9.7 Residual Income Exercise: IBM Exercise

We verify for the same cost of equity

capital as follows:

Residual Earnings Calculations for IBM:

Difference:

(RE2011) 7.365 – (RE2010) 7.077 =

0.289 which equals the above 2010 Abnormal Earnings Growth

above.

This verifies the analytical result for

IBM

Finally, in the next section we apply

this model to assess intrinsic value.

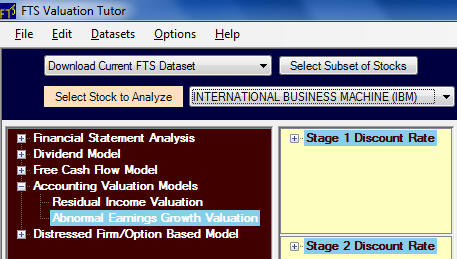

Working with the Valuation Tutor

First launch the Valuation Tutor and

select International Business Machine (IBM), Accounting

Valuation Models and select the Abnormal Earnings Growth

Valuation as illustrated below:

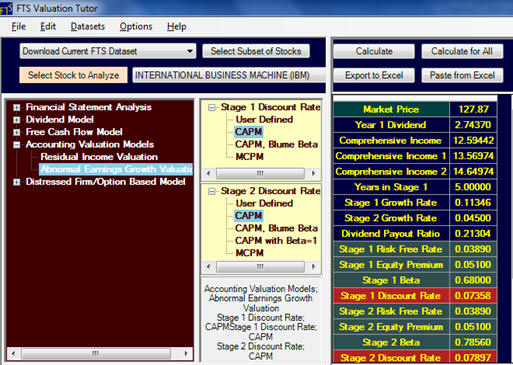

Next click beside Stage 1 Discount Rate

and Stage 2 Discount Rate and select CAPM for each.

The resulting calculator from this step is displayed

below:

You can enter values into Valuation Tutor

by several methods.

Enter Data Directly and save your dataset:

You can type each number directly into

the above calculator (for non-derived fields).

That is, Stage 1 and Stage 2 discount rates are derived

fields from the inputs into CAPM in the above example (e.g.,

Risk free Rate, Equity Premium and Beta).