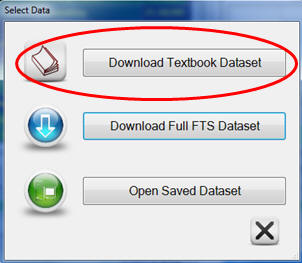

If you already have the regular data set read in click on

the Data menu in the screen below, select Download Data and

click on Yes when prompted.

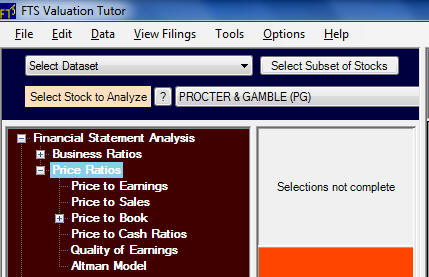

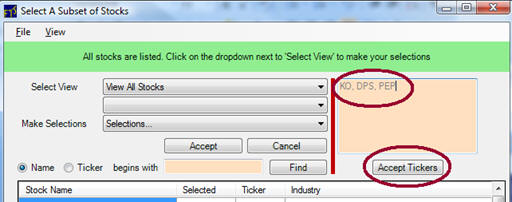

In the bottom LHS of

Valuation Tutor click on Profile and select Competitors:

KO (Coca-Cola), DPS (Dr

Pepper Snapple Group, Inc.) and PEP (PepsiCo)

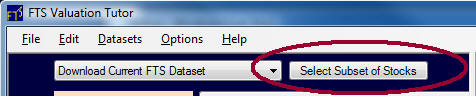

Now at the top of the

screen in the button to the left of Calculate you will see

Select Subset of Stocks:

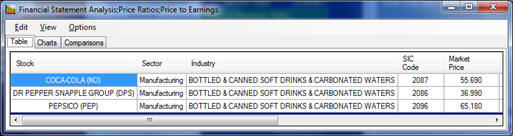

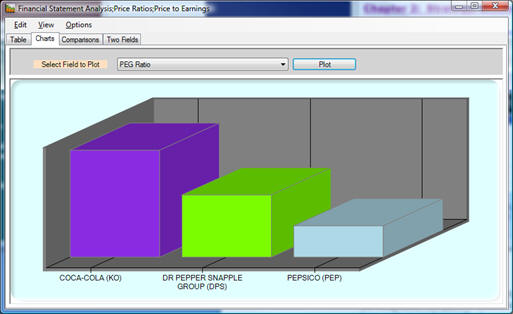

This computes P/E Ratios

in various forms for the immediate competitors of Coca-Cola and

provides detailed access to the comparisons.

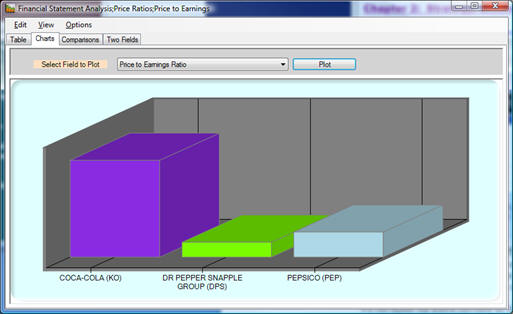

For example we plot the P/E Ratios for the three

competitors below:

From this exercise, you

can see that Valuation Tutor makes it easy to compare

competitors.

Furthermore you can export your results to Excel by clicking on

the Edit menu item above and selecting Export to Excel.

We can repeat the above

calculate all for the remaining price ratios.

For example, the Price/Sales ratio for KO provides

additional estimates such as estimated Break/Even points in

Sales Revenue.