5.21 Chapter 5: Questions

Question 1:

Define and briefly describe the difference between a P/E

Ratio and a Forward P/E ratio.

Question 2:

What is the difference between a “Trailing P/E Ratio” and a

“Forward P/E Ratio”?

Question 3: Information

Using the information provided, and by considering

only the Price to

Earnings Ratio (i.e., you should ignore the other information for

this part), which company is valued more highly? Provide brief

reasons in support of your answer.

Question 4:

Using

all of the information

provided for Question 3, which company is valued more highly?

Provide brief reasons in support of your answer.

By conducting a DuPont decomposition analysis of

the ROE for Wal-Mart and Best Buy, describe why they are

different. Next, refer

to the information provided for Question 2 in relation to P/E ratios

and PEG ratios. Taking

into account both your ROE analysis and your price ratio analysis

provide a more complete interpretation of the observed price ratios

for Wal-Mart and Best Buy.

In particular, from a relative valuation perspective does one

appear to be overvalued relative to the other?

Provide reasons in support of your answer.

Question 6:

Stock analysts work with

both the bottom line (P/E ratios) and the top line (Price/Sales

ratios). Provide a

brief interpretation of each type of ratio (Price/EPS and

Price/Sales per Share) and discuss the advantages and disadvantage

of each type of ratio.

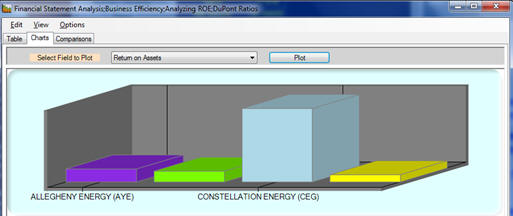

Information for the next three questions:

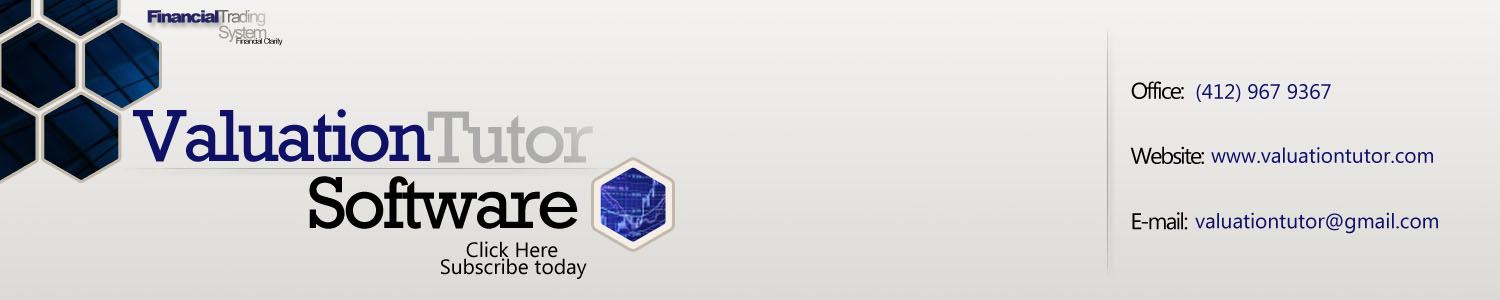

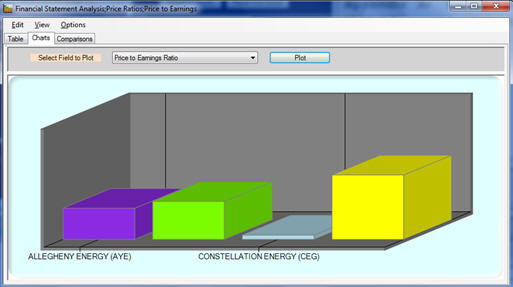

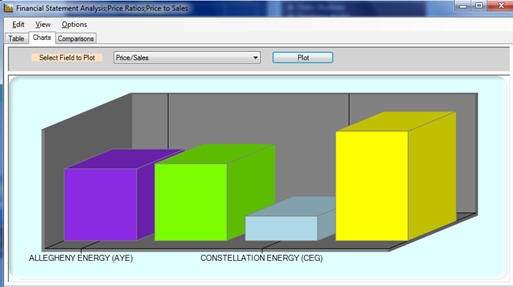

In the graphs below the Price to Earnings, Price to Sales and the

Return on Assets is provided for the following four companies:

·

Allegheny Energy (AYE), Purple

·

American Electric Power (AEP) Green,

·

Constellation Energy (CEG), Light Blue

·

Duke Energy Corporation (DUK) Yellow

Question 7:

If you were adopting a relative valuation approach using

price ratios, which stock is the highest priced in the market and

which stock is the cheapest?

Provide reasons in support of your answer.

Question 8:

If you were combining relative valuation using price ratios

with an analysis of business ratios (again only referring to the

information provided) which stock would you recommend as the

cheapest to acquire in the market and which is the most expensive?

Provide reasons in support of your answer.

Question 9:

A summary of the findings from the Fama & French 1995 study titled “Size

and Book-to-Market Factors in Earnings and Returns” found that

firms with a very high book-to-market tend to be persistently

distressed stocks (which supported their argument for this being a

“risk factor”).

Note:

Fama and French “Book to Price Ratio” rather than the “Price

to Book Ratio.” This has the advantage of preserving the ranking

when some firms have negative book values.

This same point applies to the P/E ratio, where in

statistical analysis, the “Earnings to Price Ratio is used.

In the graph below, the Price to Book Ratio is provided for

the four stocks:

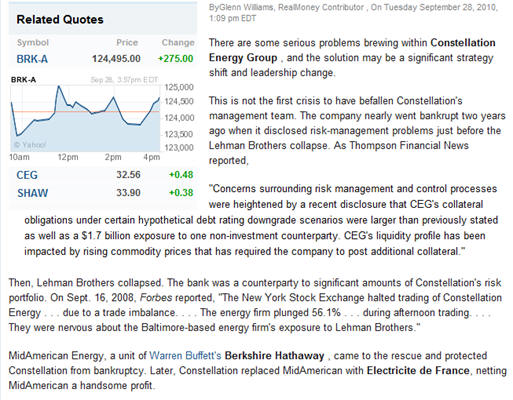

Question 10:

Refer to the following report that appeared on the internet:

Real World Exercise on Price Ratios

Select two

companies from the Current FTS Dataset that are competitors, or at

least are in the same industry even if they do not directly compete

with each other.

Provide a

summary report of the results from conducting financial statement

analysis of the price ratios for your two stocks relative to each

other. Summarize

how you view the market to be assessing their comparative advantages

and disadvantages for these two stocks relative to this analysis.

In addition, comment on how efficiently the market is

assessing for how each firm is implementing their business

model/business strategy, based upon your analysis of the price

ratios.