5.3 Price to Earnings

Ratio

P/E Ratio

is the number of years to recover the stock price

with zero earnings growth

|

The Price Earnings Ratio divides the stock price by earnings per

share (EPS). This

multiple can be used to identify the relative value of similar

stocks. There are

three different types of P/E ratios commonly used in practice:

i.

P/E Ratio = Stock

Price/Annual Earnings per Share (EPS)

ii.

Trailing P/E Ratio = Stock

Price/EPS computed from the sum of last four quarters

iii.

Forward P/E Ratio = Stock

Price/Forecast Earnings per Share

Relative valuation

uses these ratios to rank similar stocks such that the lower the

ratio the higher the ranking.

A ratio is defined relative to annual earnings measures

of the number of years required to recover the current stock

price from earnings if there is no earnings growth.

The three types of price

earnings ratios defined above vary in terms of the timeliness

and relevance of the relative valuation ranking.

For example, the Trailing P/E Ratio provides more timely

information because the Trailing P/E Ratio constructs annual

earnings per share number from the most recent available four

quarters.

Role of Growth Forecasts

Stock prices reflect

expectations about the future.

The Forward P/E Ratio is a refinement of the Trailing P/E

Ratio because it incorporates expectations about future earnings

into the analysis. A

potential weakness with this is that only the next year is taken

into account, while a stock price will reflect earnings

expectations about future years as well.

One refinement of the P/E ratio designed to incorporate

this idea is the Price/Earnings to Growth Ratio (PEG) Ratio.

Here Growth is usually defined as the expected Growth

over the next 5-years to overcome this problem.

PEG Ratio = P/E

Ratio divided by Growth

Again, this ratio is

interpreted relative to a similar stock or set of stocks in an

industry. All other

things being equal, the stock with a lower PEG ratio is ranked

higher than a similar stock with a higher PEG ratio.

We illustrate these ideas

next for a small set of well known stocks with similar business

models.

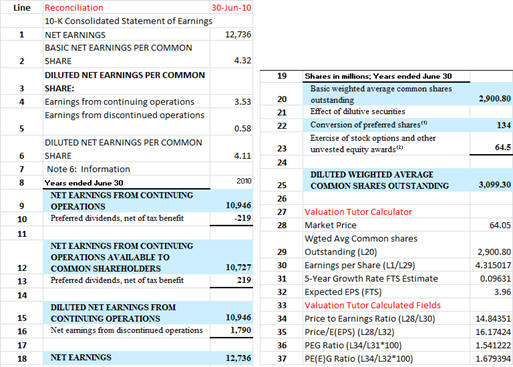

Tutor Reconciliation:

Proctor and Gamble (PG)

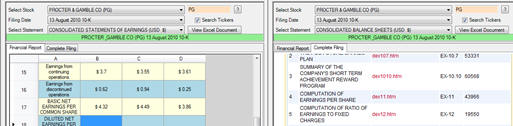

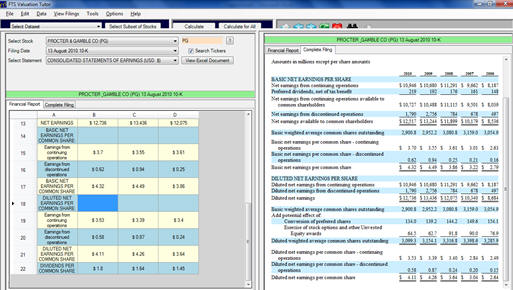

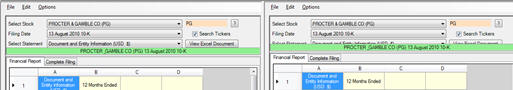

Step 1:

Refer to section 5.2 to bring up the Income Statement and

Balance Sheet for Proctor and Gamble as described in section

3.2. Be sure to

select the August 13, 2010 10-K from the dropdown.

This is displayed at the bottom of the screen as follows:

Earnings per Share = $4.315

5-Year Growth Rate = 0.0963

Price = $64.050

Price to Earnings Ratio = $64.050/4.315 = 14.84

Expected EPS = 3.99 (Note: this is next year which can be a

forecast decline even though the next five years is forecast to

be positive 9.63%)

Price /E(EPS) = $64.05/3.96 = 16.05

PEG Ratio = 14.84/9.63

PE(E)G Ratio = 16.17/9.63

Step 3:

Where did these numbers come from?

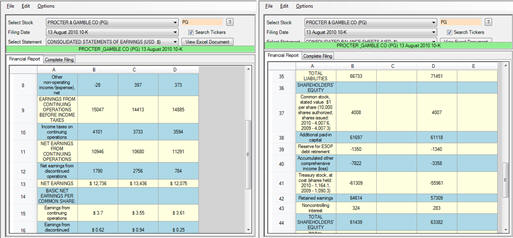

Unfortunately in the financial statements there are many

variations of the EPS!

For example, both the numerator Earnings, and denominator

number of shares can take different values.

The main point is that so long as you are consistent

across stocks then relative pricing is relevant.

However, this is one of those numbers where additional

analysis is required.

The accountants realize this and full details are

provided in the 10-K as well as the interactive statements.

Valuation tutor software lets you quickly compare both sources:

In the LHS we have already got up the interactive consolidated

income statement.

Now consider the bottom RHS of the screen.

If you click on the tab Company Filing you are taken

immediately to the company filings as depicted below: