9.8 Entering Data via Excel

First click on the button Export to

Excel to create a template, and then overwrite these values

in Excel and copy and paste from Excel back to Valuation tutor.

You can then save the Excel workbook.

Working with Excel and Valuation Tutor Using the “Best Method

for Entering Data”

Step 1:

All labels have to be exactly as the labels on the

screen. So first

click on the button “Export to Excel” this will immediately

create your Excel template:

Step 2:

Edit the numbers above directly in Excel with the numbers

from the current example:

Note the numbers in red in the previous Valuation Tutor screen

are automatically derived and do not need to be changed.

The current example’s numbers are:

Dividend per Share

= Dividends/Shares issued = 2,860/1341 = $2.132 equals the

dividend per share.

Year 1 Dividend (Forward Annual Dividend) = 2.403

Dividend Payout Ratio (Relative to Comprehensive Earnings) =

2860/10115 = 0.283

Comprehensive Earnings per share 2009 = $10,115/1341 =

$7.543

Expected Comprehensive EPS FY 2010

$7.543*1.1255 = $8.49

Expected Comprehensive EPS FY 2011

$8.49*1.094 = $9.288

Years in Stage 1:

5-years

5-Year Growth =

0.1043

Normal Growth = 0.045

Projected Dividend Per Share (Next Year) = $8.49*0.283 =

$2.403

Inputs for Cost of Equity Capital (CAPM)

Risk Free Rate = 0.0419

Equity Premium = 0.055

Beta (IBM) = 0.76

Derived (Don’t Enter):

Cost of Equity Capital (ke) = 0.0837

Entering the above into Excel yields:

Step 3:

Copy the first two columns from row 2 (i.e., include the

stock name) to Row 20 in Excel above, into the windows clipboard

and then click on the Valuation tutor button Paste from Excel to

generate the following screen:

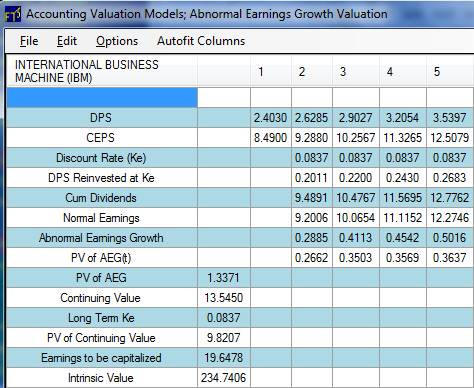

For this first pass the AEG assessment is that IBM is either

currently undervalued at $127.87 or its cost of capital is

higher (= 0.1144).

Verifying the

Calculations for Intrinsic Value

By double clicking on the name above International Business

Machine in the Abnormal Earnings Growth Model’s analytical

support reveals the following grid:

After clicking “Calculate” you also see the intermediate

calculations:

Support for Above Numbers

1=2010, 2=2011, 3=2012, 4=2013, 5=2014

DPS equals projected Dividends per share.

Here 2.403 = Dividend payout ratio times the

Comprehensive Earnings per share for 2010 (8.49), and so on for

2011 etc.,.

CEPS for years 2012, 2013 are respectively 9.288*1.1043,

10.2567*1.1043 ….

DPS Reinvested at Ke = Opportunity cost associated with the

dividends per share.

For 2011 = 2.4030*0.0837 and so on.

CEPS Cum Dividends = Comprehensive Earningst

+ ke * Dividendst-1

For 2011 this equals 9.2880 + 0.2011 = 9.4891 and so on.

Normal Earningst = (1+Cost of Equity

Capital)*Comprehensive Earningst-1

For 2011 this equals 8.49*1.083 = 9.2006, 2012 = 9.288*1.0837 =

10.0654 and so on.

Abnormal Earnings Growth = Cum-Dividend Comprehensive Incomet

– Normal Earnings t = (Earningst +

(ke*Dividendst-1) – (1+ke)*Earningst-1 =

9.4891 – 9.2006 = 0.2885 for 2010 and so on.

The time value of money now uses the discount rate each year

equal to the cost of equity capital (0.0837).

The total earnings to be capitalized (19.6478) consist of three

components at the end of 2010:

Earnings2010 + PV2010 Abnormal Earnings

Growth + PV2010 Continuing Value

Aside: Continuing

value is the value under normal growth for years greater than

year 5. In year 5

this is:

0.5016*(1+0.045)/(0.0837 – 0.045) = 13.545.

Finally this is discounted back to present (beginning of

2010) (13.545/(1.0837^5) = 9.8207

Earnings to be capitalized = 8.49 + 1.3371 + 9.8207 = 19.6478

Intrinsic ValueBeginning of 2010 = 19.6478/0.0837 =

$234.74