5.18 Example:

Wal-Mart versus Target

First, construct the

ratios from the 10-K reports (Consolidated Balance Sheet for R1,

R2, R4) and Consolidated Income Statement/Balance sheet for R3 &

R5.

Wal-Mart:

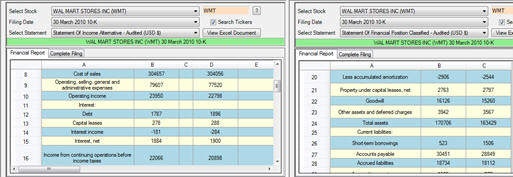

In Valuation Tutor you can bring up the 30th

March 2010 10-K and set up the Income Statement and Balance

Sheet as described in section 5.2.

These statements contain the raw data for the following

example:

Net Working Capital

= (Current Assets - Current Liabilities) = 48331 – 55561

Total Assets =

170,706

Retained Earnings =

66,638

EBIT = 23950

Shareholders’

Equity = 72,929

Total Liabilities =

97,777

Sales = 408,214

Weighted-average

number of shares Diluted = 3,877

In the above the Adjusted

Z-Score more appropriately uses the current market value in lieu

of Shareholders’ Equity.

Neither WMT or TGT are

judged as being distressed using Altman’s Z-score.

Alternative Version of the Altman Z-score:

EM Model

An alternative form of the Altman model has been constructed

(Altman, Hartzell and Peck (1995)) referred to as the EM-score

(emerging markets) model.

This is

defined as:

EM

Score = 3.25 + 6.56(X1) + 3.26(X2) + 6.72(X3) + 1.05(X4)

Where:

X1 =

Working Capital/Total Assets = (Current Assets - Current

Liabilities)/TA

X2 =

Retained Earnings/Total Assets

X3 =

EBIT/Total

X4 =

Book Value or Market Value of of Equity divided by Total

Liabilities

This model has been used to estimate bond ratings for a firm’s

debt. The following

table provides the estimates:

|

|

|

|

|

|

Rating

|

EM Score

|

Rating

|

EM Score |

|

AAA |

8.15 |

BB+ |

5.25 |

|

AA+ |

7.60 |

BB |

4.95 |

|

AA |

7.30 |

BB- |

4.75 |

|

AA- |

7.00 |

B+ |

4.50 |

|

A+ |

6.85 |

B |

4.15 |

|

A |

6.65 |

B- |

3.75 |

|

A- |

6.40 |

CCC+ |

3.20 |

|

BBB+ |

6.25 |

CCC |

2.50 |

|

BBB |

5.85 |

CCC- |

1.75 |

|

BBB- |

5.65 |

D |

0.00 |

The extended model uses

R1-R4 above plus an intercept term.

For Wal-Mart and Target this is:

Target’s implied bond

rating from the EM model is slightly lower than current bond

ratings (A to A+). Valuation Tutor by allowing you to work with

averages for Industry, SIC or user defined benchmarks, provides

a powerful tool for analyzing and predicting and understanding

bond ratings.

Now that you understand

how to work with this assessment you can use the Valuation Tutor

calculator as the following P&G Reconciliation illustrates: