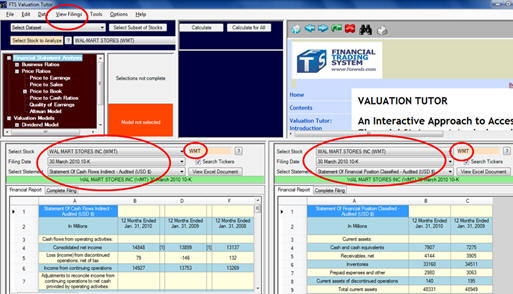

5.14 Example Wal-Mart

Following section 5.2 we

bring in the Consolidated Balance Sheet for WMT.

The key elements of the screen are circled below for this

example. That is we

are working with the 30 March 2010 10-K and Wal-Marts

Consolidated Balance Sheets for the years ending January 31,

2010 and 2009.

Computation of Net Operating Assets Jan 31, 2010

Note to the above 10-K:

Following FASB Statement 160 (ASC 810-10) the FASB has

recently (beginning on or after December 15, 2008) required that

“non-controlling interests” are part of equity in a consolidated

reporting entity.

This is a departure from the previous practice of treating

minority interests as a mezzanine item between liabilities and

equity. This

has resulted from the convergence process between US GAAP and

IFRS and in particular aligns reporting of non-controlling

interests with the requirements in IAS27.

This convergence adopts a

single method of accounting for economically similar

transactions. It eliminates the need to apply purchase

accounting to a parent’s acquisition of non-controlling

ownership interests in a subsidiary, and thus eliminates the

need to value the assets and liabilities of the subsidiary on

the date that each additional interest is acquired.

In the numbers below we

will keep non-controlling interests in the equity section.

Prior to the latest requirements of statement 160 some

analysts may have included non-controlling interests in Total

Liabilities (e.g., via Total Assets – Equity type of

calculation) and you can easily edit any of the numbers in the

calculator if desired.

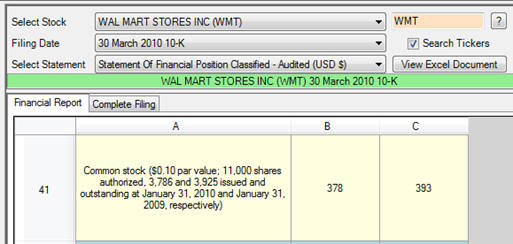

Working from Wal-Marts 10-K

Shares Issued and

Outstanding Jan 31, 2010 = 3,786

Total Assets =

170,706 (2009), 163,429 (2008)

Cash and Cash

Equivalents = 7,907 (2009), 7,275 (2008)

Operating Assets =

170,706 – 7,907 = 162,799 (2009), 163,429 – 7,275 = 156,154

(2008)

Adjusted

Liabilities2009

= Total Liabilities and Equity2009 –

Total Equity2009 = (170,706 – 72,929) – (33,231 +

4,050 + 523) = $59,973

Adjusted

Liabilities2008

= Total Liabilities and Equity2008 –

Total Equity2008 = (163,429 – 67,079) – (31,349 +

5,848 + 1,506) = $57,647

Net Operating

Assets2009 = 162,799 – 59,973 = 102,826

Net Operating

Assets2008 = 156,154 – 57,647 = 98,507

Aggregate Accruals

= 102,826 – 98,507 = 4,319

Average Net

Operating Assets = (102,826 + 98,507)/2 = 100,666.5

Accruals Ratio

(Balance Sheet) = 4,319/100,666.5 = 0.0429 or 4.3%

Online you can verify the

above numbers from the Consolidated Balance Sheet as in the

example below:

Aggregate Accruals

Aggregate Accruals2009

= Net Income2009 – (Cash Flows from Operations + Cash

Flows from Investments)

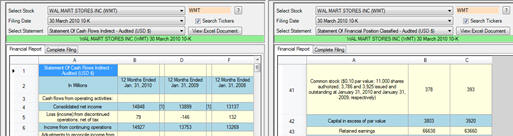

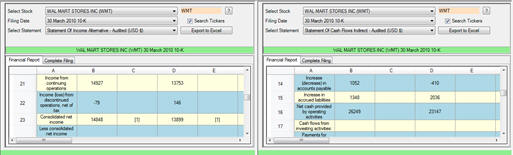

Refer to the Consolidated

Cash Flow Statement for Wal-Mart.

This is in the LHS of the screen below:

The Aggregate

Accruals for 2009 are:

14,848 – (26,249 + (11,620)) = 298

Accruals Ratio

(Cash Flow Statement) = 298/100,666.5 = 0.00296

Finally we can construct

the Percent Operating Accruals for Wal-Mart as follows:

Percent Operating

Accruals = (Net Income – Cash from Operations)/Net Income

Percent Operating

Accruals = (14,848 – 26,249)/14,848 = -0.76785

In other words, Wal-Mart

has negative accruals which is a very positive signal for

underlying strength of future earnings given the empirical

findings from Hafzalla, Lundholm and Winkel (2010).

You can verify these numbers from the statements below:

But how can you determine

what is high versus low quality?

The answer to this is an

empirical issue that is often handled by forming portfolios

ranked in terms of the ratios.

Valuation Tutor lets you do this directly by clicking on

Calculate All and then sorting the results provided in the grid

that automatically pops up.

This lets you compare important ratios by SIC code,

industry or even stock index classification.

In the next section we will first introduce Valuation

Tutor’s Earnings’ Quality calculator and use it to reconcile the

numbers for P&G. We

will then extend the use of this calculator to see how to

develop your professional judgment in relation to the numbers

produced by exploiting the feature “Calculate All.”