Chapter 5:

Financial Statement Analysis: Price Ratios

In this chapter, we extend

ratio analysis to price

based ratios. A

major difference between business ratios and price ratios is

that emphasis now shifts to forward looking analysis.

The market price of a stock reflects future performance

(i.e., expected return) and discounts this expected return by

assessing a company’s risk.

As a result, price ratios represent the market’s

scorecard of how the company is performing along the set of

dimensions covered in Chapter’s 3 and 4

taking into account forward looking information.

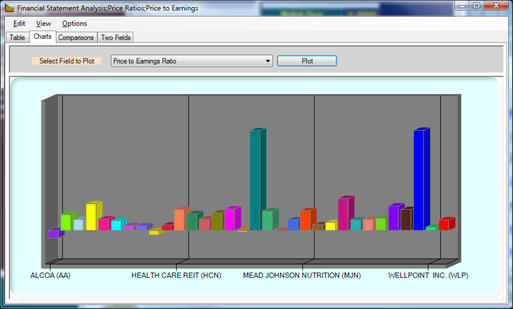

Figure 1:

Price Ratios

The market’s scorecard

includes assessing the quality of the accounting earnings and

the credit risk of the firm.

There have been persistent questions raised in accounting

research on whether the market correctly assesses earnings

quality. This

research studies the use of and relative importance of

accounting accruals to accounting net income measures.

Because accounting accruals must reverse over time these

studies have implications for assessing both the expected return

and the risk of a company.

The Valuation Tutor software performs a comprehensive

analysis of earnings quality working directly with current

accounting disclosures.

The credit rating models assess whether a company is a

going concern or is a distressed firm and calculates the

likelihood that a firm going to go bankrupt.

We start with price

ratios. Extreme

price ratios usually provide a signal that forward looking

information, beyond standard financial disclosures, is

significant. Recall

from Chapter 2 that the MD&A section of the 10-K has been

subjected to criticism.

A recent SEC study concluded that forward looking

information disclosures can be improved.

As a result, studying price ratios is an important means

of assessing whether the MD&A and related sources should be

subjected to closer scrutiny.

Perhaps the most famous

price-based ratio is the Price to Earnings (P/E) ratio, which is

the price of the stock divided by the earnings per share.

This ratio measures the amount investors in the market

(or simply the “market”) are willing to pay per dollar of

earnings per share.

If you compare the P/E ratio of two firms, you could infer that

investors who buy the stock feel that the stock with the high

P/E ratio has stronger growth prospects.

A stock with a higher P/E ratio is said to be more

expensive than one with a lower P/E ratio because you have to

pay more per dollar of earnings for that stock.

Sometimes, the ratio is expressed in terms of a multiple;

if a stock’s P/E ratio is 15, then we say that the stock is

trading at a multiple of 15, or that the price is 15 times the

annual earnings per share; a stock trading at 20 times earnings

is then more “expensive” than one trading at 15 times earnings.

The usual reasons for such differences are expected

earnings’ growth and/or risk.

Analyzing differences in

earnings’ growth leads to another popular measure which is the

PEG, or P/E to Growth, ratio.

That is, the P/E ratio is divided by the expected growth

of earnings.

Generally, we expect that companies with a high P/E ratio will

grow faster, and so simply comparing them on the basis of the

P/E ratio would make us think that the high growth stocks are

expensive. The PEG

ratio normalizes the P/E ratio by the growth rate, and therefore

makes companies with different growth rates more comparable and

which then lets an analyst explore issues such as earnings’

quality, degree of operating leverage and other sources of risk

that can influence earnings.

In principle, you can

construct a price based ratio using any of the firm’s

activities, for example, the Price-Sales Ratio or the Price-Cash

Flow ratio.

Each such ratio tells you how the market evaluates or “prices”

or “values” that activity.

We can then make inferences about firms by ranking these

measures. This gives

you a “market scorecard” of the activities of the firm, and

tells you which activities are the drivers of the firm’s value.

In other words, price ratios provide the markets evaluation of

the firm’s business model and strategy.

Given your understanding

of the firm’s business strategy the market should value

activities that are important to the strategy if implemented

efficiently. By

adopting this line of reasoning you can see how price ratios

become an important source of information to firms today that

faces dynamic value chains as described in Chapter 4.

The specific learning

objective is:

·

To understand the major price based ratios, how to construct

them from the firm’s financial statements, and how to interpret

them

The chapter proceeds by

introducing the most popular of all price based ratios, the

Price to Earnings Ratio.

The following chart shows the P/E ratios for the stocks

in the Dow Jones Industrial Average at the time of this writing.

This “bottom line” ratio

is extended to the Price Earnings to Growth (PEG) ratio.

This measures the market’s assessment of both financial

and learning and growth perspectives of the firm.

We then proceed to the “top line” with the Price to Sales

Revenue ratio which measures the market’s assessment of the

customer perspective.

Next we introduce the Price to Book Value of Equity

ratio, and show that by decomposing this ratio further, we

obtain important measures of how the market prices the various

internal activities of the firm.

Finally, we introduce the Price to Cash Flow Ratio in aggregate

and decomposed forms.

Compared to the Price Earnings Ratio, this provides

insights into the quality of accounting earnings and the

decomposed forms allow additional information to be extracted,

such as how the market is pricing working capital management and

capital investment decisions made by the firm.

If earnings management is an issue, then price to cash

flow ratios may provide what on the surface appears to be an

inconsistent picture.

After price ratios, we take you through a detailed analysis of

earnings quality, and conclude the chapter with an analysis of

credit ratings.

Before starting into the

ratios, the next section provides the common set of steps

required to recreate each of the formal Proctor and Gamble

reconciliations directly from the 10-K filings for each ratio.

This follows the format introduced in Chapter 3 for the

Business Ratios.