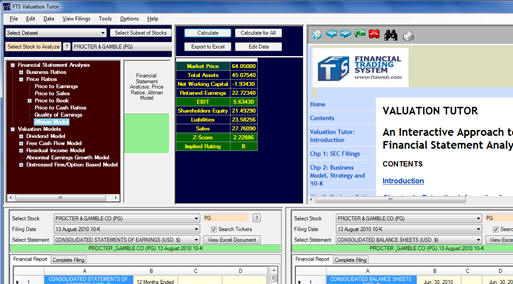

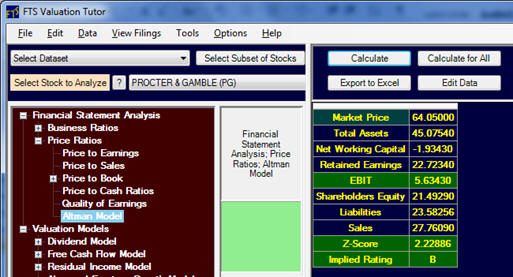

5.19 Using Valuation Tutor’s Altman

Model Calculator

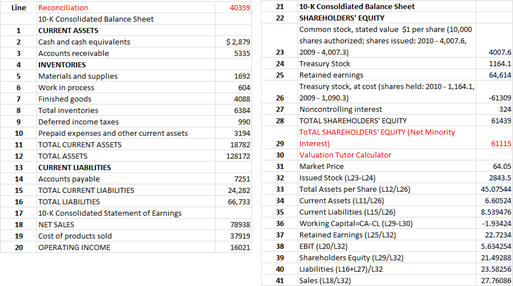

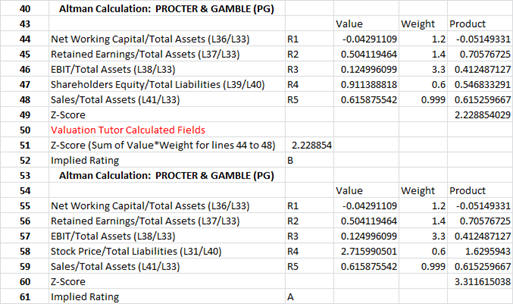

R4 = Shareholders’

Equity/Total Liabilities or Market Value of Equity/Total

Liabilities

The choice of this variable is important and the default in

Valuation Tutor is to use the traditional measure.

However, for the case of P&G the traditional measure

provides a rating that is out of line with a ratio analysis of

P&G which are all relatively strong.

Using Market Prices results in a more realistic “A.”

To reconcile this we will need to access P&G’s two major

statements: The

Consolidated Income Statement and the Consolidated Balance

Sheet. We can do

this by first setting up the screen as described in section 5.2: